TL;DR

- The ProShares Ultra XRP ETF has secured SEC approval for listing on NYSE Arca, marking a major step for leveraged crypto products in the US.

- The fund offers 2x daily exposure to XRP through futures contracts, not direct token ownership.

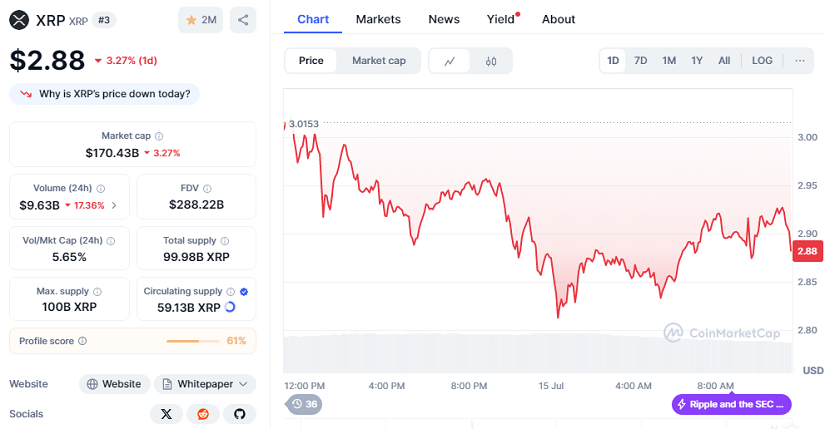

- XRP currently trades at $2.88 with a 24-hour performance of -3.27% and a total market cap of $170.43 billion.

The ProShares Ultra XRP ETF, trading under the ticker UXRP, is now officially set to join NYSE Arca’s roster of futures-based crypto offerings. Investors will have access to double daily exposure to XRP’s price movements without needing to hold the asset itself. Instead, the fund uses a mix of futures contracts and swaps to replicate XRP’s price behavior.

While futures-based ETFs have become more common for Bitcoin and Ethereum, this approval expands the leveraged futures market to XRP, the world’s sixth-largest digital asset by market capitalization. Many traders see this as an additional option to amplify their XRP strategies in a regulated framework.

Two More XRP ETFs Await Approval

ProShares has signaled that it plans to follow UXRP with two more products: the Short XRP ETF (XRPS) and the UltraShort XRP ETF (RIPS). XRPS aims to deliver -1x daily returns and RIPS targets -2x exposure to XRP’s price moves. Both funds are designed for traders looking to profit from downward price trends in XRP. Neither has cleared final listing hurdles yet, but July 18 has been floated as a potential debut date.

Leveraged and inverse ETFs have grown popular among active traders who seek amplified short-term gains. However, these funds carry heightened risk due to daily rebalancing and compounding effects, making them better suited for experienced participants than passive investors.

XRP Price Slips Ahead Of ETF Launch

Despite the buzz, XRP’s price dipped 3.27% in the last 24 hours to $2.88, leaving its total market capitalization at about $170.43 billion. Market watchers attribute the short-term decline to profit-taking and general crypto market volatility as traders anticipate new rules in Washington, D.C. that could reshape the regulatory landscape.

The timing of the UXRP launch coincides with Crypto Week, during which US lawmakers are weighing measures like the Clarity Act and the Anti-CBDC Surveillance State Act. As policy debates continue, interest in regulated crypto investment products remains strong. Many expect these new ETFs to drive fresh volume to XRP futures and add more liquidity for traders seeking leveraged exposure in a compliant way.

For now, all eyes are on NYSE Arca as investors await the green light for UXRP’s first day of trading, expected later this week.