The latest XRP news is moving fast. Swift announced a blockchain ledger for 24/7 cross-border payments. Regulators closed the long Ripple case. Markets now weigh what this means for the XRP price and for adoption across banks and fintechs. Early signs point to real change in how global money moves.

BullZilla has drawn fresh attention with a staged sale and a tight price step-up model. Interest comes from clear numbers and an active community push. The pitch centers on social reach, consistent messaging, and clear security hygiene, including verified contracts and audits. Attention now turns to liquidity depth after launch, exchange access, and whether the team ships on roadmap items like staking, integrations, and creator partnerships.

Legal Clarity Changes The Risk Premium

The five-year SEC fight weighed on XRP. It created headline risk and capped institutional adoption. That overhang is now resolved. A U.S. judge kept the split ruling that programmatic sales on exchanges did not make XRP a security, while institutional sales faced limits. Appeals ended, and Ripple accepted a monetary penalty to close the case. Markets now price XRP with a cleaner legal path, which helps banks and payment firms evaluate integrations.

With the case closed, Ripple has shifted disclosure practices. The company said it would retire its old quarterly “XRP Markets” format after Q2 2025 and provide deeper, more decision-useful insights. CoinDesk reported the same transition. For analysts, that means new data on holdings, flows, and on-ledger activity might become more granular and more focused on institutional use.

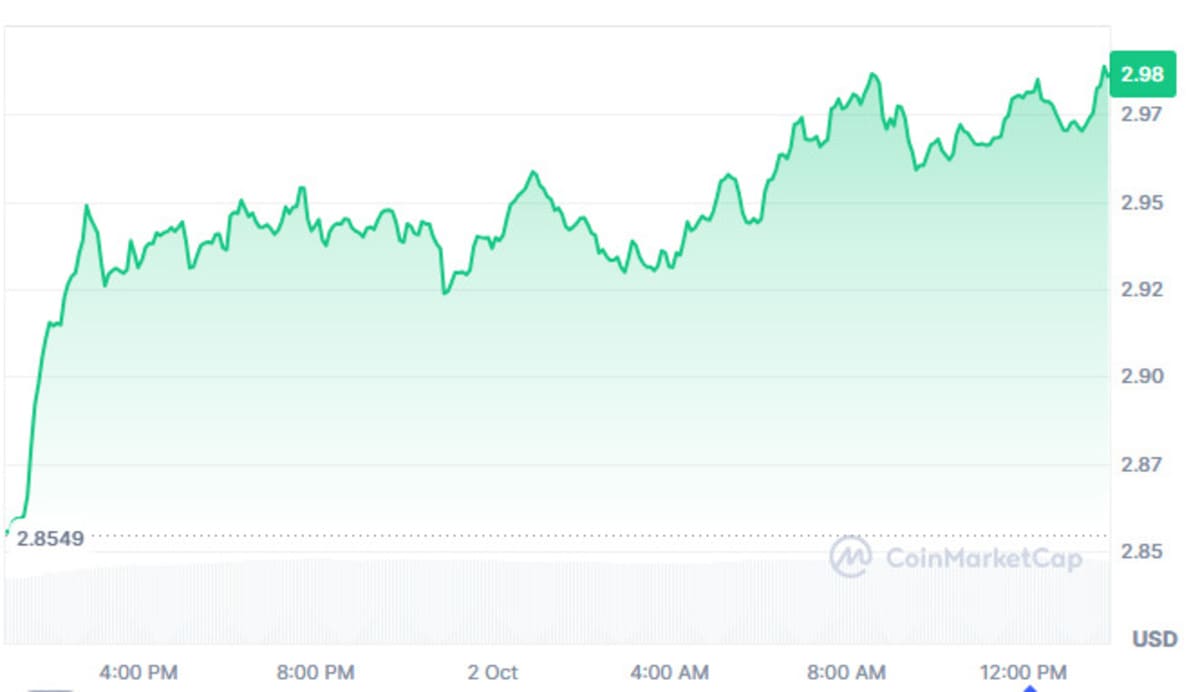

Today’s XRP price trades around the $3 mark after a strong Q3. Traders frame October as a test of momentum and policy. They watch liquidity, exchange inventories, and any spot ETF updates. Institutional desks also track Swift’s timeline and bank pilots. The setup adds fuel to a broader “Uptober” narrative that often lifts majors and strong large-cap altcoins.

Stock market information for XRP (XRP)

- XRP is a crypto in the CRYPTO market.

- The price is 2.99 USD currently with a change of 0.10 USD (0.03%) from the previous close.

- The intraday high is 2.99 USD and the intraday low is 2.89 USD.

Prices shift quickly. Always check real-time feeds and exchange depth before making decisions.

Why Swift’s Blockchain Pivot Matters For XRP

Swift plans a shared ledger with smart-contract style validation to support instant, always-on cross-border payments. That directly targets pain points that XRP Ledger has addressed for years: speed, finality, and lower costs. Swift’s move signals that global finance now treats blockchain as core market plumbing, not a side experiment. It also raises the bar for interoperability. Banks want systems that bridge fiat rails, tokenized money, and public networks.

This is where the XRP story fits. Ripple built enterprise software around the XRP Ledger (XRPL) to clear and settle value in seconds with minimal fees. XRPL uses a consensus model, not mining, which enables fast finality and high throughput. Official docs describe confirmation in roughly 3 to 5 seconds and throughput measured in the thousands in lab tests. These traits line up with Swift’s goals for near-instant settlement and transparent sequencing.

Ripple Uptober Momentum – Can XRP Lead The Altcoin Rally?

Seasonality favors crypto in Q4, and XRP often moves in tandem with Bitcoin and liquidity cycles. But leadership requires catalysts. Swift’s ledger plan is one. Post-settlement clarity is another. A third involves product structure. If spot-based products or derivative listings expand in key markets, it can draw new flows and reduce frictions for funds that track benchmarks. Analysts have linked recent rallies to those improving structures. Still, liquidity can flip on macro data or policy shifts, so risk controls remain essential.

XRPL fundamentals also matter. Official docs and engineering posts describe fast finality and tested throughput above 1,500 transactions per second, with higher sustained rates in controlled tests. That performance supports remittances, fiat bridges, and tokenized assets. For developers, XRPL’s maturity, robust tooling, and predictable fees are practical advantages when designing payment flows.

XRP vs Bitcoin and Ethereum Forecast 2025

Forecasts compare speed, cost, and policy posture. Bitcoin secures value through proof-of-work and acts as a macro asset. Ethereum runs a broad smart-contract economy with modular scaling. XRP targets settlement. If Swift’s new ledger pushes banks toward 24/7 operations, demand for fast bridges could rise. That favors networks with finality and stable fees at high volume. The relative edge for XRP comes from deterministic settlement rather than yield farming or complex DeFi logic. This is a different lane than Bitcoin or Ethereum, yet the lanes converge inside bank workflows.

Macro policy may set the ceiling. Europe’s MiCA provides a clear rulebook for issuers and service providers. FATF standards drive Travel Rule compliance across virtual asset service providers. As banks and payment firms standardize on these frameworks, friction falls for compliant chains and products. That backdrop supports steady demand for XRP as a settlement asset if banks see cost savings and lower reconciliation risk.

Ripple News Today: Investor Outlook and Long-Term Targets

Investors watch three streams. First, Swift pilots and bank participation. Second, regulatory follow-through across the U.S., EU, and Asia. Third, exchange float and fund flows into XRP products. Reuters’ timeline shows how final court actions removed a large source of uncertainty. If policy stays constructive and Swift’s rollout hits milestones, long-term targets based on utility can hold more weight than pure sentiment targets.

Messari’s state report flagged growing tokenization on XRPL, stablecoin traction, and listings that improve access. That growth supports a thesis where payment tokens live beside fiat and bank tokens in shared ledgers. In that world, message standards, identity rules, and settlement engines need to interoperate. XRP benefits when that stack gets built in the open and mapped to bank compliance.

XRP Price Forecast October 2025 – SEC Case Impact

October brings data drops, regulator updates, and earnings that can sway risk assets. With the SEC case done, XRP trades with less headline drag. The base case treats XRP price as sensitive to Swift milestones and liquidity in spot and derivatives. If exchange inventories remain tight and fund structures expand, rallies can extend. If macro tightens or bank pilots slip, prices can retrace. Use position sizing that respects volatility and fat tails.

Ripple Market Update: Is XRP The Next Big Crypto in 2025?

“Next big” depends on real usage. Banks measure seconds saved, errors avoided, and capital released from pre-funding. XRP can help compress those costs if the rails support end-to-end compliance and clear finality. Swift’s plan adds urgency. If the Swift ledger adopts open interfaces and plays well with public chains, banks can route flows to the best path at any hour. That creates room for XRP to serve as a bridge asset when it is the cheapest and fastest hop.

OneSafe’s article captures the rise in interest while stressing that smaller Web3 firms still face banking hurdles. That view aligns with FATF’s push for better Travel Rule implementation and KYC controls across providers. The market will reward assets that plug into those controls without breaking speed. XRP sits close to that line.

XRP Price Prediction 2025 – Ripple’s Market Outlook

Price targets vary. Models that anchor on network usage and bank integrations tend to be more conservative than pure momentum models. A reasonable framework looks at settlement volumes that could migrate to crypto-enabled rails by 2026, then assigns a share to XRP-enabled paths. It adds spreads saved per transfer and discounts those cash flows. The result is sensitive to Swift’s timeline and to the mix of public versus permissioned rails. Treat any single target with caution and review assumptions when policy or bank behavior changes. For transparency, Ripple has said it will update market disclosures to better match institutional needs, which will help analysts refine inputs.

XRP Price Today and Market Structure

Spot price, depth, and derivatives open interest shape near-term moves. As of this writing, XRP price sits near $3 with intraday ranges close to ten cents. Liquidity improves during U.S. and EU hours, with spreads tightest on top venues. Be mindful of funding rate swings and the impact of large option expiries into month-end. Always verify data across multiple sources.

Under The Hood: What The XRP Ledger Actually Does

The XRP Ledger uses a unique consensus protocol where independent validators agree on the order and validity of transactions. There is no mining. Confirmation can finalize in seconds, and fees are tiny because fees act as anti-spam rather than miner rewards. XRPL supports issued tokens, automated market makers, and features that enable stablecoin and RWA issuance. Those tools are now part of bank and fintech trials that seek to cut settlement times from days to seconds.

Compliance, MiCA, And Why Banks Care

Banks do not adopt tech on hype. They adopt clear rulebooks. Europe’s MiCA enforces disclosures, authorization, and supervision for crypto-asset service providers. FATF’s standards require identity data to travel with transfers. Providers that align with both can scale cross-border volumes without constant exceptions. For XRP, the win is not only fast settlement. It is fast settlement that passes audits. That is how volumes become durable.

What OneSafe’s Ripple–Swift Story Gets Right

The OneSafe piece argues that a Ripple–Swift nexus brings speed to legacy rails while raising compliance stakes. That matches what Swift itself describes for its forthcoming ledger. It tracks, sequences, and validates payments to enable 24/7 operation across currencies. If those rails interoperate with XRPL and with bank token systems, routing engines can pick cheapest paths in real time. That is a direct tailwind for XRP utility.

BullZilla: The New Altcoin Getting Attention Before The Close

BullZilla ($BZIL) is a memecoin project with a progressive pricing engine, a staged presale, and scheduled on-chain burns before each stage shift. The site lists a 5 percent burn reserve, staking at 70 percent APY, and a referral program. Tokenomics allocate 50 percent to presale, 20 percent to staking, 20 percent to a community vault, and 5 percent each to the team and burn reserve. Treat these as project claims and verify with audits and contract reads.

BullZilla Presale Performance (as of October 2, 2025; project figures)

| Metric | Value |

| Current Stage | 5th (Roar Drop Incoming) |

| Phase | 1st |

| Current Price | $0.00011241 |

| Presale Tally | Over $760,000 raised |

| Token Holders | Over 2,400 |

| Tokens Sold | Over 30,000,000,000 |

| Current ROI | 4,589.44% from Stage 5A to listing price $0.00527 |

| ROI Until Stage 5A (Earliest Joiners) | 1,854.95% |

| $1,000 Purchase | ≈ 8.896 million BZIL |

| Next Stage Change | Price rise of 5.92% to $0.00011907 |

How to Buy BullZilla Tokens

Buyers need an ERC-20 wallet like MetaMask or Trust Wallet, on a network with sufficient ETH for gas. Connect to the official presale page. Confirm the contract address on the site and in the audit before sending any funds. Never copy addresses from social threads. After purchase, verify receipt on Etherscan and consider using a hardware wallet for storage. Staking and referral rewards carry lockups, so read vesting rules carefully. This is project-level risk. Only commit what you can afford to lose.

Conclusion: The Path From Demo To Daily Volume

A real shift is underway in cross-border payments. Swift’s ledger plan and Ripple’s legal clarity reduce two major blockers. Companies can now test always-on settlement with fewer unknowns. XRP stands to benefit if banks choose the fastest and most auditable path for each payment. The XRP price will track that progress in waves. Sharp rallies and pullbacks will likely persist as pilots scale and rules tighten. Investors, students, and developers should study the rails, not just the charts. The winners will be systems that are fast, compliant, and open enough to interoperate at bank scale. Bull Zilla is a meme token built around bold branding, an active community, and a simple, execution first utility roadmap.

For More Information:

Follow BZIL on X (Formerly Twitter)

FAQs About XRP Price Today and Market Sentiments with Bullzilla Presale

What is driving the XRP price in October 2025?

Two factors lead the story. Swift’s blockchain plan and the end of the Ripple–SEC case. These reduce uncertainty and open paths for bank pilots. Macro and liquidity still matter.

Is XRP a security in the United States?

A judge ruled that exchange sales did not make it a security, while certain institutional sales fell under securities law. The case has closed with penalties and injunctions.

How fast is the XRP Ledger?

XRPL finalizes transactions in seconds and supports high throughput in tests. Fees are tiny and act as anti-spam.

Will Swift use XRP directly?

Swift plans a shared ledger for instant cross-border payments. Whether banks will route flows that use XRP will depend on interoperability and cost. Trials and standards will decide.

What risks should investors consider with XRP?

Volatility, regulatory shifts, exchange liquidity, and integration delays all pose risks. Use careful sizing and verify data across sources.

Is BullZilla a safe investment?

BullZilla is a new project with presale risk. Validate contracts, audits, vesting, and team details. Only invest what you can afford to lose.

Where can developers learn more about XRPL?

Start with the official docs and tooling pages, then track engineering posts for performance updates.

Glossary

- XRP: The native asset of the XRP Ledger used for fast, low-cost settlement.

- XRP Ledger (XRPL): A decentralized blockchain that uses a consensus protocol to finalize transactions in seconds.

- Finality: The point when a transaction cannot be reversed. XRPL aims for 3 to 5 seconds.

- Swift: The global financial messaging network building a blockchain ledger for 24/7 payments.

- ISO 20022: A financial messaging standard used by banks and payment systems worldwide.

- MiCA: EU regulation that sets rules for crypto-asset service providers and issuers.

- FATF Travel Rule: A standard requiring identity data to travel with crypto transfers.

- Tokenization: Issuing digital representations of assets on a blockchain, including stablecoins and RWAs.

- Programmatic Sales: Exchange-based sales that a U.S. court said did not make XRP a security.

- Settlement Risk: The risk that a payment fails or reverses after initiation.

Summary

Swift will launch a blockchain ledger to enable 24/7 cross-border payments, with smart-contract-style validation and bank participation. This reduces institutional barriers to instant settlement and strengthens the case for assets built for speed and finality, notably XRP. The Ripple–SEC case has ended, with a penalty and clear guidance that exchange-based XRP sales are not securities, which lowers legal risk and improves adoption odds. XRPL offers second-level finality, tiny fees, and high tested throughput. Europe’s MiCA and FATF’s Travel Rule shape compliant routes for bank-grade flows. The XRP price now reflects a cleaner policy path and new infrastructure timelines. A brief BullZilla section presents presale data and cautions on project risk. Overall, the thesis centers on auditable, interoperable, and instant settlement as the driver of durable value for XRP in 2025.

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.