TL;DR

- 10x Research reveals only 44% of U.S. spot Bitcoin ETF inflows are intended for long-term investments, with the remaining 56% driven by short-term trading strategies like arbitrage.

- Arbitrage strategies dominate inflows, with investors profiting from price discrepancies between spot Bitcoin and Bitcoin futures.

- Market sentiment is impacted as hedge funds and trading firms, the largest holders of BlackRock’s IBIT ETF, focus on market inefficiencies rather than directional bets on Bitcoin’s price.

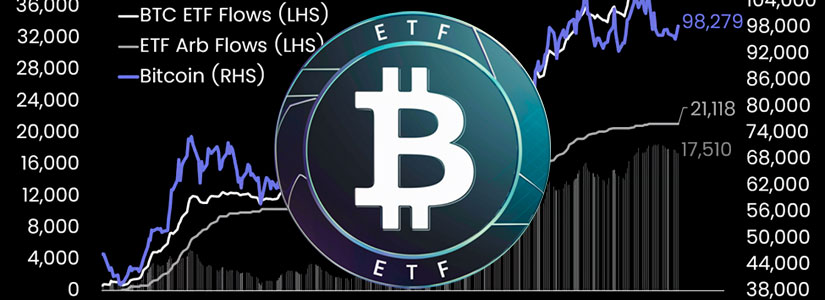

A recent study by 10x Research has revealed that only 44% of inflows into U.S. spot Bitcoin ETFs are intended for long-term investments. Since the launch of these ETFs in January 2024, they have attracted approximately $39 billion in net inflows.

However, just $17.5 billion of this amount reflects genuine long-term buying. The majority of the inflows, around 56%, are driven by short-term trading strategies, particularly arbitrage.

Arbitrage Dominates Inflows

The research highlights that a significant portion of the inflows is linked to arbitrage strategies, specifically the “carry trade.” Investors can take advantage of price differences between the spot Bitcoin market and Bitcoin futures by purchasing spot Bitcoin through ETFs and simultaneously shorting Bitcoin futures.

Markus Thielen, head of research at 10x Research, explained that this indicates a smaller actual demand for Bitcoin as a long-term asset in multi-asset portfolios than media reports suggest.

Impact on Market Sentiment

The dominance of arbitrage strategies in Bitcoin ETF inflows has implications for market sentiment. Thielen noted that the largest holders of BlackRock’s IBIT ETF are hedge funds and trading firms that focus on capturing market inefficiencies rather than taking directional bets on Bitcoin’s price movement.

With funding rates and basis spreads now too low to sustain profitable arbitrage, many trading firms have stopped adding new inflows into Bitcoin ETFs and are actively unwinding existing positions.

Recent Trends and Future Outlook

Despite the recent outflows, Bitcoin’s price has remained relatively stable. Thielen emphasized that the selling of ETFs is offset by simultaneous futures purchases, making the overall market impact neutral.

He also noted a shift in recent buying behavior, with long-only Bitcoin purchases increasing following the U.S. presidential election. While genuine long-term buying has picked up, the decline in retail trading volumes has led to a decrease in funding rates, making arbitrage strategies less attractive.

The findings from 10x Research underscore the complexities of the Bitcoin ETF market. While the inflows into these ETFs are substantial, the majority are driven by short-term trading strategies rather than long-term investments. As the market continues to evolve, it will be crucial to monitor these trends and their impact on the broader cryptocurrency ecosystem.