TL;DR

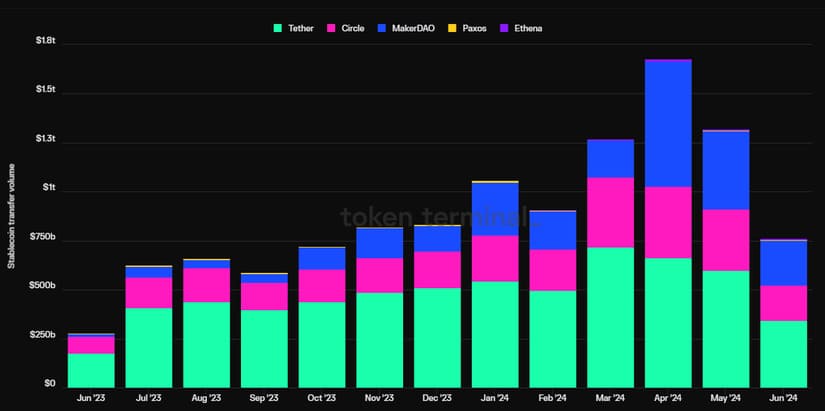

- The volume of stablecoin transfers has grown more than 16 times in the past four years, reaching a monthly record of $1.68 trillion in April 2024.

- ‘Stablecoins’ act as a bridge between the traditional financial system and digital assets. Total market capitalization has increased by 24% this year, surpassing $162 billion.

- More than 31.1 million active monthly users conducted over 353 million transactions in the last month, indicating increasing adoption and a solid user base.

Stablecoin transfer volume has grown exponentially by more than 16 times in the last four years, reaching a monthly record of $1.68 trillion in April this year, up from $100 billion in October 2020, according to Token Terminal data. This growth is seen as a promising indicator of widespread cryptocurrency adoption.

‘Stablecoins’ represent a crucial bridge between the traditional financial system and the digital asset industry. They are used to gauge the health of the crypto market and investor confidence. The increase in transfer volume also coincides with a 24% rise in cumulative market capitalization year-to-date, exceeding $162 billion, according to DefiLlama.

Monthly stablecoin transfer volumes have ~10x'd over the past 4 years.

From $100B to $1T+ per month.

Benchmark value from @Visa:

"During our FY23, the Visa network enabled $15 trillion in total volume." – Ryan McInerney, Chief Executive Officer pic.twitter.com/KxrUyb1IIW

— Token Terminal (@tokenterminal) June 19, 2024

Visa reported over 31.1 million active monthly users who conducted more than 353 million transactions in the last 30 days. The explosive increase in usage not only reflects greater adoption but also signals the consolidation of a significant active user base.

The Potential of Stablecoins to Bring Users to the Blockchain

Kilian Peter Krings, CEO of Stabble, stated that stablecoins are ideal tools for securely storing value, which helps mitigate risks and facilitates overall cryptocurrency adoption by reducing volatility and building a better reputation.

Stablecoin transfer volume surpassed the $1 trillion mark for the first time in March 2024, totaling $1.27 trillion, largely driven by the tokenized real-world assets (RWAs) sector. This includes property purchases, obtaining loans, and facilitating borderless transactions, thereby enhancing accessibility to the global financial market.

In terms of trading volume, Tether (USDT) dominated with $716 billion in March, followed by Circle’s USD Coin (USDC) with $358 billion. Stablecoins play a crucial role in the crypto ecosystem, both as investment tools and in everyday practical applications, consolidating their potential to transform economic inclusivity and reshape traditional finance.