The crypto market has entered 2026 with renewed activity. Total market capitalization has moved back above $3 trillion, daily trading volume remains elevated, and institutional participation continues to support liquidity. Bitcoin dominance still plays a central role, but attention is gradually shifting toward alternative networks as participants assess where future growth may emerge.

Within this environment, Tron price action has remained relatively stable and range-bound, supported by consistent network usage and its role in stablecoin transfers. As TRX matures, its price behavior has become more measured. Monero price activity, by contrast, has shown sharper movements, driven by renewed interest in privacy-focused assets followed by periods of consolidation. Both networks continue to serve established use cases, though their growth profiles differ.

This contrast has brought growing attention to ZKP. Analysts describe it as an infrastructure-first project built around zero-knowledge technology, with an emphasis on privacy, scalability, and verifiable computation. A defining feature is the use of Proof Pods, physical devices that contribute to network validation while earning protocol-based rewards. This introduces a hardware component into the network model, linking participation to real-world infrastructure.

ZKP Brings Hardware and Blockchain Together

ZKP enters the market as a Layer-1 network designed around execution and verification. Observers note that more than $100 million was allocated to infrastructure development before the public presale, alongside a live network and a daily auction-based distribution model. With a low minimum entry threshold and defined participation limits, the structure is designed to encourage broader access rather than concentrated allocation.

Interest has continued to build as the presale structure progresses. A fixed number of tokens are released daily, and over time the available supply per day decreases. Analysts note that this mechanism gradually raises the average participation cost, while earlier participants engage under conditions of wider availability. Comparisons with established Layer-1 networks are increasingly part of broader valuation discussions.

A key distinction lies in the inclusion of Proof Pods. These devices, priced separately, function as physical validators that support network operations and earn ongoing rewards. Analysts point out that tying network participation to hardware introduces scarcity dynamics that differ from purely digital token models.

As later phases of the auction approach, daily digital issuance declines while hardware-related activity continues. Researchers suggest this structure may support balanced network growth by aligning token distribution with real operational contribution.

Taken together, analysts increasingly reference ZKP as a notable crypto presale due to its controlled issuance, infrastructure-first execution, and hardware-linked participation model.

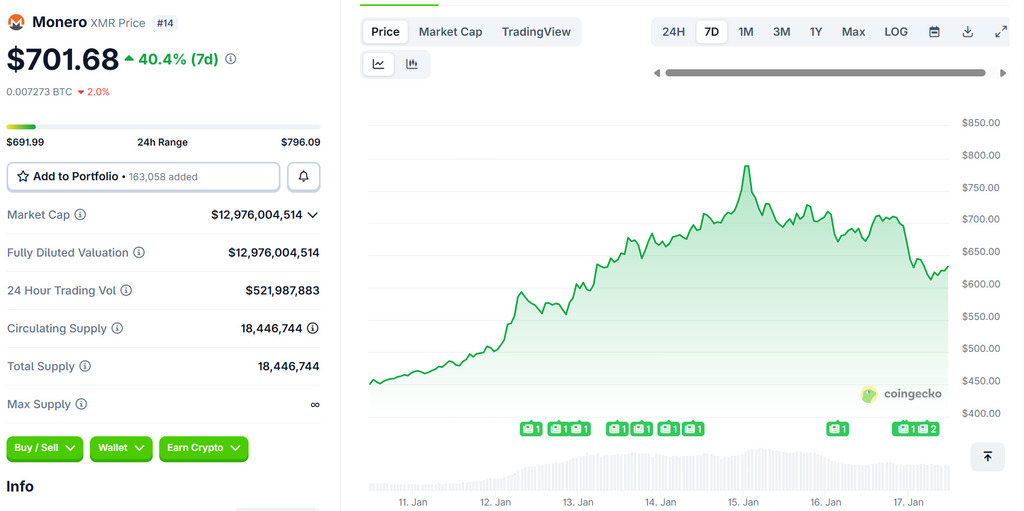

Monero’s Recent Price Action Reflects Strong Interest and Elevated Volatility

Monero price activity accelerated in mid-January 2026, trading largely between $620 and $720 after reaching a recent high earlier in the month. Market capitalization remained near the top tier of privacy-focused assets, while daily trading volume indicated sustained market participation. The move followed a rapid advance from lower price levels, highlighting how quickly momentum can form around privacy narratives.

At the same time, Monero’s price behavior also underscores risk. Sharp advances have often been followed by pullbacks as leverage increases and traders take profits. Despite this volatility, Monero’s privacy features continue to support demand, particularly as discussions around financial privacy remain active. This combination of strong interest and rapid price movement defines its current market phase.

Tron Maintains Stability as Network Usage Drives Value

Tron price action has remained comparatively stable, trading within a defined range during mid-January 2026. With a large market capitalization and consistent trading volume, Tron continues to rank among the more established altcoins. Technical levels show clear support and resistance zones, contributing to controlled price movement rather than abrupt swings.

From a broader perspective, Tron’s behavior reflects maturity. Much of its valuation is tied to real network use, particularly in stablecoin transfers and low-cost transactions. While broader market sentiment still influences price, Tron’s infrastructure role supports steady participation even during quieter periods. This balance between usage and stability characterizes its current position.

Why Analysts Are Paying Closer Attention to ZKP

Tron and Monero illustrate how established assets continue to play important roles. Tron demonstrates stability and consistent utility, while Monero highlights ongoing demand for privacy paired with higher volatility. Both remain relevant, though their growth paths are increasingly well-defined.

This has led some analysts to focus on projects where structural design may influence future outcomes more directly. In contrast to mature assets, ZKP combines capped issuance, early infrastructure investment, and hardware-linked validation. Observers note that Proof Pods and limited daily token release create a participation model where network growth is tied to measurable contribution rather than speculative activity alone.

As the network expands, potential links with AI workflows and privacy-sensitive use cases may add further utility. For this reason, ZKP is often cited in discussions around early-stage infrastructure projects, reflecting interest in its design rather than short-term price movement.

Many participants view this combination of real-world validation, defined supply mechanics, and technical focus as a distinct approach within the current market cycle.

Explore ZKP

Website: https://zkp.com/

Buy: http://buy.zkp.com/

X: https://x.com/ZKPofficial

Telegram: https://t.me/ZKPofficial

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.