TL;DR:

- The Jump Trading wallet received 250 million WLFI tokens (valued at $40 million).

- The Transfer of WLFI to Jump Trading occurs at a multi-month low for the token, which is under selling pressure.

- The move suggests an injection of liquidity and a possible market-making operation to boost the price.

World Liberty Fi (WLFI) may be preparing a strategy to boost the value of its native token. On-chain data revealed the massive transfer of WLFI to Jump Trading, one of the leading market makers in the crypto space. This recent transaction, valued at $40 million and involving 250 million tokens, has sparked a wave of speculation in the market about a possible price rally.

The information reveals that the operation was done directly to one of Jump Trading’s trading wallets, an address identified by its activity on DEXs (decentralized exchanges). Although the tokens remained inactive for the first few hours, recent history shows that Jump Trading has received multiple batches of WLFI, indicating a coordinated strategy.

Notably, on November 10th, a transfer of 45 million tokens was executed, marking the largest transfer of WLFI to Jump Trading up until that point.

Implications of the Transfer of WLFI to Jump Trading

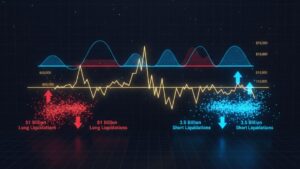

This transfer occurs at a crucial time for the token. The asset is trading at $0.15, near a multi-month low, and is under strong pressure from sellers. World Liberty Fi had recently announced buyback plans with the intention of stabilizing and raising the price.

The involvement of an active market maker like Jump Trading is key. Their holdings could be utilized for various tasks, including providing liquidity on the sell side in the event of a rally, active market-making operations to reduce volatility, or facilitating over-the-counter (OTC) deals and strategic alliances.

While the WLFI token experiences low volatility and reduced volumes, World Liberty Fi is focusing its efforts on the expansion of its stablecoin USD1. This asset was added to Binance Spot for trading with Bitcoin (BTC), maintaining a zero-fee incentive period until December 31st.

The supply of USD1 remains above 2.7 billion tokens, and the platform is also preparing plans to add the tokenization of Real-World Assets (RWA) in early 2026.

The transfer of WLFI to Jump Trading is another step in consolidating the project’s position in the crypto ecosystem.