TL;DR

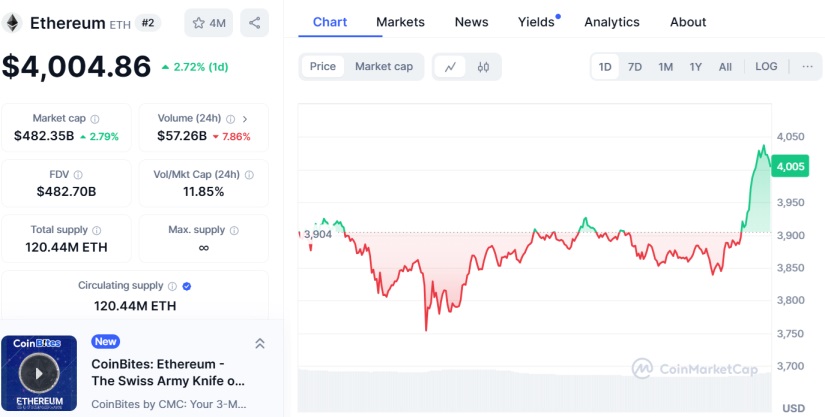

- Ethereum (ETH) has surpassed $4,000, reaching a market capitalization of $482 billion and a trading volume of $57 billion.

- The breakout of the $3,500 resistance and the crossing of exponential moving averages indicate a strong bullish trend.

- Record inflows into ETH ETFs, with $332 million on November 29, reflect growing institutional interest.

Ethereum (ETH) has surpassed $4,000, a price not seen since 2021. This figure marks a peak in its recent bullish trend, which has propelled the second-largest cryptocurrency in the market to a market capitalization of $482 billion. The increase in ETH’s value has also been supported by a trading volume of $57 billion.

Ethereum’s rise is the result of several factors. First, the breakout of the critical $3,500 resistance, where one of the largest sell walls previously existed, has been crucial for this momentum. Additionally, technical indicators suggest a strengthening of the bullish trend. A clear example of this is the 50-day exponential moving average crossing above the 200-day, a pattern that generally signals continued upward price movements.

Ethereum Could Continue Rising

The rise has been accompanied by a significant number of short liquidations in the market, reflecting pressure on investors who bet on a decline in Ethereum’s price. The liquidation of short positions often acts as a catalyst that could continue pushing the price to even higher levels if the trend remains.

On the other hand, there is the institutional investment side in Ethereum. ETH exchange-traded funds (ETFs) have seen record net inflows, reaching $332 million on November 29, surpassing even Bitcoin ETFs. This shows that institutional interest is booming, as the same trend has been repeated in the following days, such as the $132.6 million on December 3.

Ethereum’s market behavior, both in terms of its price and institutional interest, will be crucial for its short- and medium-term evolution