TL;DR

- Coinbase has experienced a significant increase in its trading volume in Q4 2024, driven by the market rally following the U.S. elections.

- The platform still relies primarily on cryptocurrency trading for revenue, with more than 50% of its earnings coming from this area.

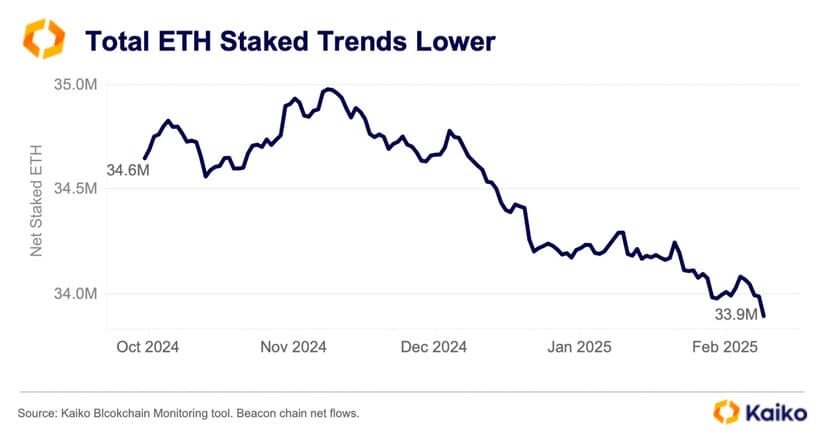

- Its market share in staking has decreased by 3.8% in the last six months, impacting its blockchain rewards revenue.

Coinbase is preparing its earnings report for the fourth quarter of 2024, a crucial moment to evaluate its performance amid the shifting crypto market dynamics.

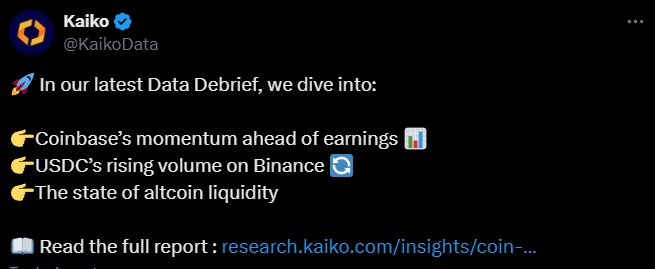

Throughout the fourth quarter, the platform saw a significant increase in its weekly trading volume, reaching levels not seen in the past two years. This surge is mainly attributed to the post-election market rally in the U.S., suggesting that Coinbase has successfully capitalized on the market growth.

Although Coinbase has diversified its revenue sources, incorporating additional services such as blockchain rewards, custodial fees, and USDC income, it still depends largely on cryptocurrency trading. This segment accounts for more than 50% of its revenue, meaning that a weak quarter in terms of trading could negatively affect other business segments, such as service-related income.

Coinbase Loses Market Share in Staking

On the other hand, data also indicates that its market share in staking has decreased. The platform, which has remained one of the preferred options for Ethereum staking, saw a 3.8% drop in its market share over the last six months, which impacted its blockchain rewards revenue. This decline is mainly due to a decrease in net flows on Ethereum’s Beacon chain, of which the exchange is a key contributor.

Growth in USDC-related revenue could act as a cushion against the lower income from staking. Coinbase benefits from its commercial agreement with Circle, which has seen a surge in USDC volume, especially after Binance reached a record high in trading volumes in January 2025.

Decline in Retail Trading

Despite its expansion into other services, retail trading volume on Coinbase remains low. Retail traders, who once accounted for a significant portion of the platform’s revenue, now represent only 18% of the trading volume, a sharp decline from the 40% seen in 2021. This is a result of the increasing competition in the U.S. market, where other platforms offer lower fees and attract new users.

The regulatory environment in the U.S. has also influenced Coinbase’s strategy. Despite diversifying its products and services, the company has slowed down its asset listing activity due to regulatory uncertainties. However, a shift in the legal landscape could potentially attract retail traders back and increase the exchange’s market share