TL;DR

- Testing USD1 Airdrop: World Liberty plans a test airdrop of its USD1 stablecoin to validate smart contract functionality and reward early supporters.

- Eligibility Details: Investors must hold WLFI tokens on the Ethereum Mainnet during the snapshot to qualify, with larger holdings potentially earning greater rewards.

- Political and Market Impact: Despite scrutiny over Trump ties, WLFI aims to solidify its position in the stablecoin market with USD1 backed by U.S. Treasuries.

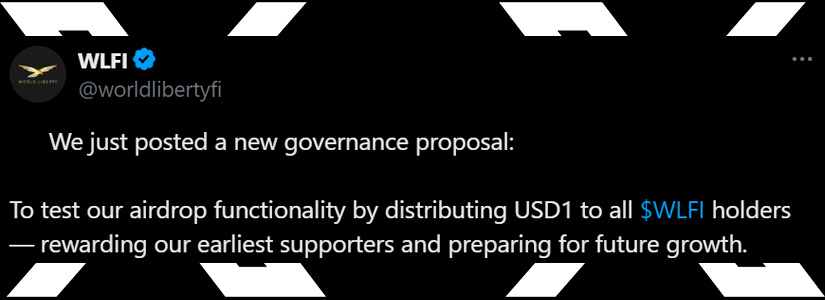

World Liberty Financial (WLFI), a decentralized finance project linked to U.S. President Donald Trump, has announced a test airdrop of its newly launched stablecoin, USD1. The initiative aims to validate its on-chain airdrop system while rewarding early supporters of the World Liberty Financial ecosystem.

Airdrop Designed to Test Smart Contract Functionality

World Liberty’s governance proposal details a plan to allocate a limited quantity of USD1 stablecoin to every WLFI token holder. The company characterizes this initiative as a test of technical functionality, aimed at verifying the seamless operation of its smart contract infrastructure in a real-world setting.

The airdrop also serves as a gesture of appreciation for early adopters who have supported the project since its inception. World Liberty, which launched in September 2024, has already raised $550 million through token sales, and USD1 went live in March 2025. The firm believes that a successful airdrop will boost visibility for USD1 ahead of a broader rollout.

How to Qualify for the Airdrop

WLFI has not yet determined the specific amount or date for the airdrop, but it is confirmed to occur on the Ethereum Mainnet, with funding provided by the WLFI project. Investors looking to take advantage of this opportunity should retain their WLFI tokens until the snapshot is captured.

In the past, airdrop distributions have typically depended on the number of tokens owned, suggesting that those with larger WLFI holdings might receive greater rewards. Additionally, storing tokens in a non-custodial wallet rather than on an exchange could enhance one’s eligibility.

Political Scrutiny and Transparency Concerns

Since its inception, WLFI has come under political examination because of its connections to Trump. Legislators have expressed worries regarding his financial stake, cautioning that it may influence future regulations like the STABLE Act. According to reports, $390 million of the project’s funding has already been disbursed to DT Marks DEFI LLC, a company associated with Trump.

Despite the controversy, WLFI continues pushing forward, positioning itself as a major player in the stablecoin market. The USD1 stablecoin is backed by U.S. Treasuries and managed by custodian BitGo, ensuring a level of financial security for institutional investors.