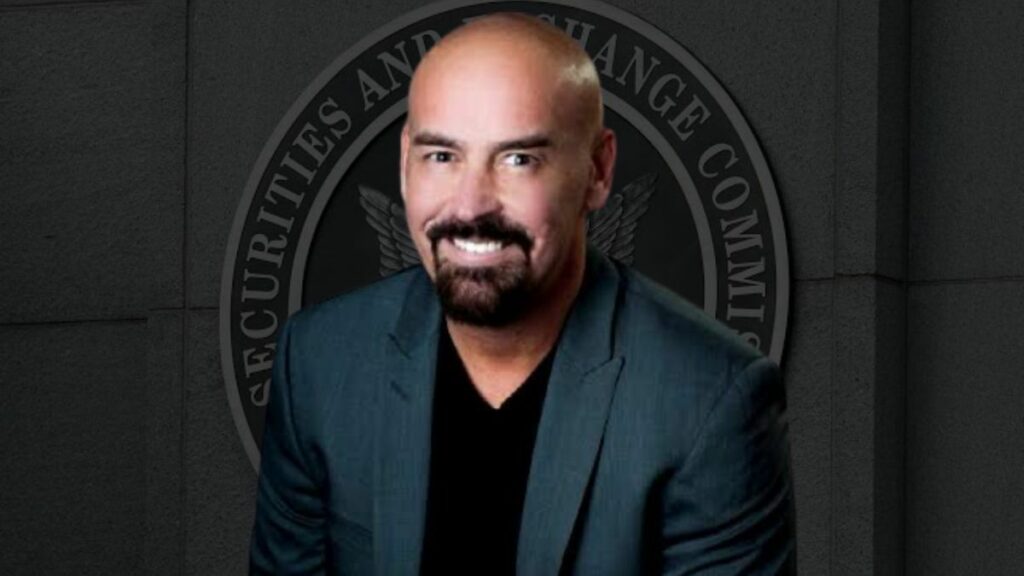

In a fiery Twitter outburst, Ripple attorney John Deaton didn’t mince words when it came to his thoughts on Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC).

Deaton, the legal representative of Ripple (XRP) holders, publicly demanded Gensler’s removal from office, emphasizing that Gensler’s academic credentials meant little when it came to understanding investment contracts and securities.

John Deaton Accuses SEC of Legal Disregard

I don’t care that @GaryGensler taught at MIT. The man has has no clue what is or isn’t an investment contract aka, a security. According to him, if an asset is being promoted by someone it transforms the asset into a security. He completely ignores the fact that U.S. securities… https://t.co/0NxRRMZ696

— John E Deaton (@JohnEDeaton1) October 1, 2023

John Deaton took issue with Gensler’s assertion that any asset promoted as an investment becomes a security. Deaton argued that this overlooks the exemption in U.S. securities regulations for assets acquired for non-investment purposes, distinguishing between investment and utility tokens.

The popular crypto lawyer accused Gensler and the SEC of flouting the law, legal tests, and court judgments, citing the agency’s admission that it ignores the common enterprise factor of the Howey test. His primary concern lies in the surge of crypto-related lawsuits initiated by the SEC, calling for an urgent revamp of the crypto regulatory landscape.

Interestingly, John Deaton criticism comes on the heels of his receipt of the Defender of Freedom Award from the International Crypto Business Law Association (ICBLA). This award recognized his strategic contributions to challenging SEC enforcement actions, notably in the SEC v. Ripple Labs et al. case.

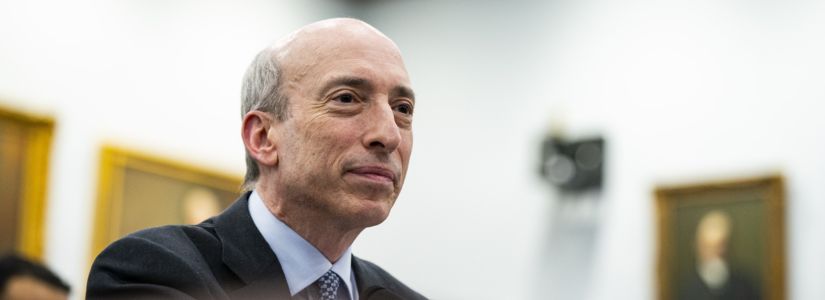

Gensler’s Stance on Crypto Regulation

Gary Gensler, as the SEC Chair, has adopted a stringent approach to crypto regulation. He consistently maintains that the majority of digital tokens qualify as securities and that crypto entities must adhere to existing securities laws. This perspective has majorly triggered a backlash from the crypto industry.

Enthusiasts argue that Gensler may be overstepping his authority by categorizing most crypto assets as securities, asserting that such decisions should rest with Congress. Furthermore, crypto companies, including Binance and Coinbase, feel that the Securities and Exchange Commission has not provided clear guidance on compliance with securities laws, hindering their operations in the United States.

Many members of the crypto industry further perceive Gensler as being hostile to innovation, interpreting his approach as detrimental to the industry’s growth.

Meanwhile, Gensler’s views were further reinforced during his testimony before the House Financial Services Committee on September 27, 2023, where he reiterated his stance on crypto assets and their compliance with securities laws. He criticized the crypto industry for what he termed “wide-ranging noncompliance” with these laws.