TL;DR

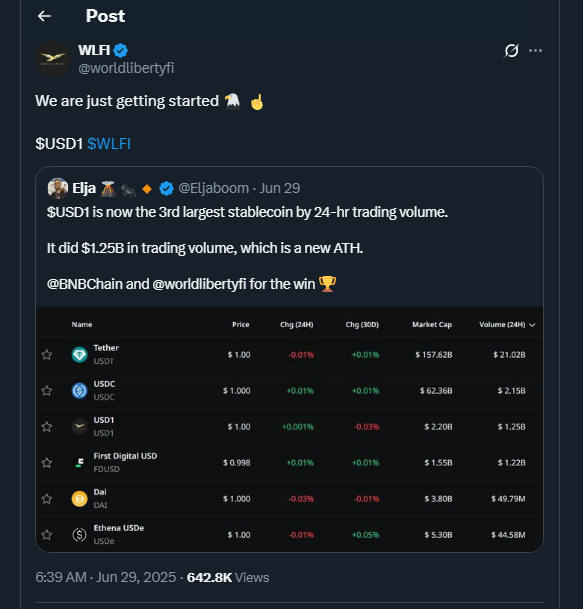

- WLFI’s USD1 stablecoin surged to $1.25 billion in daily trading volume, setting a new benchmark for politically aligned digital assets.

- Nearly $991 million of that came from just ten trading pairs, mostly on PancakeSwap V3.

- While closely associated with Trump’s circle, the stablecoin’s traction appears driven by real DeFi usage, raising questions about centralized control and signaling broader shifts in the stablecoin ecosystem.

WLFI’s USD1, a U.S. dollar-pegged stablecoin promoted by figures aligned with Donald Trump, reached a daily trading volume of $1.25 billion, an unprecedented figure for a non-major exchange listing. The stablecoin’s activity is concentrated primarily on decentralized platforms, with PancakeSwap V3 on Binance Smart Chain accounting for most of the liquidity.

A major portion of the recent spike—over $990 million—came from just ten trading pairs, pointing to strategic deployment of capital. Analysts attribute the boost to a mix of political momentum, institutional interest, and speculative DeFi use. USD1’s market cap currently stands at $2.20 billion, with a slight price increase of 0.02% in the last 24 hours, maintaining its 1:1 peg to the U.S. dollar.

DeFi Demand and Centralization Fuel Debate

Despite not being directly issued by Donald Trump or his campaign, WLFI’s branding and promotional network are deeply tied to supporters of his 2024 presidential elections. Crypto influencers and donors close to his base have rallied behind the token, viewing it as a digital dollar aligned with conservative ideals.

Yet, decentralization remains a concern. Blockchain data shows one wallet holds over 95% of the total USD1 supply, triggering questions about risk and control. This has led researchers and investors to weigh its utility against possible centralized manipulation.

CoinMarketCap analyst John Doe noted,

“USD1’s meteoric rise underscores the real demand for alternatives to traditional stablecoins. But the structure of control will be key to whether it gains long-term trust.”

Some observers argue that WLFI’s performance highlights a growing appetite for mission-driven assets in crypto. Others point to its centralized design as a limiting factor for broader adoption. Still, with no major exchange listings, its volume suggests powerful underlying market dynamics that can’t be ignored.

If WLFI can maintain its momentum and address governance concerns, it could evolve into a formidable player in the stablecoin arena. Its ability to attract liquidity without centralized exchange support may also encourage similar experiments in the space.

Investors and regulators alike will be watching WLFI closely as it navigates these challenges while carving out its place in the evolving crypto market.