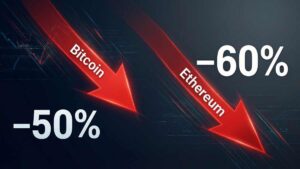

Understanding the volatility and movements of the crypto market, specifically in Ethereum (ETH) , has been an emotional roller coaster for investors during November and these first days of December.

According to a detailed technical analysis, at the beginning of last month, Ethereum was trading around $1,800, sparking a bull run that looked promising.

This upward trend took its price to around $2,120 on November 10 , marking an important milestone in its trajectory.

However, what followed was a consolidation phase , with evident support levels hovering around $1,980 and $1,920.

These levels proved to be strong and were essential pivots during this accumulation phase by buyers.

Although the coin appeared to be stabilizing, Ethereum surprised the market by breaking the consolidation and shooting towards $2,400 in early December.

Ethereum (ETH) is showing a trend that seems to mirror the footsteps of Bitcoin , as both cryptocurrencies are experiencing notable advances in their values in the last period.

This rise was significant for Ethereum, but volatility was also increasing

An abrupt correction materialized around December 11, taking Ethereum prices towards $2,150, a sharp decline from its recent high.

This level, between 2100 and 2200, initially a resistance point, could become key support for the cryptocurrency.

If the support level around $2,100 were to give way, Ethereum could look for other critical support levels. The next significant level lies around $2040, marking a possible area of additional support.

Beyond this point, there are other key levels at $1980 and $1930, each representing a possible consolidation or rebound stage for the cryptocurrency.

However, in case of greater bearish pressure, more solid supports are identified around $1850.

These lower levels may offer a stronger defense in case Ethereum experiences a significant decline in value.

Ethereum (ETH) is currently trading at $2,191.23, showing a slight decrease of 1.48% in the last day, and a drop of 3.10% in the last week, according to official data from CoinMarketCap .

However, over the course of the last month, Ethereum has seen a notable increase of 6.90%, demonstrating a bullish trend in the short term.

In the long term, in the last year , the cryptocurrency has seen significant growth of 64.18% , highlighting its strength and evolution over time.

The price range between $2,400 and $2,350 has proven to be significant for short-term sellers , with these levels operating as important markers for currency movements.

As Ethereum and other cryptocurrencies show significant fluctuations in their values, it is crucial to remember that the crypto market can become extremely volatile in short periods.

These sudden moves can represent lucrative opportunities , but they also carry substantial risks.

Therefore, it is essential to exercise caution and diligence when operating in this environment.

Maintaining a solid strategy, diversifying investments and being informed about market changes are essential aspects to mitigate risks and make informed financial decisions in the crypto universe.

Technical charts courtesy of Trading View .

Disclaimer : The opinions expressed do not constitute investment advice. If you are looking to make a purchase or investment, we recommend that you always do your own research.

If you found this article interesting, here you can find more News about Ethereum .