The Federal Reserve cut rates by 25 basis points and said it would begin buying $40 billion of Treasury bills starting December 12th. Some market participants expected this to support risk assets, but the move was followed by a “sell the news” reaction in crypto markets.

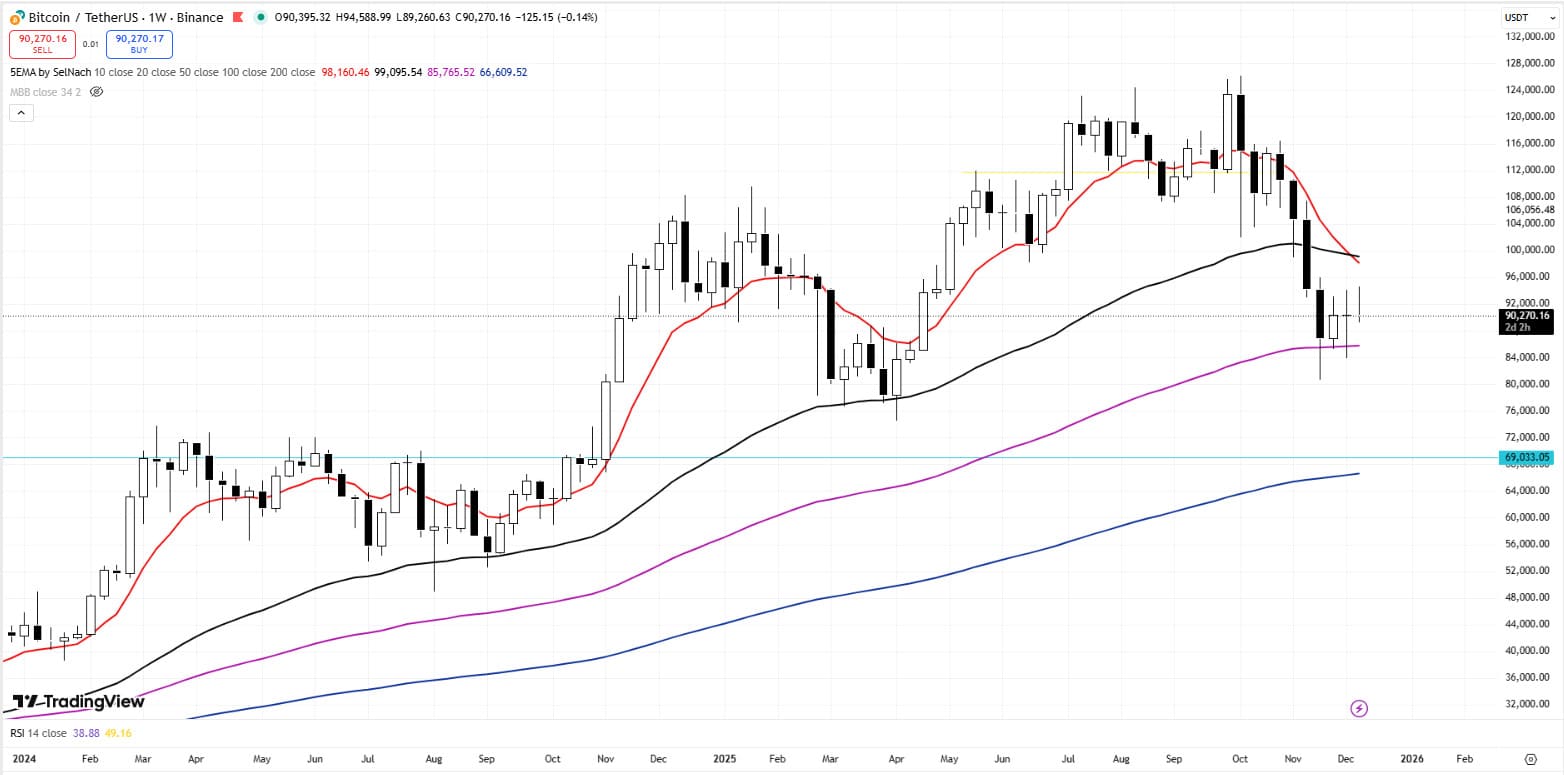

Crypto has broadly followed equities lower, and majors have been down across the board. After a relief rally into the FOMC, markets have turned more cautious. Bitcoin has recently traded around $90,000, and ETH has moved near $3,000 again. That type of action can reflect a risk-off environment.

Even in weaker markets, some projects continue to attract attention. Digitap ($TAP) is one example frequently discussed in the “banking” or payments narrative. The project says its token-sale fundraising has raised nearly $2.4 million so far, and it positions itself around stablecoin usage and payments infrastructure.

Below is a summary of the main points described in project materials and market commentary.

Why Crypto Is Down Today: Fed Cut, ETF Outflows, and Positioning

Why is crypto down today? One explanation is a mismatch between positioning and expectations. The Fed delivered a widely expected decision. Some traders had bid up BTC and other crypto assets on the view that looser liquidity conditions were approaching; when the decision arrived, markets may have had less new information to price in.

Bitcoin moved lower soon after the announcement. With equities also weakening and December often associated with tax-related selling, sentiment can deteriorate quickly. ETF flows have also been watched closely.

Reports in recent sessions have pointed to net outflows in some Bitcoin ETF products, with Ethereum-related products also seeing outflows. When leverage is high, downside moves can be amplified by liquidations and de-risking.

In periods like this, attention often shifts toward projects that claim to have working products and real-world usage rather than narratives alone.

A Banking-Focused Token-Sale Project and the “Defensive” Narrative

In risk-off markets, assets driven mainly by sentiment and liquidity can see sharper swings. By contrast, payments and banking services are often described as more stable categories because people and businesses continue to send money and settle bills in most market conditions.

Digitap positions its fundraising and product around that theme. The project says it has built a global money app that integrates fiat, stablecoins, and crypto into a single balance, and that it aims to make stablecoin-based transfers easier to use for everyday payments.

These are the project’s claims and should be evaluated independently, including any regulatory, technical, and operational risks that may apply.

Digitap’s Omni-Bank: A Live Product Today

Digitap says its app is available for download on iOS and Android. According to the project, users can hold more than twenty fiat currencies and over one hundred crypto assets in a single account.

The project also describes a multi-rail transfer system that can route payments via networks such as SWIFT, SEPA, ACH, Faster Payments, and public blockchains based on cost and speed at the moment a user initiates a transaction. It says users can spend on-chain balances via a Visa card, with support for Apple Pay and Google Pay.

As described by the team, the goal is to simplify the experience of moving between cash and crypto and reduce the need to manage multiple wallets, exchanges, and bank accounts.

Whether these features meet a user’s needs depends on factors such as availability by jurisdiction, fees, custody and counterparty risk, and the regulatory status of the services offered.

Digitap’s “12 Days of Christmas” Campaign: Project-Described Incentives

Digitap says it has launched a “12 Days of Christmas” marketing campaign linked to its token sale. Based on the project’s descriptions, the campaign includes time-boxed offers such as account upgrades and other incentives tied to participation.

Readers should treat these as promotional terms set by the project and review any conditions carefully, including eligibility, deadlines, and jurisdictional restrictions.

Token Mechanics and Risk Considerations (Project Claims)

In its materials, Digitap describes a model in which token-related incentives are connected to business performance. The project states that tokenomics are designed to share value with holders, including mechanisms such as using a portion of profits for token burns and staking-related rewards.

Any such mechanisms are subject to execution risk, regulatory considerations, and the project’s ability to generate profits, and they do not guarantee future token performance.

Project links (for reference)

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned. Crypto assets and token-sale participation can involve significant risk, including the loss of principal.