With the arrival of the virtual currencies, it became necessary for the existence of a tool to be able to buy, sell and exchange some currencies for others, that is why the cryptocurrency exchanges were created. There is a great variety of exchanges and each one has different characteristics. In this guide we bring you all the necessary information to learn what they are and how they work, in order to be able to choose which is the best exchange of cryptocurrencies to satisfy your needs.

What is a Cryptocurrency Exchange?

The first and most important, is that using the wallet of an exchange to store cryptocurrencies you are not the owner of the private keys, so you do not have full control of it.

Another reason to be taken into account, is that these platforms are usually the object of attacks by hackers, and if these attackers manage to access the exchange database, users who save their investment in them could lose it.

That is why the use of the wallets of an exchange is recommended if you are going to do trading, but not to hold (save cryptocurrencies for a long time), being the right thing to use a secure wallet where you have total control.

Some exchanges give other services that are usually used by more experienced traders, such as: leverage, OTC (Over The Counter) sale or future contracts, among others.

How to choose the best cryptocurrency exchange?

We will have to analyze certain characteristics that indicate us which one will be the most suitable for us. Characteristics such as:

Level of anonymity

Cryptocurrency exchanges have different levels of anonymity, which can range from allowing the full use of the platform with just using an email or a wallet in the registry, to the need to provide various personal information such as address, ID, photo verification or a KYC (know your customer) to create an account.

Sometimes there are different levels of restriction for the use of services, which are unlocked depending on the information offered.

It is common that offering the same services, there are exchanges that request some information and others, another. This is due to the location of the platform and the rules and laws that govern in that place.

Governments are realizing that bitcoin and cryptocurrencies are not just a passing fad and that bit by bit they are taking their place in the economy of their countries, so that in a more or less successful way (depending on each place), they are trying to control the exchanges and the operations that occur in them and therefore have a control over the people who interact with cryptocurrencies.

We say that depending on each place they impose more or less accurate rules, because there are governments whose laws are focused on the regulation and normalization of the use of cryptocurrencies, the prevention of money laundering and the protection of its citizens.

On the other hand, other governments far from facilitating and helping the adoption of cryptocurrencies, focus their resources and efforts on seeking the citizens of their countries who have invested in cryptocurrencies to tax them with abusive taxes and thus take advantage of the situation to fill the state coffers at the expense of the taxpayer.

Commissions or Fees

Knowing which commission will charge a crypto exchange when using their services, is another point that few have into account when entering the world of trading.

These platforms usually charge commissions for the use of their services, commissions that can be charged for example when performing an exchange operation, for the withdrawal of a cryptocurrency to another wallet or for the withdrawal of fiduciary money to a bank account.

All exchanges have a section where they explain what commission they charge for their services, review it before making any deposit or trading in it.

Available pairs

The definition of “a pair” in an exchange could be defined as two currencies, either digital or fiduciary, listed in an exchange and offering the possibility of direct exchange between them. A Bitcoin-Ethereum pair is usually seen in exchanges as BTC/ETH.

If we want to exchange bitcoin [BTC] for ethereum [ETH], the exchange must have the 2 cryptocurrencies and be paired to allow direct exchange, otherwise we will not be able to do it.

There is a possibility that the exchange has listed the 2 cryptocurrencies, but not have them paired, so we could do the exchange but in 2 steps instead of 1.

For example:

We have acquired BTC and we want to trade it by EOS, but in the exchange of cryptocurrencies in which we have deposited the funds does not have the BTC/EOS pair, by checking the EOS pairs of the exchange we find that the ETH/EOS pair is available, so for being able to do the trade we could change BTC for ETH and once we have ETH make the exchange for EOS, in this way we will get the desired cryptocurrency but in 2 steps instead of 1.

Knowing the available pairs is an essential factor when trading, in many cases a transaction is made to the trust exchange, and once there it is observed that the cryptocurrency in which you are interested does not have the direct pair or it is not listed in the exchange.

The problem that this error entails is the payment of unnecessary commissions, either because we must send our cryptocurrency to another exchange that has the desired pair or because to make the trade we must do 2 operations instead of one, which entails a commission for an extra exchange.

Fiat coins accepted

If when trading the ultimate goal is to withdraw the benefits to dollars, euros or other fiduciary currency, we must know what exchanges allow this operation, but in addition to knowing which has the crypto/fiat pair, it must be taken into account if the direct withdrawal to a bank account is allowed.

Knowing what cryptocurrency exchange has the crypto/fiat par that we want is simple, you just have to visit one of the pages that offer information about the different cryptocurrencies and their market capitalization, for instance, Coinmarketcap.

Once there, choose the cryptocurrency that you want to trade and click on the option Markets, here you can see all the exchanges that exchange that cryptocurrency and the pairs available in each one of them.

Once you have defined which exchanges have the crypto/fiat pair of your interest, you should do the following research in each of them, which is to see if they allow the extraction of fiducial money to a bank account, and thus convert your bitcoin to real money.

Safety

When cryptocurrencies are transferred to an exchange, it is assumed that the funds deposited will be in a safe place, in general this is the case, but in some cases, either due to carelessness or due to errors in both the exchange and the users themselves, these funds will be in danger, even getting lost.

The security must be taken care of by both parties, but the one that more impetus must put in this point is the user. When we make an investment in cryptocurrencies the investor is responsible for their funds and must put all the means at their disposal to protect them.

We will give some advice when improving security, both for the user and for the account of the cryptocurrency exchanges.

From the user

Passwords:

Passwords must be safe enough to be easily guessed, avoiding the use of dates, phone numbers, ID numbers, names … or any data that may come to be related to the owner, instead it is recommended to use alphanumeric keys, inserting capital letters and symbols.

It is not advisable to use the same password for all exchanges, because if the security of one of them is compromised, the funds of all the exchanges in which there are funds deposited may be in danger.

The backups of the passwords should be stored in external devices and if they are saved in the “daily use” computer, the safest option would be to use an encrypted partition.

In the exchange

Cryptocurrency exchanges usually offer different levels of security and it is the user who must activate them to secure their account.

Levels like:

- Second key authentication factor

- Sending an email to accept transactions

- Sending an SMS code to validate transaction

In addition to the access password to the platform, it is advisable to activate the second authentication factor at least.

Easy to use

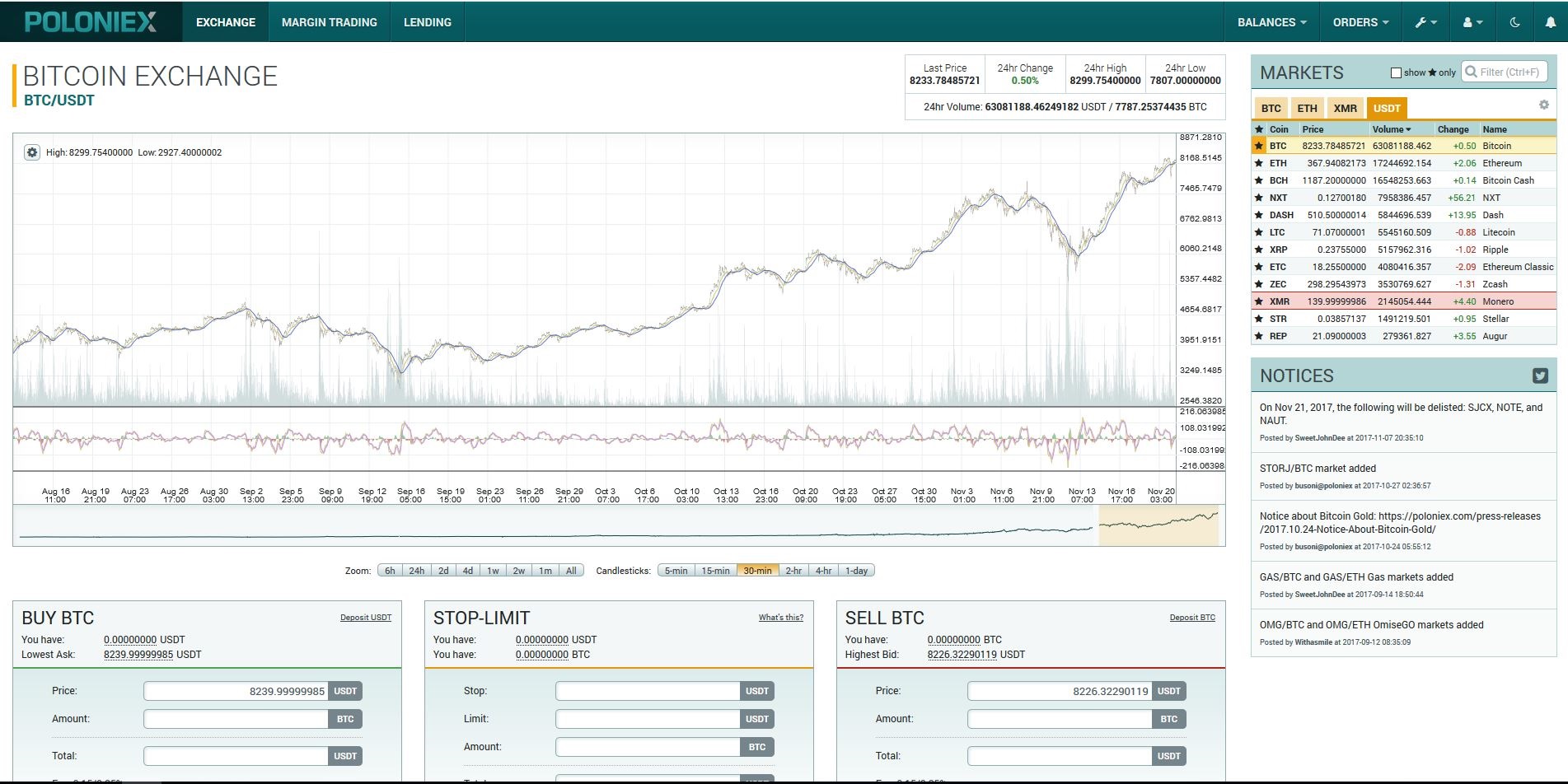

Although in reality the information offered by all of them is practically the same, only that the layout and the way of presenting it on each platform is different.

The data to locate in the exchanges to perform trading are:

- Buy/Sell: Place where the users make their Buy/Sell offerings and where they must put the amount of cryptocurrencies to buy/sell and the price that they are willing to pay/receive for them

- Asks: List of sale orders sort by price normally from lowest to highest

- Bids: List of buy orders sort by price from highest to lowest

Other sources of information that can come out in the trading section of the exchange but are not so essential when doing traidng are: price graphs; troll box or list of previous transactions among others.

Volume and liquidity

Having a high volume of the cryptocurrency that we want to negotiate can be the difference between whether we can make the trade successfully or not.

If for instance we want to exchange 1 Bitcoin for Tron [TRX] and in the chosen exchange the TRX volume amounts to 0.57 BTC, we can find several situations.

The first, as it can easily be deduced, is that we will only be able to trade 0.57 BTC and the rest will not be negotiated, our purchase order will remain waiting for another user to enter their TRX to exchange them. Depending on which volume the exchange moves, this can take seconds, minutes, hours, days …

The next problem is that the acquisition price is not going to be optimal, since those TRX that were for sale can have different prices (the price that each seller wants to put) and to acquire all the negotiated volume, we must buy them all, both those with the lowest price and those with the highest price.

Support service

The support service is an important part in any exchange, it is true that most problems that arise are usually due to user error, for example with the loss of passwords, or loss of the mobile where the second factor is activated.

Either way, whenever there is a problem, there must be a support team to solve it, and do it quickly and efficiently.

To know if this service is good or bad, the best way is to investigate the social networks of the exchanges and see the opinions of the users or if the shared issues or problems have been resolved.

Conclusion

Once these points are analyzed, it will be much easier to choose the best cryptocurrency exchange according to our needs, these needs may vary depending on the time elapsed and the knowledge about cryptocurrencies increases, as well as the number of exchanges used to make transactions.

The most important points to take into account in this guide are:

- Do not use the wallet of an exchange to save your cryptocurrencies

- Security starts with the user. Use strong passwords and backups, and activates the second authentication factor whenever possible

- Make sure the pair you are looking for is listed in the exchange you are going to use

- Investigate the social networks of the exchange to see if you have an active team and solve the users’ problems

- Check the liquidity of the exchange of the cryptocurrency that you want to trade

- If you are going to make withdrawals to fiat make sure that the exchange allows it.