TLDR:

- On January 15, the Senate Banking Committee will vote on the final amendments to the CLARITY Act.

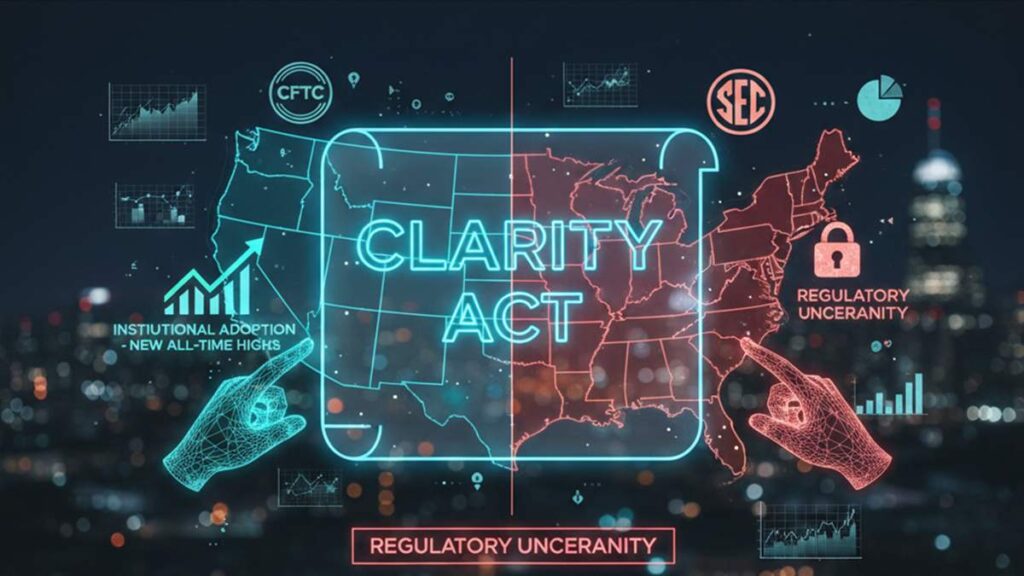

- The regulation will define the jurisdiction between the SEC and the CFTC to eliminate “regulation by enforcement.”

- Experts suggest that its approval could drive Solana toward new all-time highs.

The Trump administration is preparing for its second major legislative achievement following the success of the GENIUS Act last year. This is the CLARITY Act, a bill designed to establish a definitive regulatory framework in the United States.

On January 15, the bill will enter discussion within the Senate Banking Committee.

The CLARITY Act seeks to delimit the responsibilities between the SEC and the CFTC, finally clarifying when a digital asset is a security or a commodity—a distinction vital for the growth of networks like Solana.

One of the core objectives of this proposal is to professionalize the crypto ecosystem by linking it to AML compliance standards and transparency requirements. For institutional investors, this operational clarity is the “green light” signal the market has awaited for years.

Analysts from firms such as Bitwise suggest that by removing legal uncertainty, assets with high transactional efficiency like Solana could experience unprecedented institutional adoption, pushing its price toward new record levels.

Tensions with Coinbase and the Stablecoin Debate

While there is optimism, there are also obstacles on the path toward the approval of the CLARITY Act. Coinbase has threatened to withdraw its support if the legislation imposes severe restrictions on rewards for holding stablecoins.

The industry fears that, under the guise of transparency, the ability to generate yields—a fundamental pillar of today’s digital economy—could be limited. Furthermore, critical points such as legal protection for developers against the illicit use of their protocols by third parties will be debated.

On the other hand, the CLARITY Act faces criticism from more decentralized sectors of the community, who view potential KYC requirements for DeFi applications as a threat to blockchain privacy.

Nonetheless, the general consensus suggests that this legislative framework is the necessary toll for the United States to become the world’s cryptocurrency capital.

In summary, the outcome of the January 15 session will be decisive in defining whether the Solana ecosystem and the global market enter a phase of definitive corporate expansion or if regulatory restrictions will slow down innovation in the short term.