TL;DR

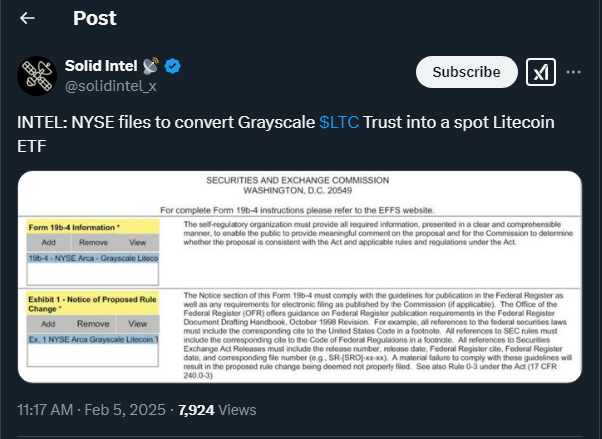

- The New York Stock Exchange (NYSE) has filed to convert the Grayscale Litecoin Trust into a spot Litecoin (LTC) ETF.

- The application is under review by the U.S. Securities and Exchange Commission (SEC), with public comments being welcomed.

- Approval could create new investment opportunities and boost liquidity in the LTC market, attracting both institutional and retail investors.

The New York Stock Exchange (NYSE) has taken a significant step by formally submitting a request to the U.S. Securities and Exchange Commission (SEC) to convert the Grayscale Litecoin Trust into a spot Litecoin (LTC) ETF. This move could represent a major milestone in the cryptocurrency landscape, as, if approved, it would allow Litecoin to enter the same regulatory framework as previously approved Bitcoin and Ethereum spot ETFs, bringing it further into the spotlight.

The SEC’s review process has already begun, and the agency has opened the floor for public comments on the proposal. This type of initiative demonstrates the increasing maturity of the cryptocurrency market and its integration into traditional regulatory frameworks. Investors now have the opportunity to voice their opinions on how this move could impact the ecosystem, sparking a debate on the viability and benefits of ETFs in the world of digital assets, potentially influencing the future of crypto markets.

Boosting Liquidity and Accessibility for Investors

If the SEC grants approval, the Grayscale Litecoin Trust converted into a spot ETF could inject additional liquidity into the LTC market, providing investors with a more direct and regulated way to gain exposure to Litecoin without needing to manage digital assets directly. This could be particularly attractive to institutional investors who are seeking safer, regulatory-compliant investment alternatives, enhancing the overall legitimacy of crypto as a mainstream asset class.

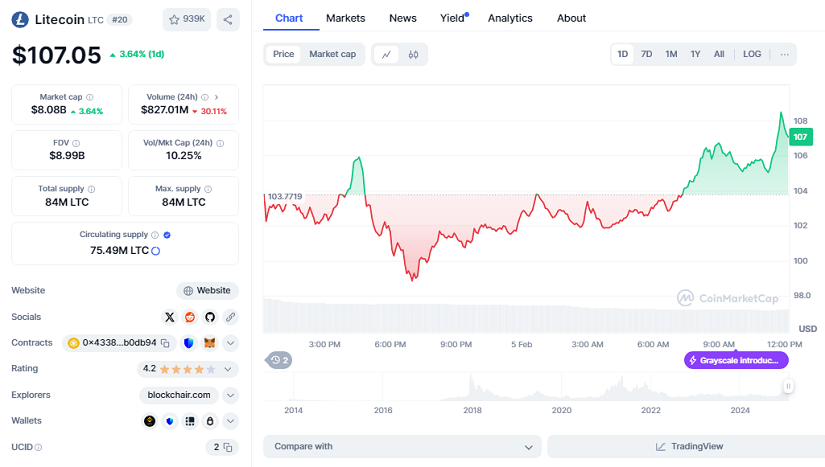

In the current context, Litecoin is priced at $107.05, having recorded a positive performance of +3.64% over the last 24 hours, which underscores the interest in this cryptocurrency. Its market capitalization of $8.08 billion reflects the market’s confidence in its potential. The creation of a spot Litecoin ETF would represent another step toward the consolidation of cryptocurrencies as conventional assets in the financial market.

While a final decision has not yet been reached, the crypto community remains eagerly awaiting the outcome of this crucial application. The approval of a Litecoin ETF could be just the beginning of a new chapter for cryptocurrency adoption, offering greater opportunities for growth and participation for both traditional investors and crypto enthusiasts alike.