TL;DR

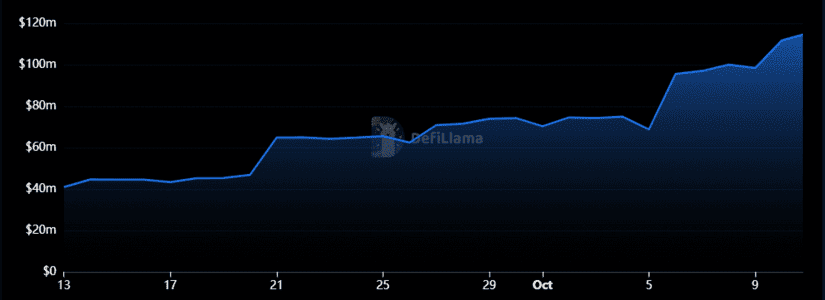

- Lombard Vault has nearly tripled its total value locked (TVL), reaching $114.5 million in less than a month since its launch.

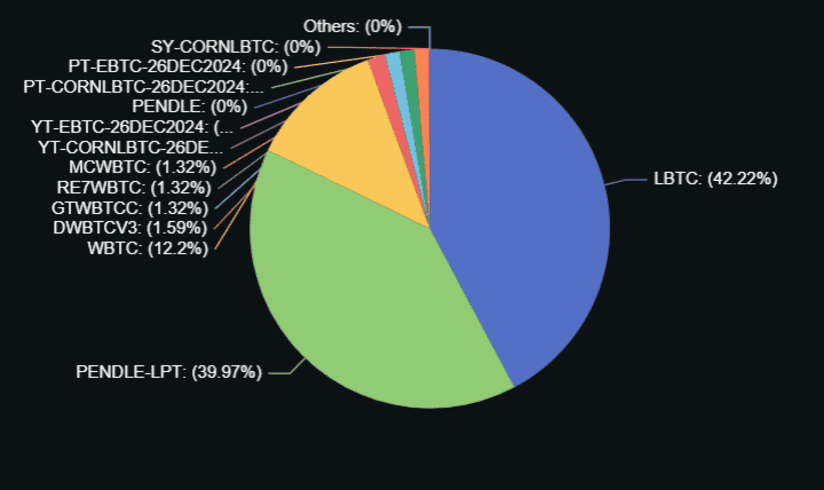

- The platform allows users to deposit Wrapped Bitcoin (WBTC), LBTC, and other digital assets, offering an annual percentage yield (APY) exceeding 11%.

- On October 10, it reported over $17 million in deposits in a single day, with LBTC accounting for more than 95% of the inflows.

Lombard Vault, a yield-focused platform oriented towards Bitcoin, has experienced strong growth following its launch, nearly tripling its total value locked (TVL) to $114.5 million in less than a month.

Since its launch in September, Lombard Vault has surpassed the $100 million mark in TVL, reaching a record today that reflects a clear interest in its services. At its inception, the platform had approximately $40 million in TVL, demonstrating a substantial increase in liquidity in a short period of time.

Lombard Offers an APY Exceeding 11%

This product allows users to deposit Wrapped Bitcoin (WBTC), LBTC, which represents a liquid staking token of Bitcoin, and other digital assets to implement decentralized finance (DeFi) strategies. Lombard Vault offers an annual percentage yield (APY) exceeding 11%, making it attractive for investors looking to maximize their returns.

Developed in collaboration with Veda, the platform serves as an automated yield management solution. This enables Bitcoin deposits to be strategically deployed across various DeFi products, including Gearbox, Morpho Blue, Pendle, and Uniswap. Additionally, the platform facilitates automated compounding by converting generated rewards into LBTC, simplifying asset management for users.

The Platform’s Overwhelming Success

On October 10, the platform reported record inflow volumes, with more than $17 million in tokens deposited in a single day. This massive influx was largely due to LBTC representing over 95% of the deposits. LBTC, which is based on Ethereum and backed by Bitcoin at a 1:1 ratio, also generates a native yield through Babylon Staking.

The demand for minting LBTC has reached very high levels, surpassing $500 million in BTC deposits for its minting. Since the platform’s launch in early September, Lombard has minted over 8,300 LBTC tokens, which are now held by more than 12,700 wallets, a notable increase in adoption.

Lombard Vault has proven to be a crucial component in the DeFi ecosystem, and its growth emphasizes the importance of solutions that offer attractive yields and automated asset management