TL;DR

- 21,800 Bitcoin options contracts, valued at $1.33 billion, are set to expire today.

- There is a predominance of long position options, with higher open interest at $80,000 strike prices. Additionally, 297,000 Ethereum options contracts are also expiring today.

- Implied volatility of long-term options is significantly decreasing.

With the imminent expiration of options of considerable value, Friday will be a crucial day for Bitcoin investors. The financial community is attentive and awaits the implications this event will have on the price and stability of the leading cryptocurrency.

A total of approximately 21,800 Bitcoin options contracts, with a nominal value of around $1.33 billion, are scheduled to expire today. The figure represents a significant amount of financial derivatives. Additionally, investor interest in BTC positions in the market stands out.

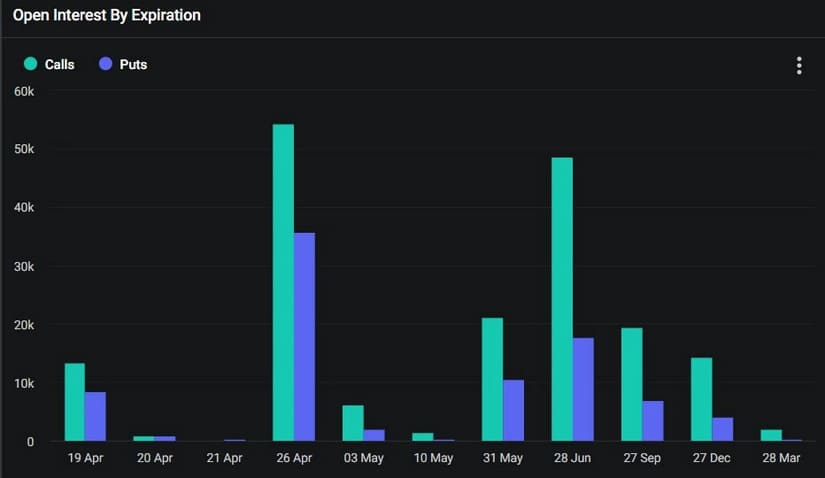

Despite the crypto market downturn during the week, with Bitcoin on the verge of losing its psychological level of $60,000, the majority of expiring options contracts are long positions (calls). This indicates a dominance of bulls in the derivatives market, with a put/call ratio of 0.63.

The highest open interest in BTC options is at the $80,000 strike price, valued at $881 million, closely followed by strike prices of $70,000 and $75,000, with a total value of over $1.5 billion. However, the total open interest in options at $60,000 is $453 million. This level could be a critical point for the current price of BTC.

Do Investors Maintain their Confidence in Bitcoin?

On the other hand, 297,000 Ethereum options contracts are also expiring, with a nominal value of $960 million and a put/call ratio of 0.42, with a higher number of long positions in Ethereum.

Despite the decline in Bitcoin and major altcoins, the implied volatility of long-term options is significantly decreasing. This could indicate that investors maintain some confidence in the future of cryptocurrencies.

As for the overall market, the total capitalization has remained relatively stable at $2.35 trillion after a nearly 4% rebound. Although markets have started to fall again during the Friday morning Asian trading session. Bitcoin is hovering around $65,000, while Ethereum has had a 2% recovery after falling to $2,876, managing to reclaim the psychological level of $3,000. Its current price is $3,090.