Are you looking for decentralized exchanges in which to exchange and invest your cryptocurrencies? Then Aerodrome Finance may be exactly what you need. Unlike traditional exchanges that require personal data and store each user’s information, Aerodrome is completely private and offers very low transaction fees and incredible performance options for your cryptocurrencies.

What is Aerodrome Finance and what are its benefits?

Aerodrome Finance is a platform on the Base blockchain that allows users to exchange cryptocurrencies easily and efficiently and completely decentralized, unlike platforms like Binance.

What makes Aerodrome Finance special is its system for attracting liquidity, which is basically the amount of money available to exchange on the platform. For this market to work well, it needs a lot of liquidity, and Aerodrome achieves this by offering rewards to users who contribute their cryptocurrencies to the platform. These rewards are in the form of tokens called AERO, which users can earn by depositing their cryptocurrencies and allowing others to exchange them.

In addition, Aerodrome has a governance system that allows AERO holders to participate in decisions about how the platform is run. These users can “lock” their AERO tokens for a period of time to obtain a special token called veAERO, which gives them voting power on the platform and which we will discuss in more detail later in this article. The longer they lock their tokens, the more influence they will have on decisions.

How Aerodrome Finance Works

Aerodrome Finance has several functions and features that make it a unique platform. Let’s take a look at each of them:

- Token Exchange: On Aerodrome, users can exchange different cryptocurrencies quickly and with low commissions. This is ideal for those looking to make transactions without losing a lot of money in fees or suffering large price variations during the process.

- Liquidity Provisioning: In order for these exchanges to run smoothly, Aerodrome requires users to contribute their tokens to the system, known as “liquidity provisioning”. In return, these users receive rewards in the form of AERO tokens. The more cryptocurrencies they contribute, the more rewards they get.

- Governance and Decisions: Users who own AERO tokens can decide to block them for a period of time to receive veAERO. This token gives them voting power in important decisions about how rewards are distributed on the platform and which areas to focus more resources on. This system ensures that the community has a voice in the future of the platform.

- Epochal Rewards: Rewards in Aerodrome are distributed over periods of time called “epochs”. During each epoch, users who have contributed liquidity receive their rewards based on how many votes their liquidity pool has received.

AERO Token: Its Functions and Features

AERO is Aerodrome Finance’s native token and is a key element within its ecosystem. AERO serves two main functions: it serves as a utility token and as a governance token.

As a utility token, AERO is used to reward those who provide liquidity on the platform. When users deposit their cryptocurrencies to facilitate token exchange, they receive AERO as a reward for their contribution. This incentivizes users to participate and support the growth of the platform.

What is VeAERO

On the other hand, AERO also plays a crucial role in the governance of the platform. Holders can choose to “lock” their tokens for a period of time, up to 4 years, and in return receive a non-fungible token called veAERO. This veAERO grants voting rights in important platform decisions, such as the distribution of new rewards in the form of AERO. Those who participate in governance receive in return all the commissions and rewards generated by the funds they vote on, allowing them to directly influence the operation and development of the protocol.

This ensures that Aerodrome remains completely decentralized, giving its participants real decision-making power over the direction the platform will take.

How to use Aerodrome Finance Step by Step

Swap

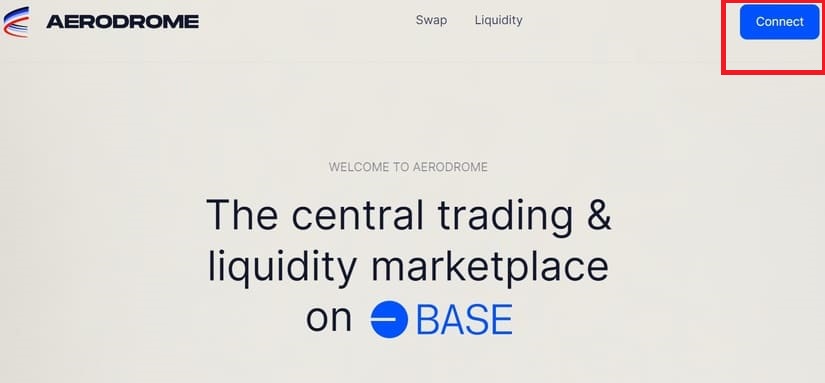

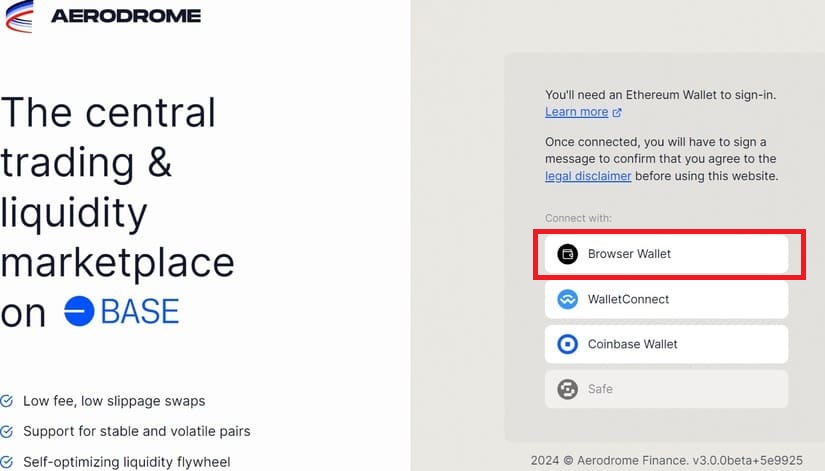

1. Connect your wallet: To start you must connect your wallet, for example Metamask, to be able to dispose of your cryptocurrencies. The process is fast and completely secure.

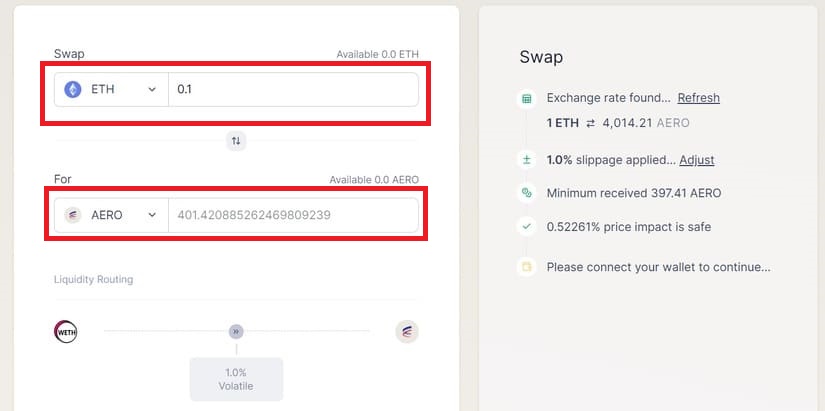

2. Choose the pair of cryptocurrencies you want to exchange (Swap): Select which cryptocurrency you are going to acquire and which one you will deliver in exchange. Aerodrome will give you the exchange rate. For example: exchange ETH for AERO.

3. Confirm the transaction: once you have verified that all the data is correct, confirm the transaction and after a few moments you will be able to access your new tokens.

Provide Liquidity to a Pool in Aerodrome

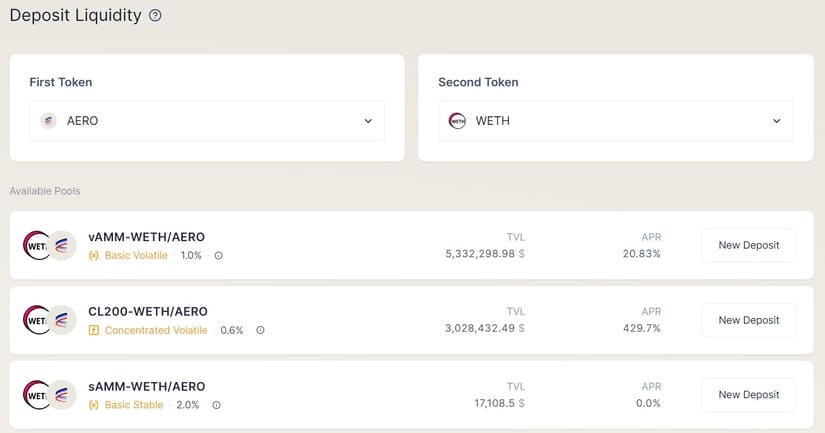

1. Access the Liquidity Pools section and choose the cryptocurrency pair: Once in the Liquidity Pool section, look for the Pool that best suits your investment objectives. Each one varies according to its annual percentage yield (APR), volume and commissions.

2. Choose the amount of each token: Once you have chosen the pair you want, choose the amount you are willing to block.

3. Accept the transaction: When you click on ‘Deposit’ you must also confirm the transaction in your wallet.

4. ‘Stake your deposit‘: Working with liquidity tokens you can ‘stake’ your deposit to generate more rewards. You can choose the percentage of your deposit you want to stake.

Conclusion

Decentralized exchanges have gained great relevance in the crypto space for all users looking for privacy and security in your transactions. Within the Base blockchain, Aerodrome has established itself as the best alternative.

Its low costs, simplicity and diversity of investment options have made the number of Aerodrome Finance users grow exponentially since its creation. The platform’s liquidity pools are another way to obtain good income in a completely private way, without having to give any personal data, unlike what happens with exchanges or centralized platforms.