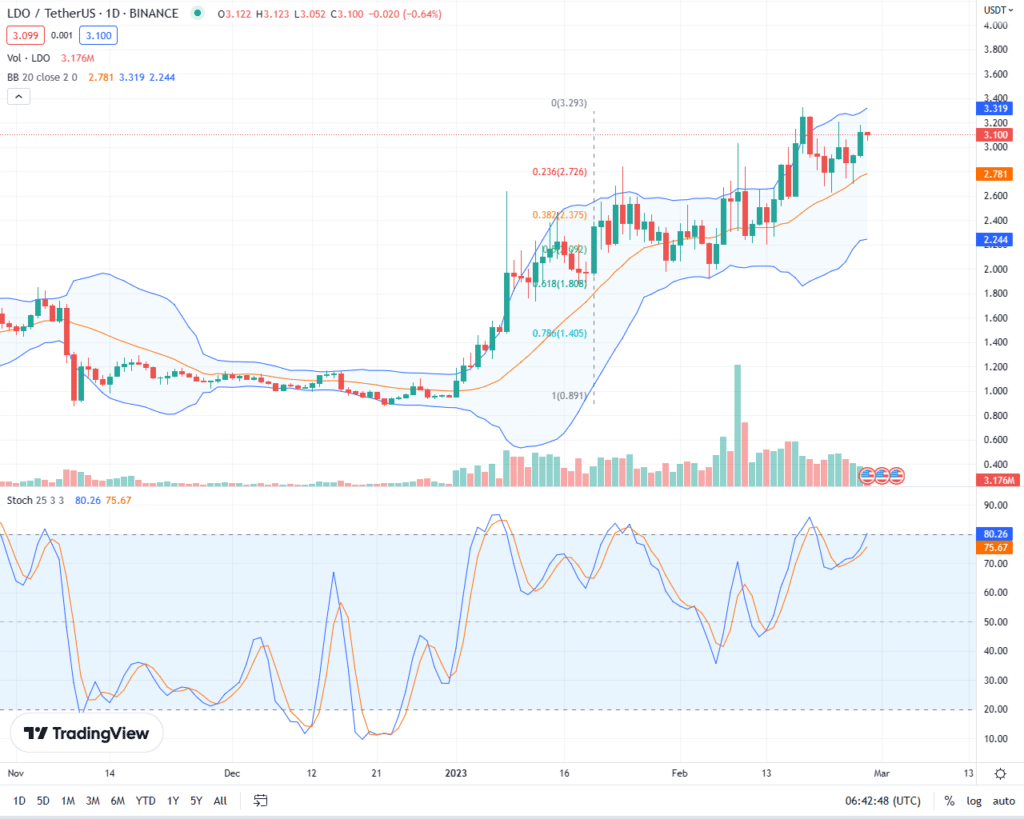

Lido Finance is one of the top-performing tokens, looking at the performance in the daily chart.

For perspective, LDO, the native token of the liquidity staking protocol, is up over 2.5x from the December low.

At spot rates, the token is trading slightly above August 2022 highs and looks likely to rally some more.

Per the candlestick arrangement, buyers remain in control. The immediate resistance is $3.3, while support is by the middle BB.

For the uptrend to be valid, prices must be above the flexible support line, and should price pump, the surge above last week’s high must be with rising volumes.

Shanghai is coming

There are several factors behind the token’s rally in recent days. Lido Finance is one of the top liquidity staking platforms.

This portal allows retail holders of leading proof of stake platforms like Ethereum or Solana to stake coins and earn network rewards.

In recent weeks, Lido has become the most valuable DeFi protocol by total value locked (TVL). There are over $9.1 billion of assets under management, out of which over 99 percent is ETH.

Next month, Ethereum will activate the Shanghai Upgrade. With this, users who had locked their 32 ETH in the Beacon Chain would be free to withdraw their coins.

LDO holders interpret this as a bullish event, explaining the surge in the token’s price. Ahead of this upgrade, it is highly likely that LDO will break above recent highs, registering new Q1 2023 highs.

Lido Finance Price Analysis

LDO is consolidating, edging higher relative to last week’s lows, and the uptrend is firm. In the short term, the resistance lies at $3.3, while support is marked by the middle BB and $2.6.

For the uptrend to be valid, the breakout above $3.3 and last week’s highs should be with a wide-ranging bar and expanding volumes. LDO may surge even higher in that case, rallying to $3.9 or better. This trigger will likely be a fundamental factor. However, this will depend on whether there is a decisive close above last week’s highs.

Conversely, should there be losses below $2.6, LDO may contract to retest February lows of $1.9, flashing with the 61.8 percent Fibonacci retracement level of the December to February trade range.

Technical charts courtesy of Trading View. Disclaimer: Opinions expressed are not investment advice. Do your research.If you found this article interesting, here you can find more information about Staking