TLDR:

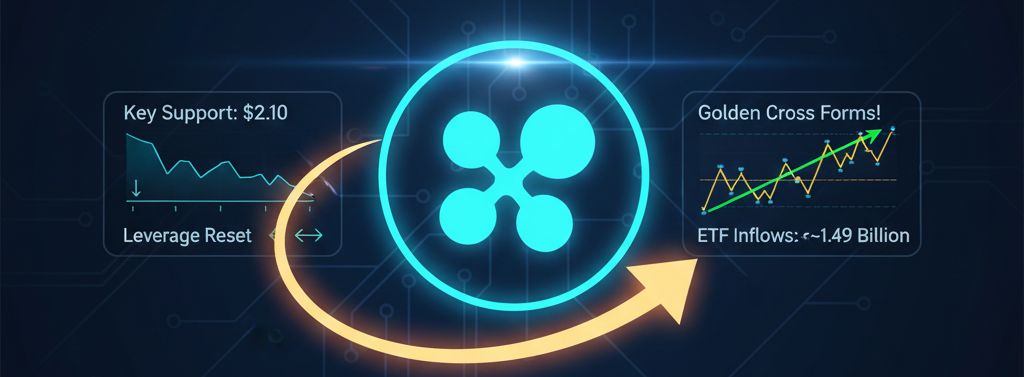

- XRP stabilizes near $2.10 after bilateral liquidations of short and long positions.

- A “Golden Cross” appears on the 5-day MACD, a pattern that historically precedes all-time highs.

- Spot XRP ETFs maintain solid institutional backing with nearly $1.5 billion in cumulative inflows.

The beginning of the year for Ripple has been marked by high volatility, and it now faces a moment of technical definition. XRP is trading near the critical level of $2.10 after the derivatives market underwent an unusual leverage reset.

Whale XRP Flows to Binance Decline, Signaling Reduced Selling Pressure

— CryptoQuant.com (@cryptoquant_com) January 8, 2026

“Decline in whale flows since mid-December, although still at relatively high levels, is a positive sign in the medium term, as it reduces the likelihood of a sudden sell-off.” – By @ArabxChain pic.twitter.com/P646tKZe1u

This “cleanup” process wiped out excess speculation through bilateral liquidations on Binance Futures, leaving the asset in a narrow range between $2.07 and $2.17. This stability has fueled expectations regarding the next XRP price prediction.

Earlier this week, a bullish impulse forced sellers out with $4.4 million in short liquidations. However, 24 hours later, the movement reversed, eliminating $5.5 million in long positions.

This entire sequence has left the market “clean” of excess debt, allowing technical indicators to reflect a more organic and healthy structure for the long term.

Technical Indicators and the Return of Institutional Interest

The most relevant signal for XRP price prediction is the formation of a “Golden Cross” on the 5-day MACD. Data from ChartNerd reveals that the histogram has moved into green territory—a technical pattern last observed in July, just before the token reached new highs.

Generally, analysts interpret this cross as a precursor to sustained rallies toward higher resistance levels.

On a fundamental level, institutional support remains the pillar of confidence. Despite a specific outflow of $40.8 million on January 7, spot XRP ETFs have accumulated nearly $1.49 billion in inflows since their launch.

Furthermore, although whale activity has slightly decreased since December 2025, they still represent 60% of the flows into major exchanges, suggesting that large holders are currently in a phase of strategic observation.

In summary, the combination of a deleveraged market, a highly reliable bullish technical indicator, and robust institutional flow suggests that the XRP price prediction remains optimistic, provided the asset can consolidate its base above the $2 support level.