TL;DR

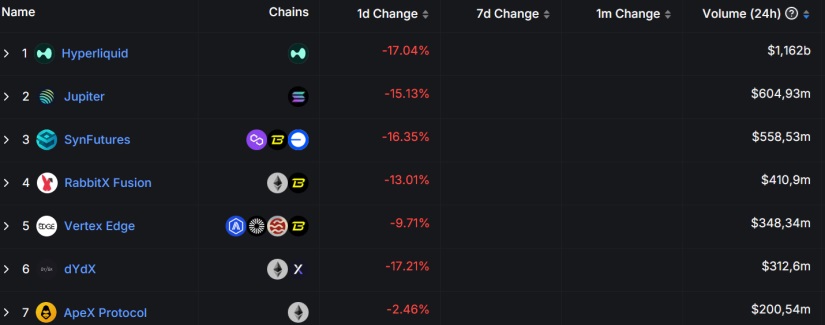

- Hyperliquid leads the trading volume of decentralized perpetual swaps, surpassing competitors like Jupiter and dYdX.

- Yesterday, the platform recorded $1.39 billion in daily volume, outperforming its rivals in the derivatives market.

- Its rapid growth is attributed to a rewards campaign that has increased traffic and interest in the platform.

Hyperliquid has positioned itself as the leader in daily trading volume for decentralized perpetual swaps, surpassing other major protocols in the derivatives market on decentralized platforms.

Yesterday, the platform recorded a trading volume of $1.39 billion, according to DeFiLlama data. This number places Hyperliquid ahead of competitors like Jupiter, SynFutures, and dYdX, which reached volumes of $699 million, $556 million, and $331 million, respectively.

Hyperliquid’s rapid growth in recent months has been remarkable. It has maintained an average daily transaction volume exceeding $1 billion. This increase in activity could be related to the points reward campaign launched by the platform, designed to distribute tokens through a future airdrop. This strategy has sparked user interest, with many seeking to benefit from the release of new assets, which in turn has boosted traffic on the platform.

Hyperliquid stands out as a decentralized platform that enables the trading of perpetual derivatives, or perpetual swaps, which are contracts without an expiration date. This allows traders to hold their positions indefinitely, as long as they maintain the necessary collateral. These instruments, which were initially exclusive to centralized exchanges like BitMex, have gained popularity on decentralized platforms in recent years.

Hyperliquid: Low Latency and High Performance

The platform operates on a Layer 1 app chain, offering native tokens such as Purr and Points. Additionally, it uses a custom trading engine designed to minimize latency, a crucial feature for high-frequency traders. This technology enables fast order execution on its network, an essential characteristic for users looking to take advantage of real-time market movements.

Another key feature of Hyperliquid is its non-custodial structure, which gives traders full control over their funds through their own cryptocurrency wallets, without the need to rely on third parties. This approach ensures that users maintain direct access to their assets, increasing confidence in the platform