Market participants often track higher-risk altcoins during bull markets, although outcomes can vary widely. Recent weakness across parts of the altcoin market has also weighed on assets such as Ripple (XRP). Against that backdrop, some commentary has focused on newer tokens that are still early stage and carry higher risk.

One example is Digitap ($TAP), a DeFi-focused payments project that says it aims to connect decentralized finance and traditional finance. According to the project, Digitap has raised more than $2.3 million so far in an ongoing token sale.

Below is a summary of recent XRP price action and a description of Digitap based on public information and project materials.

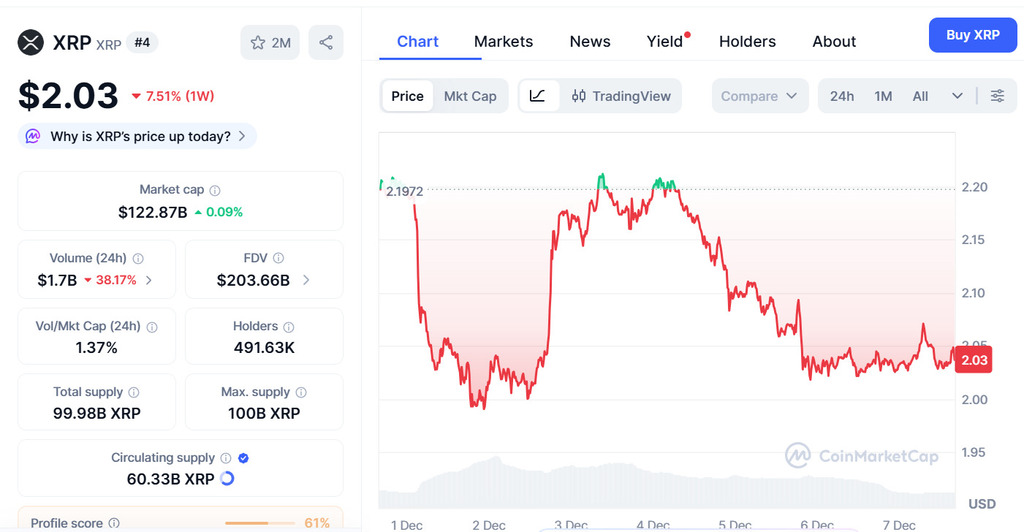

XRP Falls Over the Past Week: What Traders Are Watching

XRP has declined over the past seven days, down about 7% over the period. On December 1, XRP was trading around $2.20. It then moved lower and briefly slipped below the $2.00 level as the broader crypto market weakened. Some market commentary attributed a short-lived rebound to ETF-related headlines on December 2, though the move later faded.

XRP later traded as high as about $2.21 on December 3 before retracing. By December 7, it was hovering around $2.03.

Some short-term indicators have been interpreted by traders as showing selling pressure, although technical signals can change quickly. If price falls back below $2.00, it could add volatility, but any forecast remains uncertain and depends on broader market conditions.

Digitap’s “Omnibank” Concept (Project Description)

Digitap describes itself as an “omnibank” intended to bring crypto and fiat services into a single app. In project materials, Digitap says users would be able to manage crypto and fiat balances through an application.

The project says the Digitap app is available on Android and iOS. Digitap also states that certain product flows may be available without KYC checks; users should consider applicable legal and compliance requirements in their jurisdiction.

Digitap also says users can create virtual or physical Visa co-branded cards and integrate them with Google Pay and Apple Pay for tap-to-pay transactions, where supported.

Remittance Claims and Payments Infrastructure

Digitap positions its product as addressing costs and settlement times in the remittance market. In its materials, the project claims its approach could reduce fees compared with traditional remittance options, citing a reduction from an average of 6.2% to under 1%; these figures are project-reported and should not be treated as guaranteed outcomes.

Digitap also states that its protocol is interoperable across multiple blockchain networks for on-chain transactions. For off-chain transactions, the project says it supports fiat payment rails such as ACH, SWIFT, and SEPA. It also describes a “DigiTag” feature for internal transfers, subject to the project’s terms.

In its documentation, Digitap cites measures it says are intended to strengthen security and custody processes, including:

- Partnering with Coinsult and SolidProof for smart contract audit work, according to the project.

- Storing user funds in offshore accounts that the project describes as regulated.

$TAP Token Details (Project-Reported)

$TAP is described as Digitap’s native token. The project states that the token supply has a hard cap of 2 billion, and that it is designed to be deflationary over time.

Digitap’s materials also describe utility features that may include governance participation, fee discounts, and promotional cashback programs. The project also advertises staking rewards of up to 124% annually; such figures are project-provided, can change, and are not guaranteed.

For reference, Digitap lists the following links:

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.