TL;DR

- The stablecoin market reached a capitalization of $161 billion in May, the highest level in 24 months, although its dominance fell to 6.07% from 7% in March.

- Athena USDe and Tether (USDT) showed strong growth, with market capitalizations of $2.61 billion and $111 billion, respectively.

- The market has managed to recover from the losses suffered since the collapse of the Terra Luna ecosystem.

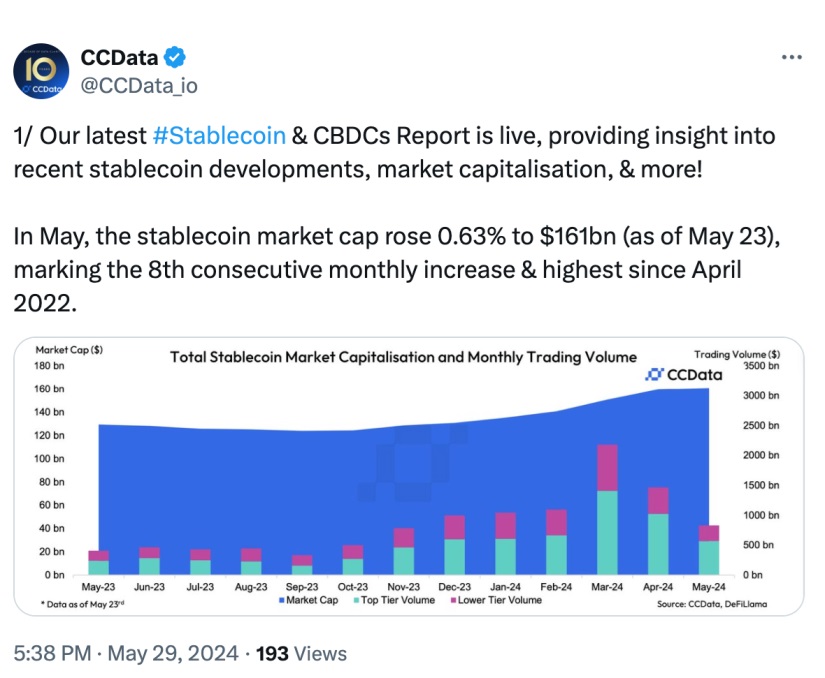

After eight consecutive months of growth, the stablecoin market reached a capitalization of $161 billion in May, its highest level in 24 months, according to a recent CCData report. However, its dominance has slightly decreased to 6.07%, from the 7% reached in March. This reflects a recovery in the prices of major cryptocurrencies and a shift in market sentiment following the unexpected approval of Ethereum ETFs in the United States.

Among the most notable stablecoins is Athena USDe, which has shown strong growth. Its market capitalization increased by 11.6%, reaching $2.61 billion. This is largely due to its expanded use as collateral for perpetual trading on ByBit. On the other hand, Tether (USDT), the market leader in terms of capitalization, reached an all-time high of $111 billion, increasing its dominance to 69.3%.

Another asset that has shown remarkable performance is BlackRock’s BUIDL token. This token, representing a share in BlackRock’s USD Institutional Digital Liquidity Fund, increased its market capitalization by 19.6%, reaching $448 million and surpassing Franklin Templeton’s BENJI token. BUIDL can be exchanged for USDC at a 1:1 ratio.

Circle’s USDC has also shown consistent growth, with its market capitalization increasing for the sixth consecutive month to $32.6 billion in May. This growth aligns with an increase in demand, evidenced by a record monthly trading volume of USDC pairs in March. Additionally, the participation of USDC on blockchain networks such as Base and Solana has increased, with the supply of USDC on these chains growing to 9.29% and 7.78%, respectively.

Effects of Bitcoin Halving on Stablecoins

However, despite the increase in the market capitalization of stablecoins, trading volumes on centralized exchanges have decreased, reaching a monthly low of $829 billion on May 23. According to the CCData report, this is a phenomenon historically observed in the two months following a Bitcoin halving event.

The CCData report concludes that the stablecoin market has managed to recover from the losses suffered since the collapse of the Terra Luna ecosystem and the near 100% depeg of the algorithmic stablecoin TerraClassicUSD (USTC). This collapse initiated a seventeen-month downtrend, severely affecting user confidence. Now, there appears to be renewed investor confidence and market adaptation to new conditions and opportunities.