Institutional capital continues to shape the crypto landscape, and XRP is once again drawing notable attention from asset managers. While retail sentiment remains cautious following a broader market pullback, steady inflows into XRP products suggest larger players are positioning strategically for the long term.

As XRP navigates a technically fragile structure in early February 2026, the broader question becomes whether institutional conviction can fuel a sustainable recovery—and whether that same utility-driven thesis could extend to emerging projects.

XRP Remains An Institutional Favorite

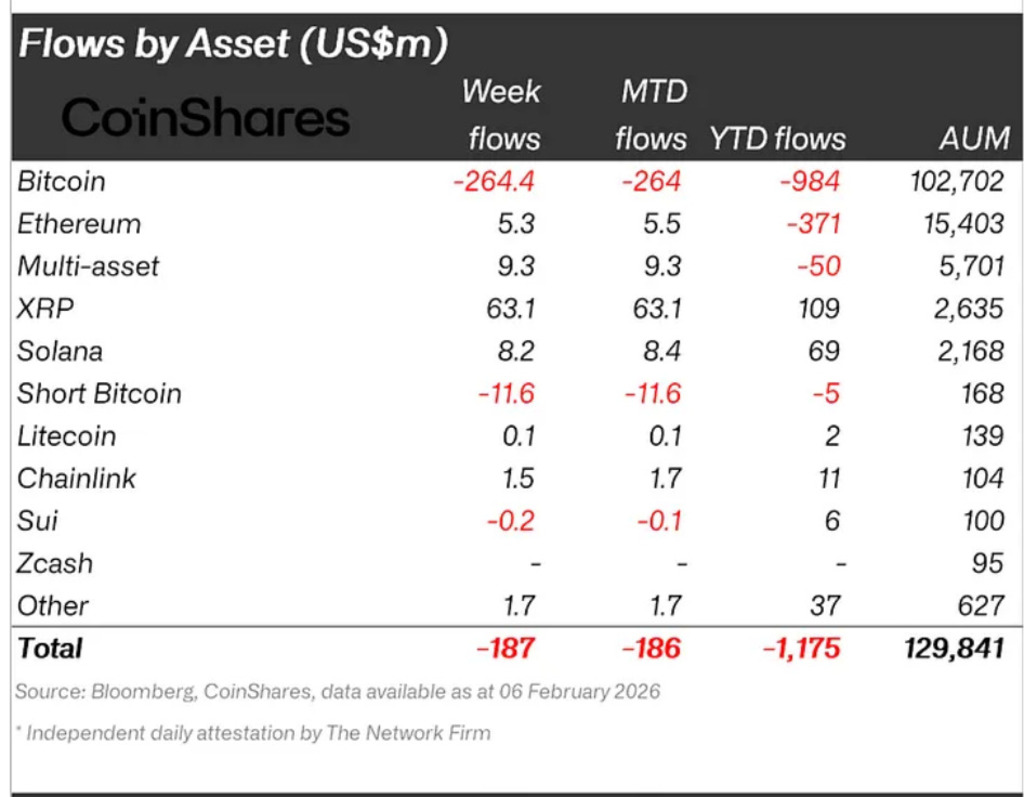

While retail participants remain hesitant during the current market correction, larger financial players are continuing to allocate capital to XRP. Data from the latest CoinShares Digital Asset Fund Flows report shows that, for the week ending February 6, 2026, XRP-linked products attracted $63.1 million in new inflows.

Since the start of the year, total inflows into XRP-focused products have reached $109 million, positioning it as the most successful asset year-to-date in terms of institutional allocation. In contrast, Bitcoin has recorded significant net withdrawals during the same period. This divergence indicates that institutional holders may see durability in XRP’s payments-focused utility, particularly for cross-border transactions, even as broader market sentiment fluctuates.

Institutional Net Flows. Source: CoinShares

Consistent inflows from asset managers often act as a stabilizing force during softer conditions. Although volatility is inherent to the digital asset market, this continued institutional positioning may help cushion XRP against deeper downside moves or an extended period of sideways price action.

Can XRP Recover Its Recent Losses?

The XRP/USD pair on the daily timeframe reflects the broader pressure felt across the market. After testing highs earlier in the year, the price has recently retraced, currently trading near $1.4028.

XRP Price – Source – TradingView

- Technical Resistance: Immediate resistance stands at $1.4320 (the 0.382 Fibonacci level). A daily close above $1.5290 would be required to invalidate the current bearish bias and open the path toward $1.76.

- Support Levels: On the downside, the $1.3120 mark serves as critical immediate support. If selling pressure accelerates, the price could target the $1.1180 zone, where significant buy-side reaction was previously observed.

- Momentum: The 14-day RSI is currently neutral at 47.19, suggesting the market is in a phase of consolidation. While the descending trendline remains intact, institutional buying at these levels could prevent a deeper capitulation toward the $1.00 psychological floor.

How Could Institutions’ Interest Shift To Minotaurus (MTAUR)?

From a market perspective, institutions rarely rotate into assets without a clear value proposition. When evaluating assets like XRP, the draw has always been its straightforward payment infrastructure.

That same logic applies when analyzing emerging projects like Minotaurus (MTAUR). Instead of relying on speculative hype, MTAUR integrates token demand directly into its gaming ecosystem.

- Utility-Driven Demand: Within the Minotaurus ecosystem, the token is used for in-game upgrades, character enhancements, and unlocking new stages, creating a functional demand loop.

- Entry Point & Distribution: Currently priced at 0.00012662 USDT in its presale phase, the project features a balanced distribution structure—including a 10% community allocation—which contrasts with the top-heavy supply often seen in early-stage launches.

If institutional desks continue to favor assets backed by clear utility rather than narrative alone, projects like MTAUR could enter the radar of those seeking infrastructure-focused growth. Sustained on-chain activity and a rising user base remain the primary catalysts for any project aiming for institutional-grade recognition.

The information presented in this article is for informational purposes only and should not be construed as investment advice. Crypto Economy is not affiliated with the project. The cryptocurrency market is highly volatile and can involve significant risks. We recommend that you conduct your own analysis.