TL;DR

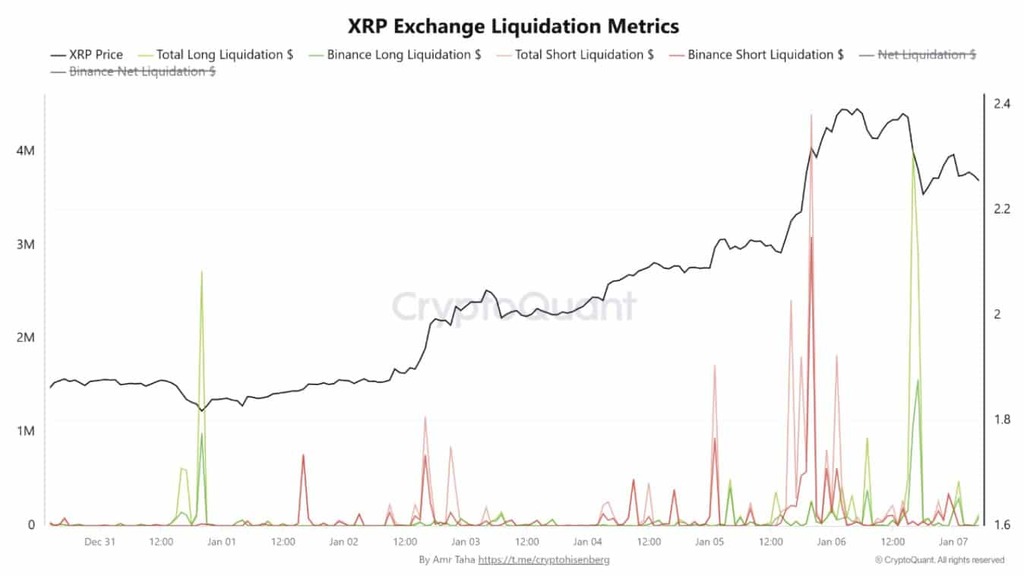

- XRP’s derivatives market saw forced liquidations of long and short positions from January 5-7, showing market instability.

- Binance was the main center for these liquidations, with short-side pressure on the 5th and long-side pressure on the 6th.

- Despite the sell-off, 69% of traders held long positions, indicating repeated but unsuccessful attempts to bet on a price rise.

The derivatives market for the XRP token experienced a series of forced liquidations affecting both long and short positions in the first days of January. Data from tracking platforms shows a pattern of instability, without a clear directional impulse in the asset’s price. Leveraged trading is defining the short-term movement.

The activity was prominently concentrated on the Binance exchange

Between January 5th and 7th, it was the main center for XRP liquidations. On the 5th, short position liquidations reached approximately $24.4 million. Of that figure, Binance accounted for nearly $8 million. XRP’s price was around $2.35 at that time.

The next day, January 6th, the focus shifted to long positions. These liquidations totaled around $22.9 million, with significant contributions from Binance, Bybit, and OKX. As this happened, the price of XRP retreated toward $2.30. This swing showed market forces canceling each other out, failing to establish a firm support level.

By January 7th, the pressure eased but maintained a downward bias. Long position liquidations summed to $8.4 million, while short liquidations were under one million. The token’s price continued its gradual decline, approaching the $2.20 mark.

A Forced Restructuring of Leverage

Coinglass data from January 7th revealed that, despite the liquidations, 69% of accounts maintained long positions in XRP. This persistent tilt toward bullish bets, even during a phase of falling prices, indicates traders repeatedly rebuilt their optimistic exposure. However, the price’s inability to stabilize forced them out of their positions again.

This cycle suggests a deleveraging or reset process, rather than sustained directional pressure from the spot market. The bursts of liquidations, during both brief rallies and pullbacks, point to fragile conviction and destabilized positions.

Taken together, XRP’s market behavior in these days reflects an environment where derivatives activity dominates short-term price action. As long as liquidation pressure continues and positioning does not stabilize, XRP’s movement is likely to be reactive to these flows, rather than responding to sustained spot demand.