TL;DR

- World Liberty Financial (WLFI), backed by Trump, has invested a total of $336 million in cryptocurrencies, with a recent $21.5 million purchase in ETH, WBTC, and MOVE.

- This move comes just ahead of the White House Crypto Summit, a key event that could shape the future regulatory framework for cryptocurrencies in the U.S.

- Despite an unrealized loss of $88 million, WLFI continues to show strong commitment to the crypto ecosystem, signaling a long-term bullish outlook.

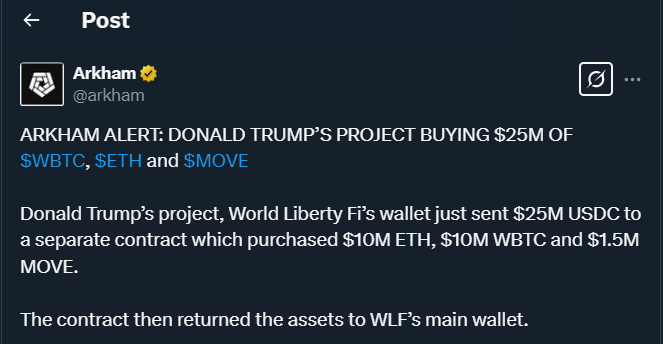

World Liberty Financial (WLFI), a crypto project backed by Donald Trump, has taken a bold step by adding $21.5 million in new digital assets to its portfolio. According to Arkham Intelligence, this recent investment includes $10 million in Wrapped Bitcoin (110 WBTC), $10 million in Ethereum (4,468 ETH), and $1.5 million in Movement (3.42 million MOVE). With this transaction, WLFI has now accumulated a total of $336 million in cryptocurrency investments, distributed across nine key assets, including TRX, LINK, AAVE, ENA, ONDO, and SEI.

The timing of this acquisition is no coincidence. The purchase was made less than 24 hours before the White House Crypto Summit, a crucial event that could influence Trump’s stance on the creation of a national crypto reserve.

WLFI Maintains a Bullish Strategy Despite Unrealized Losses

Despite facing an unrealized loss of $88 million due to market volatility, WLFI has made it clear that its strategy is not focused on the short term. Ethereum accounts for the largest portion of this decline, with a devaluation of $67.35 million, equivalent to 31% of its investment in the asset. However, WLFI’s continued buying during every market dip suggests unwavering confidence in the long-term potential of crypto.

According to Rekt Fencer, founder of X DAO:

“Despite the market pullback caused by Trump’s tariffs, he keeps accumulating ETH on every dip. This is a clear sign of bullish sentiment and shows how serious he is about crypto.”

It remains a mystery whether WLFI has liquidated any of its positions, as a significant portion of its assets has been transferred to Coinbase Prime.

The Highly Anticipated White House Crypto Summit

President Trump has hinted at the possibility of including digital assets such as XRP, SOL, and ADA in a future national reserve, alongside BTC and ETH. The summit will feature key figures in the crypto space, including Ripple CEO Brad Garlinghouse, Chainlink co-founder Sergey Nazarov, and Exodus CEO JP Richardson.

Among the most anticipated topics is the potential implementation of a 0% tax policy for crypto projects in the U.S., as well as clearer regulations for Bitcoin as a strategic reserve asset. Brian Armstrong, CEO of Coinbase, has argued that BTC would be the best choice for this purpose due to its simplicity and its strong “digital gold” narrative.