TL;DR

- Extended Review: The SEC has further delayed its review of several crypto ETFs, including Grayscale’s XRP ETF and Cboe’s spot Solana ETF, with the next deadline set for May.

- Cautious Approach: This extension reflects the SEC’s ongoing cautious stance amid concerns about market volatility, regulatory scrutiny, and custody security.

- Broader Impact: The delays also affect other altcoin ETFs (e.g., Dogecoin, Litecoin, Cardano), highlighting a trend of extended evaluation periods potentially moving decisions as far as October.

The U.S. SEC has once again extended the review period for several crypto ETFs, including those tied to XRP and Solana. This decision, announced on March 11, has sparked confusion and speculation within the crypto community. The SEC’s move to delay these ETF approvals is seen as part of its cautious approach to regulating the rapidly evolving crypto market.

Impact on XRP and Solana ETFs

The affected funds include Grayscale’s XRP ETF and Cboe BZX Exchange’s spot Solana ETF. The SEC has designated a longer period to decide on the proposed rule changes that would allow these funds to proceed. This extension pushes the next deadline to May, giving the SEC additional time to assess the potential impact of these ETFs on the market.

Broader Implications

The SEC’s decision to delay the approval of these ETFs is not an isolated incident. The agency has also postponed decisions on other altcoin ETFs, including those for Dogecoin, Litecoin, and Cardano. This pattern of delays reflects the SEC’s broader hesitancy to approve cryptocurrency-related investment products amid concerns about market volatility, regulatory scrutiny, and custody security.

Market Reactions

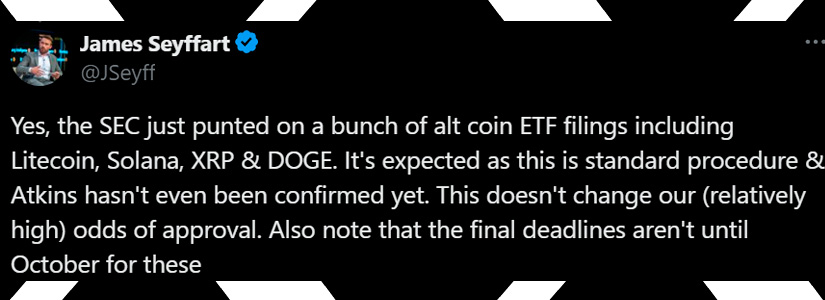

The crypto market has reacted with a mix of frustration and understanding. Bloomberg ETF analyst James Seyffart noted that these delays are standard procedure and do not significantly impact the likelihood of eventual approval. He emphasized that the final deadlines for these ETF decisions extend into October, providing ample time for the SEC to make informed decisions.

Future Prospects

Despite the delays, the approval prospects for these ETFs remain relatively high. Analysts estimate that the likelihood of approval for various altcoin ETFs has increased significantly compared to the pre-election period in November 2024. The SEC’s cautious approach aims to ensure investor protection and market stability, even as it acknowledges new filings and proposals.

As the SEC continues to navigate the complexities of cryptocurrency regulation, the extended review period for XRP and Solana ETFs underscores the agency’s commitment to thorough evaluation. Investors and issuers will need to remain patient as the regulatory process unfolds, with the next key deadline set for May.