TL;DR

- Ethereum shows bullish signals despite the recent market correction, supported by indicators suggesting a positive outlook for the coming days.

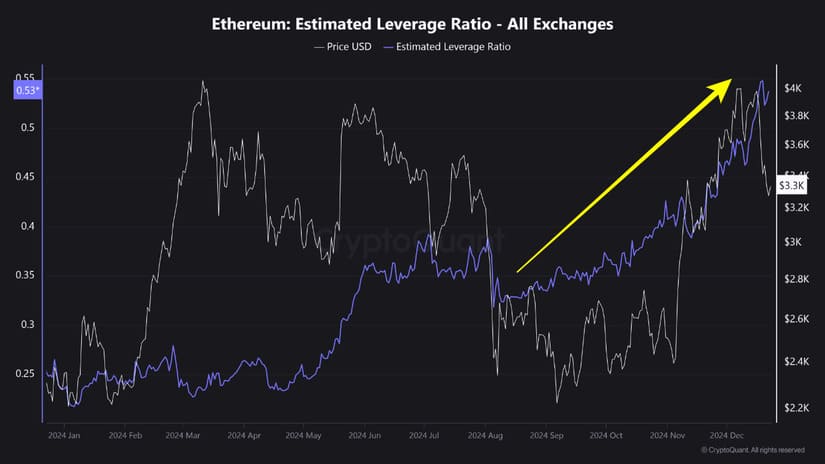

- Key factors like the high Estimated Leverage Ratio and moderately positive funding rates indicate sustained confidence and room for further growth.

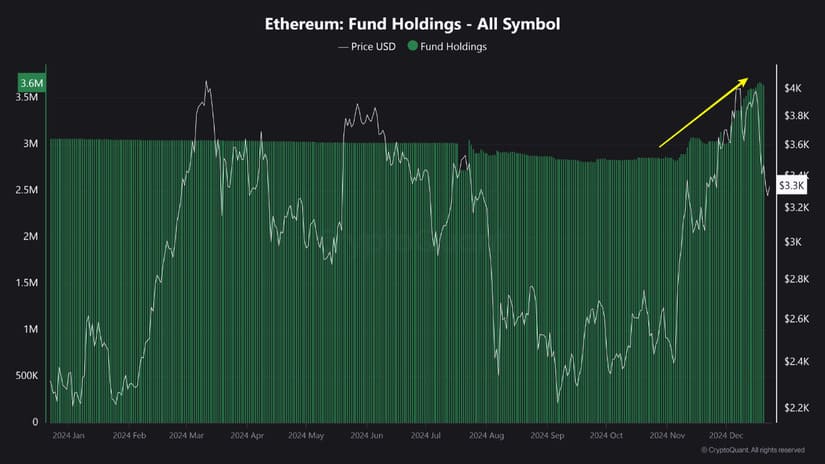

- ETH funds continue to rise, indicating strong confidence in the asset’s future.

Despite the recent market correction, Ethereum (ETH) continues to show signs of a bullish future, a trend supported by a series of indicators pointing to an optimistic outlook in the coming days.

Although Ethereum has not reached new all-time highs nor fully followed Bitcoin’s momentum after the U.S. presidential elections, several on-chain factors suggest ETH is well-positioned for a rally.

One of the most important indicators is Ethereum’s Estimated Leverage Ratio, which is at its highest point. This ratio measures investors’ tendency to use leverage in derivative trades, and in this case, its high level reflects sustained risk appetite among ETH traders. This translates to continued confidence in the cryptocurrency’s profit potential, even in the face of the latest market correction.

Additionally, Ethereum’s funding rates remain moderately positive, indicating that long positions continue to dominate the market without reaching excessive levels. This suggests there is still room for ETH’s price to grow without the risk of large-scale liquidations that could negatively affect its value. The moderation is seen as a healthy sign that the market is not overheated.

Ethereum Prepares to Recover and Continue Growing

Another crucial factor is the behavior of the Korea Premium Index, which measures the price difference between cryptocurrency exchanges in South Korea and other regions. In this case, the index has turned positive, indicating a marked and growing interest from Korean investors in Ethereum. Additionally, ETH funds have been steadily increasing, meaning both institutional and retail investors are highly confident in the cryptocurrency’s future.

Overall, the indicators suggest that Ethereum is going through a favorable moment despite the negative context. Analysts believe that the market and investors are willing to maintain their exposure to ETH and possibly increase it in the coming days. With these factors in play, the short-term outlook remains optimistic, which could translate into a recovery and sustained growth in the coming weeks.