XRP has recently drawn increased attention following developments in regulated derivatives markets. With the CFTC set to see regulated options on XRP futures launch on October 13, some market participants are watching for potential changes in liquidity and positioning.

While the wider crypto market has moved more slowly at times, XRP’s short-term price moves have differed from broader trends. Commentary and forecasting content around XRP pricing has also increased, though such forecasts are inherently uncertain.

Developments related to regulation, institutional products, and market sentiment can affect volatility, but outcomes remain uncertain. Following updates from primary sources and filings can help readers understand what is changing and what is still speculative.

CFTC Options Launch and ETF Discussions Draw Attention to XRP

With the CFTC launching regulated options on XRP futures on October 13, XRP has seen increased attention. Market participants often view regulated derivatives as one factor that can influence participation and risk management, though it does not guarantee any particular market outcome. Separately, discussion continues around the possibility of XRP spot ETF approval.

The availability of regulated options can be relevant to professional market participants because it may provide additional tools for hedging and expressing views. However, describing an asset as “more stable” because options exist would be misleading; options markets can also coincide with heightened activity and volatility.

According to publicly available market data from October 13, XRP’s price movement differed from the broader crypto market over the same period. Even though the wider market gained 0.97%, XRP increased 2.99%. Currently, XRP’s price stands at $2.29, with a $7.54 billion volume, up by 35.71%.

Alongside the options launch, some firms, such as Bitwise and 21Shares, have filed applications for XRP-related spot ETFs. If approved, such products could provide another regulated vehicle for exposure, depending on the structure and the rules governing the fund.

The SEC has previously raised questions about whether XRP should be treated as a security in certain contexts. Market commentary often points to court and regulatory developments as factors that could influence how future ETF applications are evaluated. Some coverage also references technical-analysis charts and forecasts, but these should be treated as opinion rather than certainty.

Meanwhile, a separate meme-token project has also attracted attention online, reflecting how social-media narratives can influence short-term interest in parts of the crypto market.

$MAXI: Meme-Token Project Draws Social-Media Attention

Meme tokens can see attention shift quickly, often driven by community culture and online narratives rather than fundamentals. These dynamics can be highly volatile and may not be suitable for all readers.

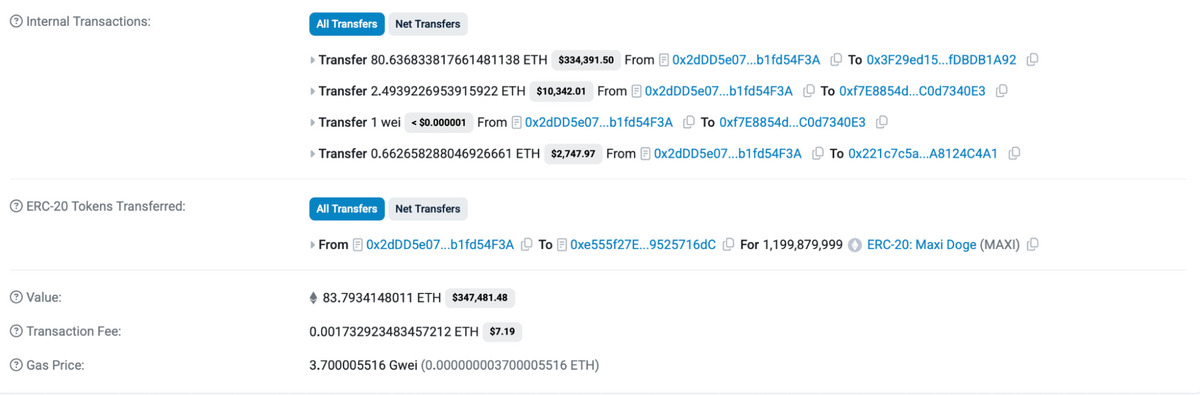

Maxi Doge has reported fundraising activity during a token sale, including a move from $2.88M to more than $3.68M over a short period, according to project-facing materials. The project also highlights two transactions close in time involving a combined 2.4B MAXI tokens (about 1.19B per transaction), each described as worth around $347,000. These figures are project- and/or on-chain-data-dependent and can be difficult to verify in real time.

Large transactions can occur for many reasons (including internal transfers, market-making activity, or individual purchases), so they should not be treated as a clear signal of future price performance.

Project branding describes $MAXI as a meme coin with a Shiba Inu-style mascot, positioning itself within the dog-themed token niche.

As described by the project, 25% of $MAXI’s total supply is reserved for the Maxi Fund, 5% for staking, 15% for liquidity, 15% for development, and 40% for marketing. Readers should treat such allocations as project-reported and review primary documentation for details and any updates.

At the time of writing, the project lists a token price of $0.0002635. The project also promotes a staking feature and advertises a quoted APY figure of 83%, which can change and is not guaranteed. Staking carries risks, including smart-contract risk and the possibility that token prices move independently of any advertised reward rates.

XRP Developments and Meme-Token Activity Highlight Ongoing Volatility

Recent attention around XRP reflects how regulated market infrastructure (such as futures options) and potential ETF filings can become focal points for traders. These developments may affect participation and sentiment, but they do not determine future performance.

In parallel, the attention around meme tokens such as $MAXI shows how community-driven narratives can also influence short-term interest. Readers should consider the risks and the limited public information often available for early-stage token-sale projects.

Project website (for reference): https://maxidogetoken.com/

This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.