Although the timeline for a potential XRP spot ETF decision remains unclear, market discussions continue around whether approvals could still arrive in the near term. The CEO of Canary Capital has said his company is prepared to launch an ETF once permitted. XRP has traded below key resistance levels amid the broader uncertainty.

During this period, some attention has also shifted to Bitcoin Hyper, a newer crypto project that says it aims to support Bitcoin-related activity across multiple ecosystems. The project has reported raising funds through an ongoing token sale.

XRP Stalls Amid XRP ETF Hopes

Due to the ongoing US government shutdown, regulatory timelines tied to XRP ETF applications have been delayed. A few funds were originally scheduled to have their deadlines between October 18 and 25, but the SEC has paused related actions during the shutdown.

The XRP ETF list awaiting SEC review includes 21Shares, Grayscale, Canary Capital, Bitwise, CoinShares, and WisdomTree. According to Polymarket’s data, market-implied odds suggested a high likelihood of approval by the end of 2025; this is not a guarantee and may change as conditions shift.

At Ripple’s Swell conference in New York, the CEO of Canary Capital, Steven McClurg, told the audience that his company is ready to launch the ETF next week if it receives approval. If an XRP spot ETF is approved, XRP would join Bitcoin and Ethereum among crypto assets with spot ETFs in the US. McClurg said he believes XRP’s technology could have implications for parts of traditional finance.

At the time of writing, XRP trades at $2.32, with a price decline of 9.88% over the past week and 21.68% over the past month. XRP has remained under pressure as large-holder activity, stalled ETF timelines, and regulatory uncertainty weigh on sentiment. Analysts’ XRP price prediction commentary has remained cautious until there is more clarity.

Even with Ripple’s reported partnership with Immunefi and periodic institutional interest, momentum and broader macro conditions have kept the token trading below key resistance levels.

While waiting for more XRP-related updates, some market participants also watch early-stage token sale projects. These offerings can carry elevated risks, including limited liquidity and incomplete disclosures.

Bitcoin Hyper: Project Overview

Bitcoin Hyper describes itself as combining Bitcoin’s settlement layer with a Solana-based development environment. According to project materials, the goal is to enable applications that use Bitcoin for settlement while offering faster execution for certain functions. Use cases cited by the project include gaming, DeFi, and other integrations that are not native to the base BTC network.

In the project’s framing, $HYPER is a token associated with activity inside its ecosystem. As with any token, its market value and utility depend on adoption, design choices, and broader market conditions.

The development layer is described as an environment where apps are built using the SVM. The project says this can provide lower-cost execution and speed, while Bitcoin functions as a medium of exchange within those apps. A settlement layer beneath, powered by the BTC network, is described as recording and finalizing transactions on-chain.

A canonical bridge is described as connecting the two layers by locking Bitcoin on the base layer and minting a wrapped BTC version within Hyper. This wrapped asset is intended to move across apps within the project’s environment.

According to the project, $HYPER is used for network fees and is also positioned as a governance and staking token.

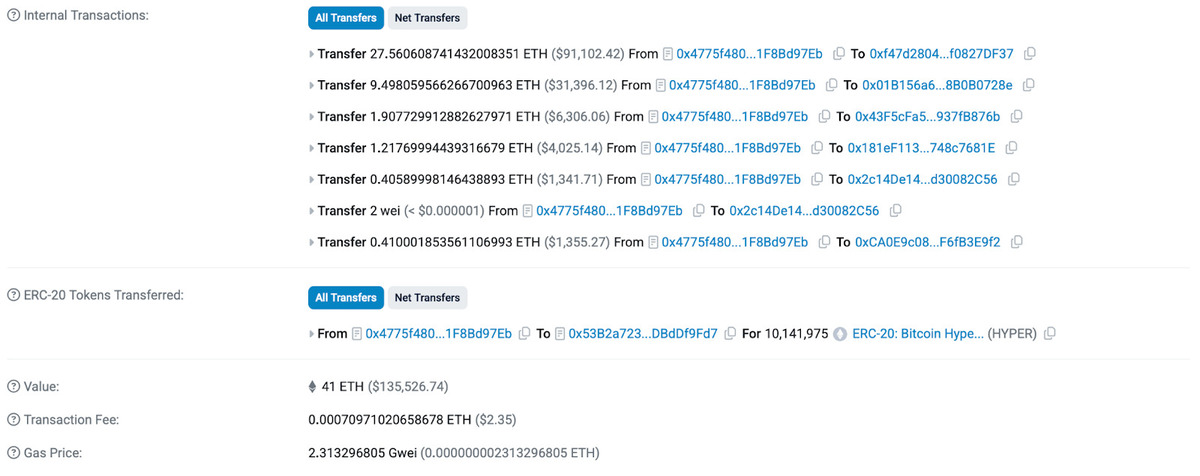

The project has stated that its token sale price is $0.013225 and that it has raised more than $26 million. The article previously referenced several large purchases described as “whale” activity; readers can review on-chain transactions where applicable, but individual purchases do not indicate future performance.

The project also advertises staking rewards with a variable annual percentage yield (APY). It has cited an APY of 45% at one point in time; such figures are not guaranteed, may change, and can involve additional risks (including smart-contract and market risks).

What to watch next

Commentary around XRP ETFs continues as market participants monitor SEC timelines and broader regulatory developments. Any decision timing remains uncertain, and market reactions can be volatile.

Separately, Bitcoin Hyper remains an early-stage project and, like other token-sale offerings, may involve heightened risks and limited public information compared with more established assets.

This article discusses an early-stage token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.