TL;DR

- Vitalik Buterin stated that the Ethereum Foundation is considering staking its ETH holdings, valued at nearly one billion dollars.

- The foundation has been criticized for its supposed lack of active participation in the Ethereum ecosystem, which has led to proposals to use staking to generate additional income.

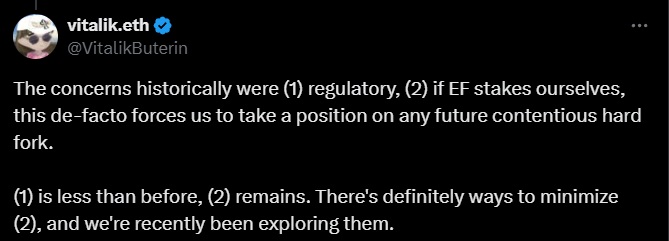

- Buterin explained that the foundation avoided staking due to regulatory concerns and the risks of hard forks, but now solutions are being considered for these issues.

Vitalik Buterin has indicated that the Ethereum Foundation is considering staking its ETH holdings, valued at nearly one billion dollars. The proposal comes amid criticism over the foundation’s alleged lack of active participation in the Ethereum ecosystem, which has sparked debates about its role and use of funds.

The Ethereum Foundation has received significant criticism from the community, which expects more direct involvement in the network’s development. Josh Stark, a foundation contributor, mentioned that its current involvement is limited to token sales, grant payouts, and event ticket management, activities many consider insufficient. According to investors, the foundation should allocate its ETH holdings to staking in order to generate income that could be used for salaries and grants.

Buterin explained that the foundation avoided staking due to two main concerns: regulatory risks and the need to take a position in case of a network hard fork. However, he noted that regulatory risks have decreased, and that ways to mitigate the risks associated with a hard fork are being evaluated. This shift in perspective could signal a willingness to adopt staking as a viable strategy.

The Numbers Behind the Ethereum Foundation

At the end of 2024, the Ethereum Foundation reported holding $788.7 million in crypto assets, 99.45% of which were in ETH. If these reserves were used on platforms like Lido Finance, offering a 2.95% annual yield, it could generate approximately $26.2 million per year, although this amount would be insufficient to cover the foundation’s total expenses.

Additionally, Joseph Lubin, another Ethereum co-founder, has proposed leadership changes at the foundation, suggesting the replacement of current executive director Aya Miyaguchi with two co-leaders: Danny Ryan and Jerome de Tychey. The proposal aims to revitalize the foundation and improve its execution capacity and communication with the community.

In response to these criticisms, Danny Ryan defended Miyaguchi’s leadership and called on the community to build a positive future, emphasizing the need for constructive approaches rather than destructive criticism