TL;DR

- Mt. Gox is in the final stages of preparation to repay its creditors through Bitstamp, generating anticipation and concern in the crypto community.

- Test transactions have been executed from addresses associated with the exchange to Bitstamp’s cold wallets, indicating that the repayment process is about to begin.

- A Reddit survey shows that 56% of Mt. Gox creditors plan to hold their Bitcoin, while only 20% intend to sell.

Mt. Gox, once one of the most important crypto exchanges in the industry, is in the final stages of preparation to repay its creditors through the Bitstamp exchange. The imminent repayment, indicated by recent fund movements on the blockchain, has generated a mix of anticipation and concern within the crypto community.

Blockchain intelligence firm Arkham Intelligence reported that test transactions have been executed from Mt. Gox-associated addresses to Bitstamp’s cold wallets, suggesting that the repayment process is about to begin.

THIS MORNING: MT GOX MOVING FUNDS

Mt. Gox addresses deposited $1 to 4 separate Bitstamp deposit addresses. Bitstamp is 1 of 5 exchanges working with the Mt. Gox Trustee to facilitate creditor repayments.

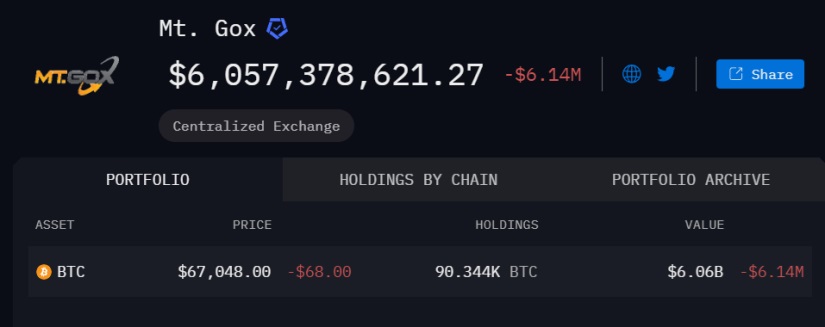

Mt. Gox currently holds: $6.08B in BTC

These transfers are likely to… pic.twitter.com/uyOLL7O065

— Arkham (@ArkhamIntel) July 22, 2024

These test transactions, which involved deposits of $1 to four different deposit addresses on Bitstamp, were seen as a clear sign that the exchange is finalizing details before starting payments to its creditors. Bitstamp is one of five exchanges working with the Mt. Gox trustee to facilitate these repayments.

Mt. Gox Still Holds Over 90,000 Bitcoin

The collapse of Mt. Gox in 2014 left about 127,000 creditors waiting for the recovery of their funds, which total more than $9.4 billion in Bitcoin. This long wait could be coming to an end. Many investors fear that the release of such a large amount of BTC could exert considerable selling pressure, negatively impacting the cryptocurrency’s price. Some analysts, such as Jacob King, have stated that up to 99% of the creditors might choose to sell their Bitcoin immediately upon receipt, which could trigger a drop in BTC’s value.

However, the Reddit community envisions a different scenario. A survey conducted among Mt. Gox creditors indicates that 56% of them plan to hold their BTC, while only about 20% intend to sell.

Despite concerns, some whales have continued accumulating Bitcoin. On July 17, one of these large holders acquired 245 BTC, valued at nearly $16 million. To date, more than 36% of the owed Bitcoin has already been distributed, and the exchange’s wallet still holds over 90,300 Bitcoin, worth approximately $6.12 billion.

Although the exact date for the start of repayments has not been confirmed, recent test transactions suggest that the process is in its final stages. The crypto community is eagerly awaiting the resolution of this long chapter in Mt. Gox’s history.