TL;DR

- Bitcoin surpassed $82,000 again, marking a 1.01% recovery after the recent decline triggered by global economic tensions.

- Altcoins like XRP (+8.3%) and Cardano (+5.6%) lead the surge, demonstrating strong investor interest following the market-wide correction.

- Senator Cynthia Lummis’s legislative proposal to expand the strategic Bitcoin reserve in the U.S. further fuels optimism in the crypto market.

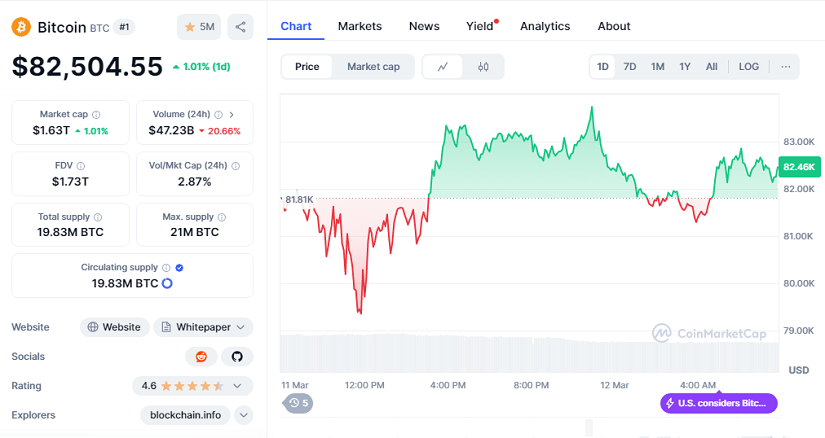

After days filled with uncertainty and a significant downturn, Bitcoin (BTC) managed to rebound strongly, once again breaking through the psychological barrier of $82,000. According to updated data, the market’s leading cryptocurrency momentarily reached $83,000 earlier today and is currently trading around $82,504.55, reflecting a rise of 1.01% over the last 24 hours.

This price increase comes as a natural reaction following the recent downturn, which saw Bitcoin briefly dipping below $77,000. The prior correction was mainly linked to global macroeconomic concerns triggered by announcements from U.S. President Donald Trump about imposing elevated trade tariffs, alongside his comments indicating a possible economic recession during a “transition period.”

The rest of the crypto market also responded positively to Bitcoin’s bounce back. Ethereum (ETH) rose 2.2% to reach $1,897, while other prominent altcoins posted even more notable gains. XRP stood out significantly, soaring by 8.3% and hitting $2.20. Similarly, Cardano (ADA) increased by 5.6%, trading at $0.73, and Dogecoin (DOGE) jumped nearly 7%, stabilizing at around $0.16.

A Recovery Driven by Macroeconomic Factors

The bullish sentiment in the crypto market was further bolstered by positive external macroeconomic developments. Among these was President Trump’s decision to cancel the proposed 50% tariffs on Canadian steel and aluminum, thereby preventing a potential trade war that had been troubling traditional markets.

Moreover, the recent 30-day ceasefire agreed upon by Ukraine, mediated by the U.S., partially alleviated investor concerns. The ceasefire aims to facilitate direct negotiations with Russian President Vladimir Putin to ease geopolitical tensions, a major factor contributing to the recent market volatility.

Pro-Crypto Regulatory Advances in the U.S.

Another critical factor boosting market confidence is the renewed legislative momentum favoring crypto adoption in the United States. Republican Senator Cynthia Lummis, a well-known Bitcoin advocate, has once again introduced a bill in Congress proposing the establishment of a national strategic Bitcoin reserve. This proposal comes shortly after Trump’s executive order favoring the creation of such a reserve, clearly signaling a pro-crypto shift in American politics and broader financial policy outlook.