TL;DR

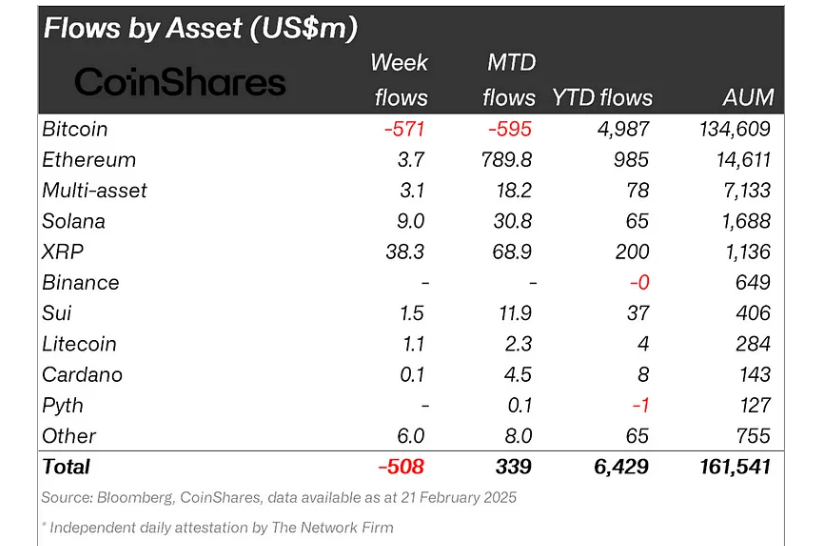

- The outflow from digital asset investment products reached $508 million last week, totaling $924 million over the last two weeks.

- Bitcoin was the hardest hit asset, with $571 million in outflows, while some investors took short positions.

- While the U.S. market saw a significant outflow, Europe, especially Germany and Switzerland, experienced significant inflows.

The digital asset market has been under significant pressure in recent days, with a $508 million outflow last week, according to a CoinShares report. This movement of funds comes amid an uncertain economic climate in the U.S., following the presidential inauguration and concerns over trade policies, inflation, and monetary policy. Investors have taken a more cautious stance, leading to a drop in transaction volume from $22 billion to $13 billion, which further emphasizes the ongoing uncertainty in global markets.

Bitcoin: The Main Victim of Outflows

Bitcoin, the flagship cryptocurrency, was the hardest hit by this trend, with $571 million in outflows. Some investors even decided to bet against the cryptocurrency, pouring $2.8 million into short-Bitcoin positions. This shift in sentiment suggests that many believe Bitcoin could face further difficulties in the short term, especially considering the lack of certainty regarding the future direction of U.S. economic policies, which continues to fuel concerns in the broader crypto market.

However, not all cryptocurrencies have followed the same path. Despite the widespread pullback, altcoins have shown remarkable resilience, with XRP standing out by leading the inflows. Since mid-November 2025, XRP has received an impressive $819 million in inflows, with $38.3 million entering just last week. This sustained interest is due to investors’ expectations that the U.S. Securities and Exchange Commission (SEC) may drop its lawsuit against the cryptocurrency, potentially paving the way for its growth, despite regulatory uncertainties.

European Market Shows a Different Trend

While U.S. investors have been cautious and withdrawn funds, Europe has experienced a completely different scenario. Germany and Switzerland have stood out for their positive flows, with $30.5 million and $15.8 million, respectively, indicating a more optimistic attitude in these markets. This disparity in flows reflects a potential divergence in the perception of the value and risk of digital assets on a global scale, particularly in the face of varying regional economic outlooks.

The CoinShares report also highlights a drop in trading volume, indicating that many investors are taking a pause and carefully evaluating their decisions. This liquidity pullback could increase market volatility, leading to more abrupt price movements in the coming weeks.