TL;DR

- Over $3.12 billion in Bitcoin and Ethereum options expire today, which could influence market volatility.

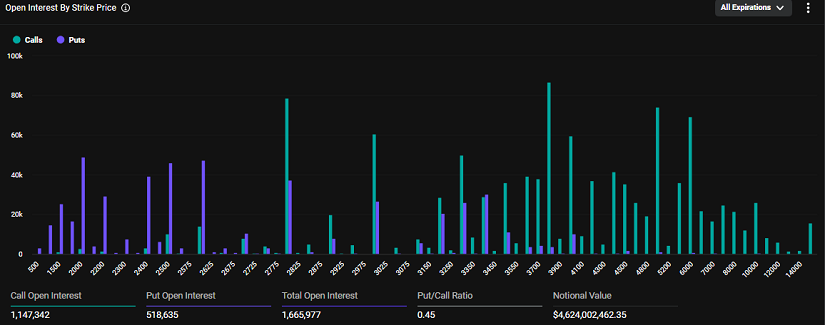

- Market sentiment remains mixed: Bitcoin’s put-to-call ratio is 0.57, reflecting some bullish optimism, while Ethereum shows a ratio of 0.45.

- Macroeconomic factors, such as Trump’s tariffs and U.S. employment data, could determine the market’s short-term direction.

Today is a crucial day for cryptocurrency markets, as over $3.12 billion in Bitcoin (BTC) and Ethereum (ETH) options, two of the most relevant assets in the industry, are set to expire. This event could bring significant volatility and define key price movements in the coming days, generating high expectations among investors and market analysts. With the expiration of these substantial options contracts, many traders are bracing for potential price swings, which could affect not only Bitcoin and Ethereum but also the broader cryptocurrency market. The outcome of today’s expiration may influence investor sentiment in the near future.

Impact of Expiration on Market Volatility

According to data from Deribit, 26,251 BTC contracts, worth $2.56 billion, are expiring. The put-to-call ratio of 0.57 suggests a slight predominance of bullish positions, although selling pressure remains. The “maximum pain zone” for these contracts is at $99,500, meaning that if Bitcoin’s price stays near this level, it will be the point where the most traders experience losses.

For Ethereum, 204,376 contracts worth $557 million are also expiring today. Its put-to-call ratio of 0.45 indicates a higher presence of call options, but with the market remaining undecided. ETH’s “maximum pain zone” is at $2,950, reflecting a lack of consensus about its future direction.

These factors are further compounded by the effects of U.S. economic policy, particularly the tariffs pushed by Donald Trump and the release of employment data. A weak labor report could increase Bitcoin’s appeal as a safe haven amid economic uncertainty, while strong figures could reinforce confidence in traditional markets, reducing interest in digital assets.

Despite the uncertainty, the crypto community sees this expiration as an opportunity. An options expiration of this magnitude often leads to significant moves, and many investors are watching closely for the potential of a bullish breakout, especially if Bitcoin can consolidate above $100,000.

The market’s immediate future will depend on how traders react and whether the bullish momentum can overcome macroeconomic concerns. What is certain is that volatility will remain a key player in the short term.