The cryptocurrency industry faces a credibility crisis as multiple licensed exchanges openly serve Iranian users despite explicit U.S. Treasury OFAC sanctions. This pattern of selective compliance creates unfair competitive advantages and threatens the sector’s legitimacy.

The Rules Being Broken

OFAC sanctions explicitly prohibit cryptocurrency exchanges from:

- Processing transactions for Iranian residents

- Accepting Iranian identity documents for KYC

- Facilitating Iranian rial conversions

- Providing services from Iranian IP addresses

Violations carry severe penalties: multi-million dollar fines, asset freezes, and criminal prosecution. Yet evidence shows systematic violations across multiple platforms.

The Evidence

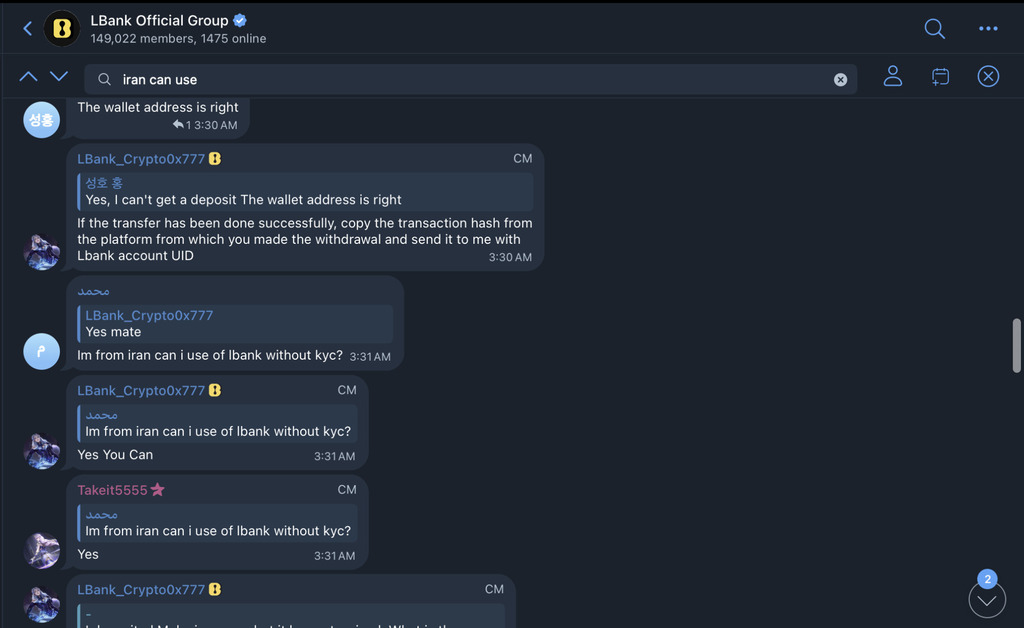

LBank: Active Accommodation

LBank, despite regulatory licenses requiring sanctions compliance, actively serves Iranian users through multiple channels:

- Accepts Iranian national IDs for KYC verification

- Enables Iranian phone numbers (+98) for registration

- Community managers confirm Iranian users face no restrictions: https://t.me/LBank_en/5849500

- Using “Persia/persian” to Obscure Violations in kyc part.

- Community manager approval on video: https://youtu.be/y63k1m_NkOE?si=IzPI18b9qDSRqxKX

- Video evidence of signup with Iranian IP: https://drive.google.com/file/d/1lTIlMp2Q5H9Pp0FbUK8qqmPz6N4d-7l3/view

The platform implements geographic detection that enables Iran-specific features only when accessed from Iranian IPs, suggesting deliberate accommodation rather than oversight.

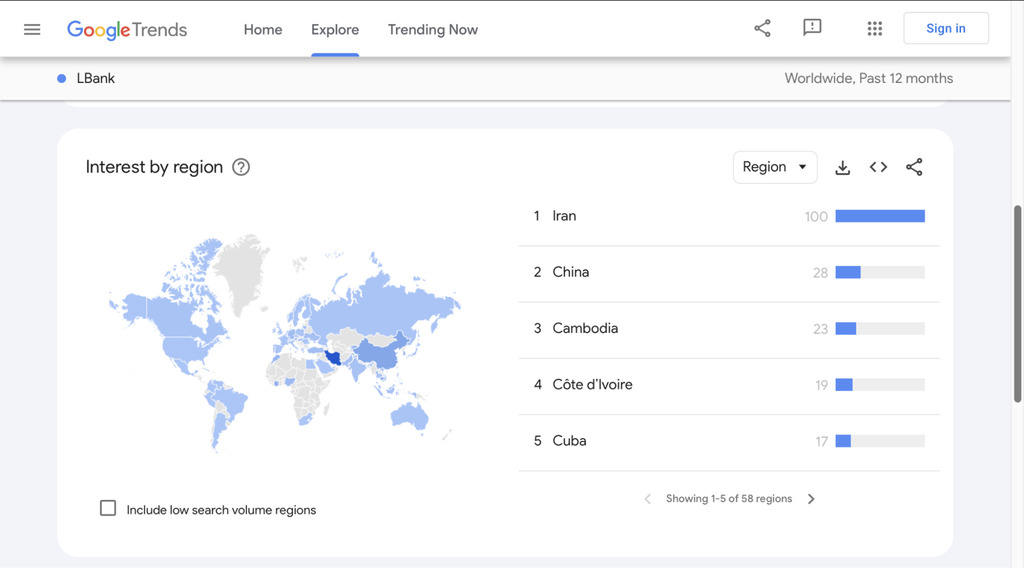

Google Trends data confirms sustained Iranian user engagement: https://trends.google.com/trends/explore?q=LBank

Weex: Active Accommodation

Weex, despite regulatory licenses requiring sanctions compliance, actively serves Iranian users through multiple channels:

- Accepts Iranian national IDs for KYC verification

- Enables Iranian phone numbers (+98) for registration

- Community managers confirm Iranian users face no restrictions:

- Using “Persia/persian” to Obscure Violations in kyc part .

- Community manager approval on video: https://youtu.be/vnq0eKXiWKo?si=qOZFAPIveVBpeYPK

- Video evidence of signup/kyc with Iranian IP: https://youtube.com/shorts/ue1E6CUxLq0?si=1DkBKMz0wCIgeBFM

The platform implements geographic detection that enables Iran-specific features only when accessed from Iranian IPs, suggesting deliberate accommodation rather than oversight.

Google Trends data confirms sustained Iranian user engagement: https://trends.google.com/trends/explore?date=today%205-y&q=%2Fg%2F11tc1mny6b&hl=en-US

XT.com: Active Accommodation

Xt.com, despite regulatory licenses requiring sanctions compliance, actively serves Iranian users through multiple channels:

- Accepts Iranian national IDs for KYC verification

- Enables Iranian phone numbers (+98) for registration

- Community managers confirm Iranian users face no restrictions:

- Using “Persia/persian” to Obscure Violations in kyc part .

- Community manager approval on video: https://youtu.be/hu6UdvIRq8I?si=9hOL5YSBv_ix8yQR

- Video evidence of signup/kyc with Iranian IP: https://youtube.com/shorts/ue1E6CUxLq0?si=1DkBKMz0wCIgeBFM

The platform implements geographic detection that enables Iran-specific features only when accessed from Iranian IPs, suggesting deliberate accommodation rather than oversight.

Google Trends data confirms sustained Iranian user engagement: https://trends.google.com/trends/explore?q=xt.com&hl=en-US

Bitunix: Systematic Violations

Bitunix demonstrates calculated circumvention of sanctions while maintaining regulatory licenses:

- Processes Iranian national IDs for verification

- Accepts Iranian phone numbers for registration

- Maintains full platform access from Iranian IP addresses

- Customer support explicitly confirms Iranian user acceptance

The platform’s deliberate targeting of Iranian users, despite operating under licenses requiring OFAC compliance, represents willful violation of international sanctions.

- Community manager approval on video: https://drive.google.com/file/d/1cZQeZVLKWkMQ1WWAQroEYCsEg7f0YQQW/view

- Video evidence of signup/kyc with Iranian IP: https://drive.google.com/file/d/1wq0b-L83xEGQHJpl5uMxW8oWbBDNZsbO/view

Google Trends data confirms sustained Iranian user engagement: https://trends.google.com/trends/explore?date=today%205-y&q=bitunix&hl=en-US

Toobit: Deliberate Targeting

Toobit shows perhaps the most sophisticated approach to serving Iranian users:

- Accepts Iranian phone numbers for account verification

- Processes Iranian national IDs through KYC system

- Maintains unrestricted access from Iranian IP addresses

- Shows consistent Iranian search traffic in market data

The platform’s targeted accommodation of Iranian users, while holding licenses requiring sanctions compliance, demonstrates systematic circumvention of regulations.

Using “Persia/persian” to Obscure Violations in kyc part.

Community manager approval on video: https://youtu.be/NJ2_rHlf_6w?si=2EcxnKuwKk5zJ3WI

- Video evidence of signup/kyc with Iranian IP: https://youtube.com/shorts/-lWQbAuDOXM?si=YbCH3hzRszlR4Wao

- Google Trends data confirms sustained Iranian user engagement: https://trends.google.com/trends/explore?geo=SH&q=toobit&hl=en-US

Tapbit: Using “Persia” to Obscure Violations

Tapbit employs deceptive terminology to mask its sanctions violations:

- Using “Persia/persian” to Obscure Violations in kyc part .

- Accepts Iranian identification documents for KYC

- Customer support explicitly confirms Iranian user access: https://youtube.com/shorts/7xtR494rT48?si=cG_2VZ84EnFkcDWR

- Community manager approval on video: https://youtu.be/MEX6AaHoTi8?si=OjastHO6G6Ln9BQO

Toobit: Deliberate Targeting

Toobit shows perhaps the most sophisticated approach to serving Iranian users:

- Accepts Iranian phone numbers for account verification

- Processes Iranian national IDs through KYC system

- Maintains unrestricted access from Iranian IP addresses

- Shows consistent Iranian search traffic in market data

The platform’s targeted accommodation of Iranian users, while holding licenses requiring sanctions compliance, demonstrates systematic circumvention of regulations.

The Competitive Distortion

Compliant exchanges investing millions in geo-blocking and monitoring systems operate at severe disadvantages. They lose volume to competitors who simply ignore sanctions, creating a fundamentally unfair marketplace.

When non-compliant platforms access markets worth millions of users that rule-following exchanges must refuse, the competitive imbalance becomes untenable. It’s equivalent to requiring some competitors to follow regulations while others operate freely.

Historical Context

Previous violations resulted in serious consequences:

- Binance: $4.3 billion settlement (2023)

- Poloniex: $7.6 million fine

- BingX: Currently under investigation for similar violations

Yet current violations appear more brazen, with exchanges openly advertising Iranian services rather than maintaining plausible deniability.

Industry Impact

Each violation provides ammunition to critics claiming cryptocurrency primarily serves illicit purposes. When licensed exchanges openly serve sanctioned markets, arguing for self-regulation becomes impossible.

This forces:

- Stricter oversight for all operators

- Higher compliance costs industry-wide

- Banking restrictions on crypto businesses

- Reduced institutional adoption

The Bottom Line

Multiple major exchanges demonstrably serve Iranian users despite clear legal prohibitions. This isn’t technical oversight but willful non-compliance that undermines fair competition and regulatory credibility.

For an industry claiming to revolutionize finance, accepting such fundamental rule-breaking represents profound failure. Compliant operators deserve a level playing field. Users deserve an industry operating with integrity.

The question isn’t whether enforcement will come, but when and how severely. In financial services, the compliance bill always comes due, and it’s always higher than expected.

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.