TL;DR

- 1inch recorded exceptional growth in Q2 2025, with daily swap activity jumping over 200% quarter-over-quarter, largely driven by BNB Chain’s surge.

- The introduction of Solana and Unichain integrations broadened cross-chain coverage, reinforcing MEV-protected routing and security.

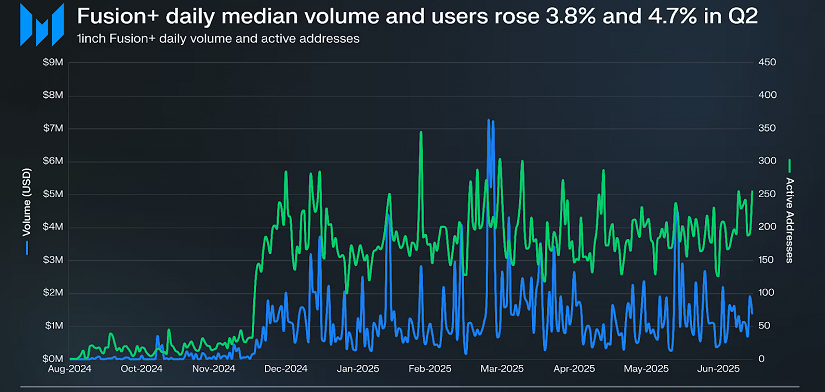

- Meanwhile, Fusion+ sustained demand for gasless cross-chain swaps, showing steady growth in active addresses and transaction volume.

1inch delivered a strong Q2 2025, reflecting both its adaptability to new market conditions and its ongoing commitment to multichain infrastructure. The network processed average daily volumes of $848.2 million through its Aggregation Protocol, a 172.8% increase from the previous quarter. Much of this momentum came from Binance’s Alpha campaign, which rewarded BNB wallet activity and led to exponential growth in swaps routed through BNB Chain.

Ethereum remained the second-largest network for 1inch, though its share declined as BNB gained dominance. Still, Ethereum’s trading volume and activity held steady, highlighting the resilience of its user base. Base and Arbitrum also played supporting roles, though their volumes fell compared to Q1, showing how competitive the layer-2 market is becoming for liquidity aggregation.

Expansion Into Solana And Unichain

One of the quarter’s most significant developments was the successful integration of Solana and Unichain. By adding Solana, 1inch enabled over a million SPL tokens to benefit from MEV-protected routing, extending its reach well beyond EVM-compatible chains. The Unichain connection also boosted execution quality by introducing a double layer of defense, combining 1inch’s resolver protections with Unichain’s trusted execution environment (TEE) block-building. These advances improved both efficiency and security for users transacting across ecosystems.

The rollout of the new Pathfinder upgrade also enhanced swap performance, reducing steps and improving capital efficiency. By optimizing routing, it allowed users to achieve better prices, with swap improvements of up to 6.5%.

Stable Growth In Fusion+

Beyond aggregation, Fusion+ continued to gain traction as a gasless cross-chain execution protocol. Median daily volumes rose to $1.06 million (+3.8%) while active wallets grew 4.7% to 187, suggesting sticky demand even after its explosive launch in Q1. The mechanism remains attractive because users do not need to pay network gas fees directly, while resolvers compete to provide efficient execution through Dutch auctions.

Resolvers like Rizzolver and Flowmatic maintained leadership in the Fusion environment, though competition grew as smaller entities expanded their market share. This diversification indicates a healthier and more decentralized ecosystem for execution.

Closing the quarter, 1inch demonstrated its ability to absorb surging demand while laying down long-term infrastructure.