TL;DR

- Bitcoin Reserve Proposal: President Trump’s executive order aims to establish a strategic Bitcoin reserve with 200,000 Bitcoin and oversee other forfeited cryptocurrencies through the U.S. Digital Asset Stockpile.

- Opposition Concerns: Congressman Gerald Connolly opposes the plan, citing conflicts of interest, fiscal irresponsibility, and potential personal financial gains for Trump.

- Controversy and Criticism: Critics argue the proposal could misallocate taxpayer funds and destabilize the crypto market, while the Treasury has yet to respond.

A top congressional Democrat has called on the U.S. Treasury to halt President Donald Trump’s plan to establish a strategic Bitcoin reserve. The proposal, which has sparked significant controversy, is being challenged on grounds of conflict of interest and fiscal irresponsibility.

The Proposal

President Trump’s executive order, signed earlier this month, directs the federal government to create a strategic Bitcoin reserve, initially capitalized with approximately 200,000 Bitcoin already in the government’s possession.

The order also creates the U.S. Digital Asset Stockpile, a distinct organization tasked with overseeing additional forfeited cryptocurrencies such as Ethereum, XRP, Solana, and Cardano.

The Opposition

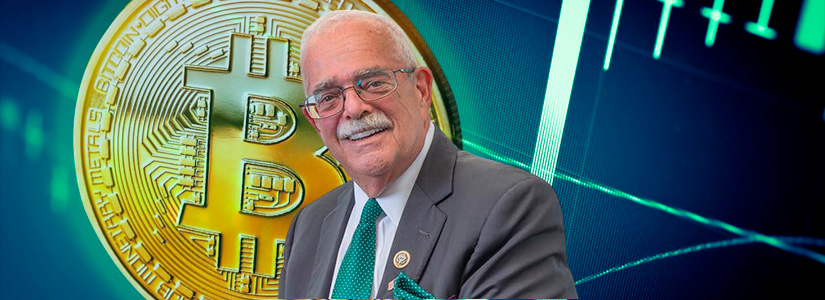

House Representative Gerald E. Connolly, the Ranking Member of the House Oversight and Government Reform Committee, has been vocal in his opposition to Trump’s plan.

In a letter to Treasury Secretary Scott Bessent, Connolly urged the department to cease all efforts to create the cryptocurrency reserve. He argued that the initiative primarily serves to enrich Trump and his financial backers rather than benefiting the American public.

Connolly criticized the plan as reckless fiscal policy, arguing that it would artificially elevate Bitcoin over other currencies through social media hype and misallocate taxpayer funds. He also cited a Federal Reserve official who had reportedly dismissed the idea as “the dumbest” proposal ever.

Conflict of Interest

Connolly’s letter raises concerns over Trump’s personal financial ties to the crypto industry, arguing that his business interests could influence federal policy in ways that serve him personally. The lawmaker specifically pointed to Trump’s stake in WLFI, a crypto-based financial services company that aims to function as a digital asset bank.

Trump, who holds a substantial stake in the venture, stands to gain significantly if federal policies enhance the value of cryptocurrencies. Additionally, Connolly flagged Trump’s involvement in $TRUMP, a meme-based cryptocurrency that has generated substantial revenue through trading fees.

Reports suggest Trump-linked entities have already raked in as much as $100 million from the token, which critics have described as his “most lucrative get-rich scheme yet.” As pressure mounts, the Treasury Department has yet to publicly comment on whether it will proceed with Trump’s controversial executive order.