Latest Ripple [XRP] News

In a world where dominance means power, we expect a tiff in coming years as SWIFT seeks to secure its turf against new but a determined competitor. The former has been around for sometimes and with bases in Belgium, the center of the EU and a symbol of unity, we can all understand why over its forty years of existence, SWIFT has not only amassed organizational assets—as they know the inner and outer working of global fund transfer, but it has strong use bases—up-to 11,000 major banks across the world use their global messaging service.

Besides, in a bid of keeping up with demand, their new GPI update would slash transfer fees but also reduce wait time, the latency SWIFT has been so blamed on. In fact as part of their marketing XRP and Ripple lay emphasis on their ability to send fund faster and cheaper—unlike SWIFT.

The good thing about Ripple the company is their ability to maintain their drive and as the major owners of XRP—60 billion XRPs are under the control, they have the war chest necessary to create incentives and power their well oiled marketing juggernaut luring in more banks in days ahead.

Already more than 200 banks are connected. Out of that, 27 acknowledge XRP and 13 more decided to utilize xRapid—a solution that make use of XRP as an on-demand liquidity tool for their cross fund border transfer.

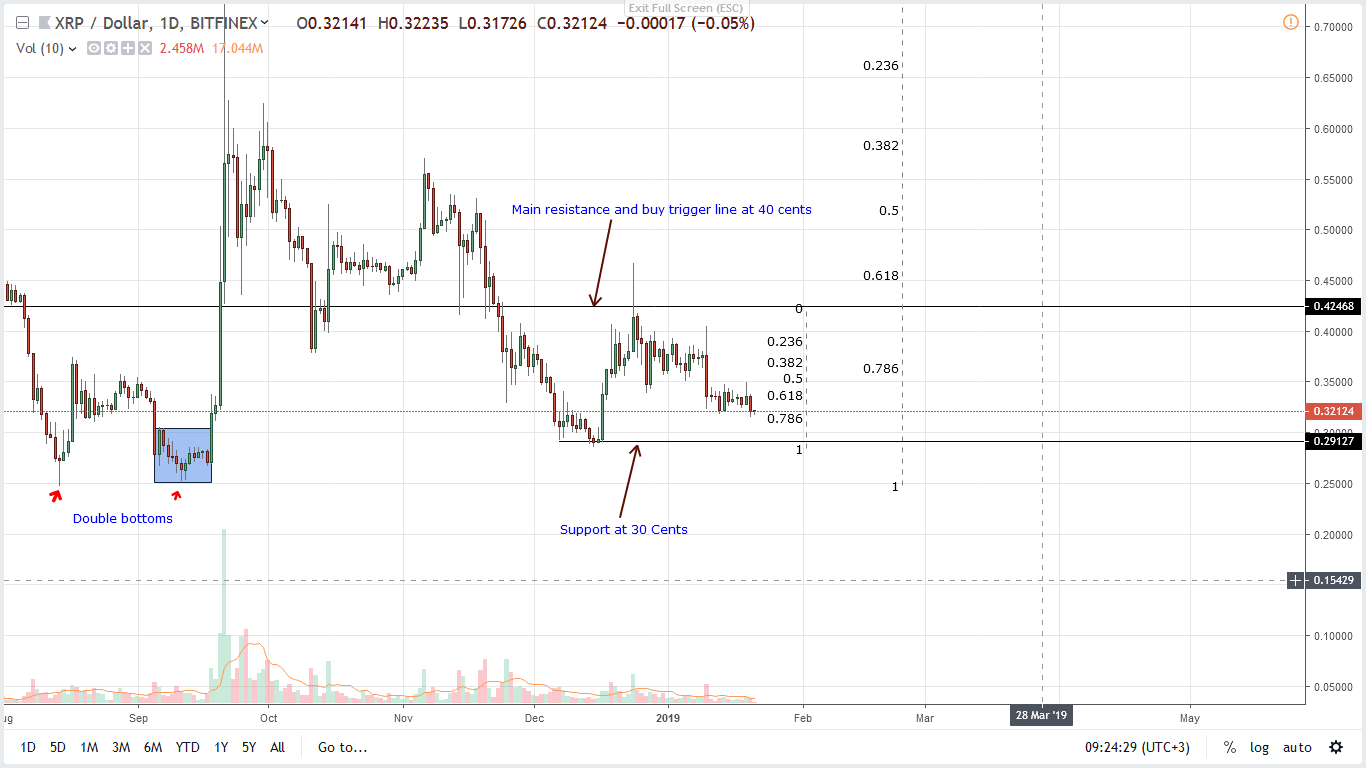

XRP/USD Price Analysis

Back to the charts and XRP performance is average. Although it is not a top performer and still at second placed in liquidity terms with a market cap of $12,901 million, XRP is steady in the last week but down 3.2 percent in the last 24 hours.

Even with that, we retain a bullish outlook expecting buyers to jump in on every low above the 30 cents minor support and help pump prices towards 34 cents and later 40 cents.

Our position is advised from events of Sep 2018 and a long as XRP prices consolidate within that bar, there is an opportunity break above 40 cents—our main resistance and buy trigger line, forming a foundation for a rally towards our ideal targets.

On the reverse side, there is danger of XRP sellers reversing Sep 2018 gains once XRP prices flunk below 25 cents. This will aside from cancelling our upbeat outlook, spur the next wave of lower lows with first targets at 10 cents.

All Charts Courtesy of TradingView—BitFinex

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.