TL;DR

- Digital asset investment products have recorded their fourth consecutive week of outflows, totaling $4.75 billion during this period.

- The leading cryptocurrency, BTC, saw $756 million in outflows last week. However, short positions also declined, suggesting a possible market capitulation.

- While U.S. investors led the sell-off, markets such as Switzerland, Canada, and Germany took advantage of the dip to accumulate cryptocurrencies.

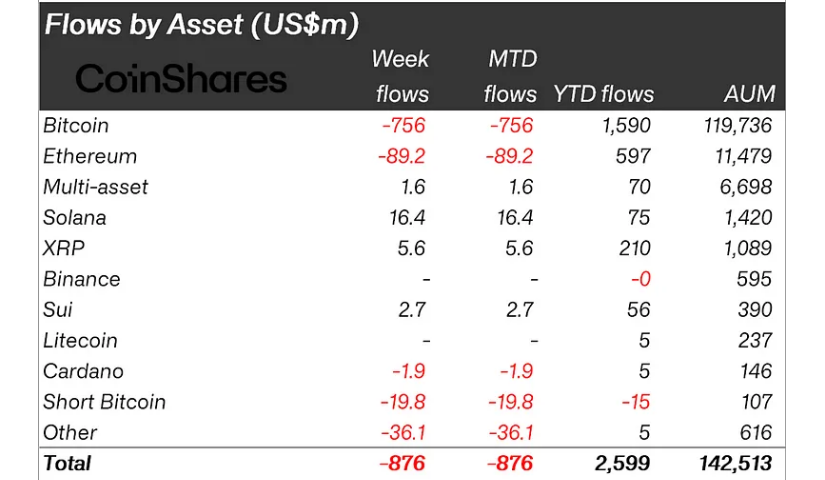

The digital asset market remains under pressure, marking its fourth consecutive week of capital outflows. The past week alone saw $876 million in withdrawals, bringing the total to $4.75 billion during this bearish cycle. Despite this downturn, data indicates a slowdown in outflows, suggesting that panic selling may be reaching its peak.

The decline in assets under management (AuM) to $142 billion, down $39 billion from its peak, shows that the correction has had a significant impact on the sector. Investor sentiment remains fragile, but the resilience of certain altcoins and the behavior of investors in key markets indicate that long-term optimism persists, with some viewing the dip as a potential buying opportunity.

Additionally, the capital outflows have been primarily driven by U.S. investors, who withdrew $922 million. Meanwhile, other markets took a different approach: Switzerland accumulated $23 million, Canada $14.7 million, and Germany $13.3 million. This contrast suggests that while some view the market with uncertainty, others see the downturn as an opportunity to expand their digital asset holdings.

Bitcoin Takes a Hit, but Short Positions Also Decline

Bitcoin was the hardest hit, with $756 million in outflows last week. However, a key detail is that short investment products on BTC also recorded an outflow of $19.8 million, the largest since December 2024. This suggests that even bearish traders are beginning to close their positions, a signal that has historically preceded trend reversals.

Ethereum also faced significant outflows of $89 million, while other cryptocurrencies such as Tron and Aave saw withdrawals of $32 million and $2.4 million, respectively. In contrast, Solana, XRP, and Sui demonstrated resilience, with inflows of $16.4 million, $5.6 million, and $2.7 million, reinforcing the narrative that certain assets are gaining investor confidence amid market turmoil.

Despite the negative sentiment, history has shown that these periods of extreme fear often present opportunities for those with a long-term vision. With signs of possible capitulation and some altcoins holding strong, alongside increasing institutional interest, the key question remains: Could this be the turning point before the next major market rally?