Solayer is a cutting‐edge solution designed to maximize staked assets on the Solana blockchain. The platform achieves exceptional performance in terms of resource utilization optimization, operational efficiency, and yield generation without compromising the liquidity of funds.

With an approach focused on providing precise tools for developers and users, Solayer enriches the Solana ecosystem through the integration of advanced restaking mechanisms and the convergence of multiple financial products.

What is Solayer?

Solayer is a restaking protocol that operates natively on the Solana blockchain. It allows the reuse of staked assets to secure additional services on the network. The proposal arises from the need to optimize staking usage, generating incremental yields without sacrificing the liquidity of funds. The mechanism is based on the conversion of SOL tokens into sSOL, a liquid asset that provides access to various applications within the ecosystem, ranging from liquidity strategies on decentralized exchanges to lending schemes and collateral provision.

Solayer’s Architecture and Restaking Processes

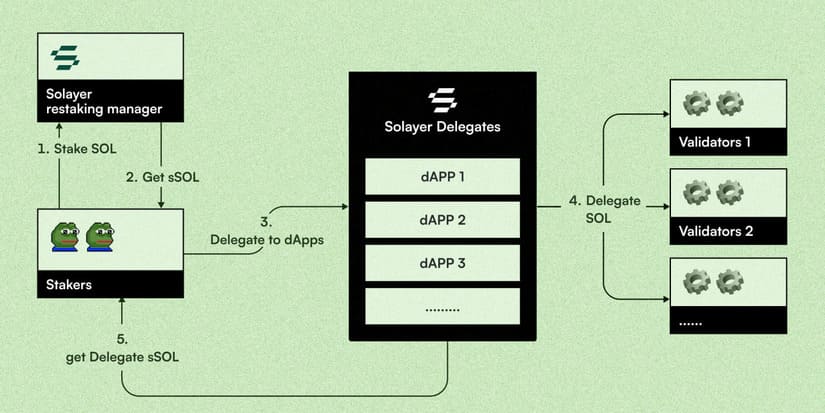

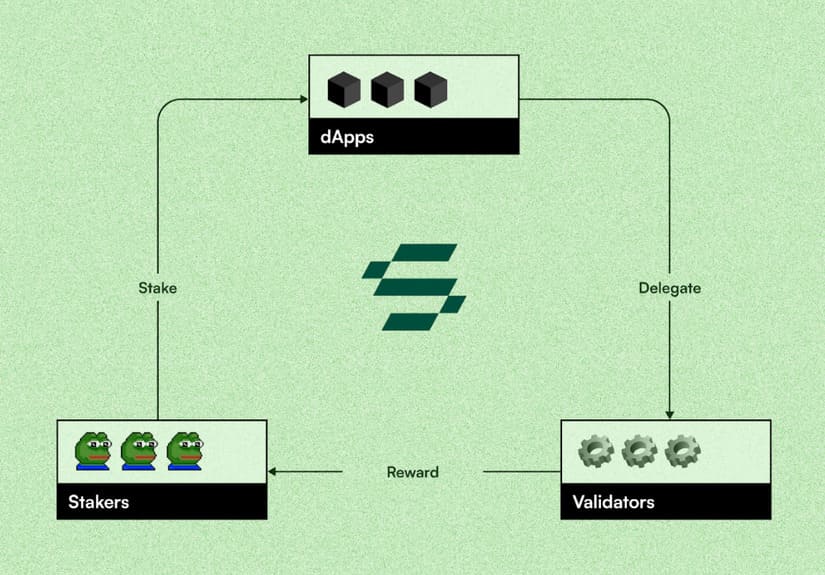

The restaking process is executed through a pool manager that supervises the flow of assets and is responsible for issuing the tokenized representation of the staked funds. Users deposit their SOL tokens and receive sSOL in return, which is used simultaneously in multiple activities. The technical structure of the protocol is organized around specialized components that manage both the conversion and delegation of assets. This organization facilitates the precise allocation of resources and the distribution of rewards, optimizing staking usage and ensuring a high level of efficiency in the network.

The system relies on a mechanism called stake-weighted quality of service (SwQoS) that assigns priorities in transaction processing. This tool benefits decentralized applications (dApps) that require constant performance during periods of high demand, ensuring that the network’s operational capacity remains at optimal levels. The integration of these components allows the infrastructure to respond agilely to load variations and additional validation requirements.

AVS Mechanism and Asset Management

A distinctive element of Solayer lies in the utilization of sets of autonomous validators (AVS) operated in a decentralized manner. The AVS automatically select validators based on performance and reliability criteria, eliminating dependence on a centralized entity and reinforcing the system’s resilience. Asset management is carried out through a delegation manager, responsible for assigning sSOL tokens to validators and ensuring that validation processes are executed accurately. Additionally, an accounting module precisely calculates the generated rewards, ensuring a transparent and error-free distribution.

Solayer incorporates customized unbonding processes that allow users to manage their investments without facing lengthy lock-up periods. A maximum period of two days has been established for these processes, which provides flexibility in fund management. Likewise, an emergency exit mechanism is implemented to guarantee the security of assets in cases of failures or anomalies, providing a safe and effective withdrawal route.

Compatibility with Liquid Staking Tokens (LST)

Solayer supports the use of liquid staking tokens (LST) in addition to native SOL. Among the compatible assets are Marinade-SOL (mSOL), Jito-SOL, Blaze-SOL (bSOL), and Infinity-SOL (INF). The integration of these tokens is carried out through a conversion process similar to that used to transform SOL into sSOL, generating an intermediate token suitable for participating in the delegation dynamics and rewards generation.

This compatibility allows the provision of a wide range of tools for users, enabling various forms of staking to benefit from the restaking infrastructure. By unifying the management of different tokens within the same system, the protocol reduces the fragmentation of liquidity pools and minimizes the costs associated with conversion between assets. The result is a smoother experience and greater operational efficiency that translates into direct benefits for users.

sUSD: Stable Yields

The development of Solayer is not limited solely to optimizing staking; it also extends to the creation of new financial products. The introduction of sUSD, a synthetic stablecoin backed by real-world assets such as United States Treasury bonds, provides an investment oriented toward stability and passive income generation. With a yield of around 4%, sUSD offers an attractive alternative for those seeking a secure exposure without the risks associated with the volatility of traditional cryptocurrencies.

Performance and Security

Solayer’s performance is evidenced by the growth of TVL, which reached $367 million at the beginning of December 2024. This figure is the result of the trust placed by users and the protocol’s ability to capture a critical mass of investment in a short period. Early adoption and the rapid expansion of TVL demonstrate that the reward distribution mechanisms and asset management operate effectively, translating into concrete benefits for those who use this system.

The protocol employs automated algorithms for the selection of validators and resource allocation, ensuring precision and security in operations. Customized unbonding processes and emergency mechanisms are implemented to immediately resolve any anomaly that may arise in the network. These technical elements combine to offer a robust environment in which efficiency and asset protection are fundamental priorities.

Conclusion

Solayer is a comprehensive solution that optimizes the use of staked assets on the Solana network. Each component of the system fulfills a precise and measurable function, enabling a harmonious and effective integration of the restaking infrastructure.

The implementation of cutting-edge technologies allows Solayer to adapt to the demands of a dynamic and competitive environment. Ultimately, beyond optimizing Solana’s capabilities, it creates new opportunities for enthusiasts of decentralized finance by offering developers and users precise and secure tools to face future challenges.