TL;DR:

- XRP records a crash of over 20%, ranking as the worst-performing asset in the Top 100.

- Ripple’s market capitalization is at risk against the rise of the USDC stablecoin.

- Privacy-focused cryptocurrencies like Monero and Zcash also suffer double-digit declines.

Several consolidated projects in the digital asset market have been hit by one of the most severe corrections in recent months. Clear evidence of this is the XRP price drop, which has captured investor attention as the asset recorded a collapse of over 20%, marking the worst performance among the top 100 cryptocurrencies by market cap.

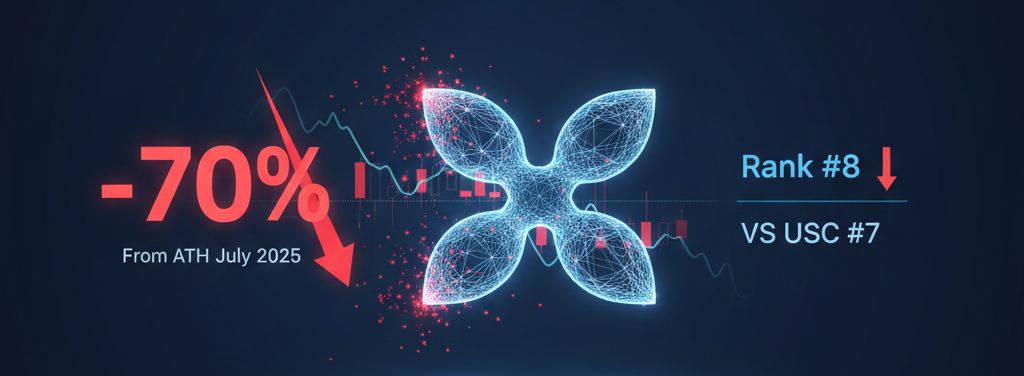

This retreat has brought the Ripple-linked token to the brink of losing its ranking position to the USDC stablecoin. Furthermore, its technical situation is a cause for concern, as the asset is now 70% below its July 2025 all-time high, reflecting a constant erosion of its market value.

A widespread crash with no apparent safe havens

However, Ripple is not the only one affected by the massive liquidation; the damage extends to the privacy-focused cryptocurrency sector. Assets such as Zcash (ZEC) and Monero (XMR) recorded losses near 19%, proving that the risk-aversion sentiment is practically universal across the industry.

Notably, not a single cryptocurrency within the Top 100, with the exception of stablecoins, has managed to remain in green territory during this session. Nevertheless, some protocols like Hyperliquid (HYPE) showed certain resilience thanks to recent listings on major exchange platforms, partially mitigating the impact.

Consequently, analysts suggest the market is flushing out excess leverage, affecting even robust networks like TRON and Toncoin, although the latter reported less drastic falls. The current scenario forces traders to closely monitor psychological support levels to avoid further cascading liquidations.

In summary, the selling pressure on XRP demonstrates the ecosystem’s fragility in the face of sudden changes in global liquidity. While the market searches for a firm floor, the community remains expectant of potential catalysts that could halt this bearish trend and stabilize the valuations of leading assets.