Polkadex is a Polkadot-based decentralized exchange (DEX) built on Substrate that uses an orderbook trading model to combine the best features of centralized and decentralized exchanges while maintaining security and intuitive trading experiences.

Decentralized exchanges (DEXes) are the new norm in the financial world that are attracting billions of dollars in trading volume. They are the answer to the centralized crypto exchanges like Binance that are often plagued by security issues. Centralized exchanges (CEX) are online trading platforms that match buyers and sellers via an orderbook.

Nonetheless, CEXes offer many benefits such as more liquidity, speed, ease of use, and other features other than exchanging one asset for another, such as margin trading, crypto derivates trading, exchange staking, and margin lending, among others. But strict know-your-customer (KYC) policies, custodial nature, and numerous hack incidents due to their centralized nature are their main weaknesses.

While DEXes solve security issues and provide anonymity to users, they are not fast and efficient as CEXes due to the scalability issues faced by most blockchains.

A team led by three engineers Vivek Prasannan, Gautham J, and Deepansh Singh has built a decentralized exchange that combines the best features of CEXes and DEXes. Their product is known as Polkadex.

Let’s take a look at Polkadex.

What is Polkadex?

Polkadex describes itself as a “fully decentralized peer-to-peer orderbook-based cryptocurrency exchange for the DeFi ecosystem built on Substrate.” Polkadex Network launched its mainnet on September 29, 2021. The project is led by executive director Vivek Prasannan, CEO Gautham J, and COO Deepansh Singh.

🗓 There is finally a date for the public launch of the Polkadex blockchain!

⛓SEPTEMBER 29TH 🤝 MAINNET LAUNCH⛓

💪 This is the most important milestone yet for the Polkadex project team & community as all Polkadex products will be built & gradually released onto this network! pic.twitter.com/OsnB2esXfp

— Polkadex (@polkadex) September 19, 2021

A key discussion in the design of decentralized exchanges is the use of the orderbook and automated market-making (AMM) model. Currently, the most famous DEXes such as Uniswap use the AMM trading algorithm.

AMM solved a considerable obstacle that has been the primary source of concern for many DEXs —illiquidity. However, it brought a set of new problems, such as high slippage, impermanent loss, frontrunning, and arbitraging. Orderbooks are mostly used by CEXes and have their pros and cons.

Polkadex uses the orderbook model to achieve the goal of combining the benefits of trading on CEXes and DEXes while eliminating any possible bottlenecks of both. However, in Polkadex, AMMs will accompany the orderbook by acting as on-chain market-making bots that connect directly with Polkadex’s trading engine.

Take a look at the different components of Polkadex.

Polkadex Orderbook

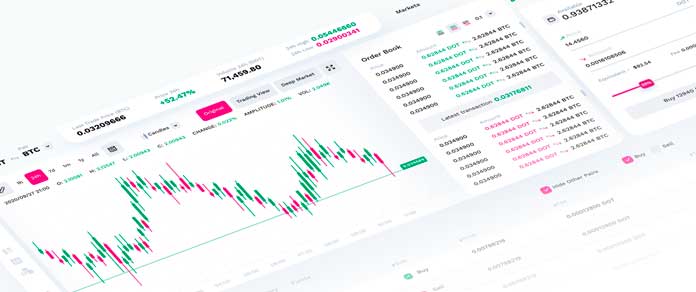

Polkadex Orderbook is the flagship product of the Polkadex team. Polkadex orderbook supports two types of trades, limit and market orders, and up to 500,000 transactions per second with sub-millisecond latency.

According to the documentation, Polkadex Orderbook is a layer-2 based exchange built on top of the Polkadot Network and featuring an orderbook. Polkadex Orderbook keeps the convenience of a centralized exchange but eliminates its bottlenecks by decentralizing the custody of assets.

Orderbook Architecture

According to the documentation, Polkadex Orderbook implements a Layer 2 Trusted Execution Environment (TEE) on top of Polkadex. It consists of four core parts: Polkadex Network, Trusted Execution Environment, Orderbook Engine, and IPFS.

Polkadex Network is the native blockchain (substrate-based parachain) that contains the Polkapool and secures the actions of the Polkadex Orderbook.

Trusted Execution Environment (TEE) is a secure area of the main processor and acts as an isolated execution environment that provides security features such as isolated execution, the integrity of applications executing with the TEE, along confidentiality of their assets. TEE’s computations can be verified by the blockchain and any tampering in the logic will result in the blockchain rejecting the TEE.

In Polkadex:

“TEE handles the balance state management of users in the Orderbook. It prevents theft of funds, verifies the matched trades provided by the Orderbook Engine, settles trades, and enables the trader to reserve and unreserve assets on the native blockchain.”

Orderbook Engine matches trades and provides them with TEE for verification and trade settlement.

Interplanetary File System (IPFS) acts as an insurance department for the Polkadex exchange. It maintains a snapshot of the latest state of the balance transfer. In case of any issue with trades, blockchain rejects all future transfers from the orderbook and returns the funds to its users within 12 seconds.

In Polkadex, only features that need public verifiability go on-chain.

“Orderbook, trader assets management, bridge mechanism to Polkadot and Ethereum, and on-chain market-making bots are on-chain. Trading features like market data aggregation, technical analysis indicators, storage and retrieval of trade history, and all the remaining exchange related features are made off-chain.”

Features of Polkadex Orderbook

Polkadex supports two types of orders, limit and market orders. According to the lightpaper, market-taking orders have a trading fee of 0.2 percent, and market-making orders have zero trading fees. 50% of this market-taking fee goes to market-makers and 50% to Polkadex team.

Polkadex doesn’t collect network fees. Network fees are charged when there are Distributed Denial of Service (DDoS) attack transactions. Polkadex classifies each transaction as a good or potential DDoS attack. Trades are classified as potential DDoS if the execution results in invalid price/quantity error, insufficient balance, invalid trading pair, and invlaid order pair.

Using Polkadex Orderbook traders can delegate their assets to a third-party asset mananger to profit from algorithmic trading without trusting the third parties with full control over their assets.

Users can buy and sell any ERC-20 tokens and other Substrate projects before Polkadex becomes a parachain. Once a parachain, it will also support any tokens issued on Kusama, Polkadot and other DOT ecosystem projects that use Substrate.

Polkadex will also be one of the first DEXes to introduce the fiat on-ramp function, making it very easy for users to exchange their fiat money into crypto assets. This will make Polkadex Orderbook a go-to decentralized exchange for users who are coming to crypto from traditional finance.

Polkapool/AMM/ On-Chain Trading Bots

Orderbook trading model is at its best when there is high liquidity but suffers at times of low liquidity. Polkadex solves the problem of low liquidity by having AMMs directly connected to its trading engine. They acts on-chain market making bots.

In the first version of Polkadex, it will be using a constant product bot. The Polkadex lightpaper explains the working of these bots as:

“When a trade is not matched against the Polkadex order book, the Polkadex Engine will check if these On-Chain trading bots can make an order that will match. The trades are executed only if a better price is provided by the On-Chain bots else it is inserted as a market-making order in the order book. It ensures that there is no price slippage problem for traders.”

Traders can provide liquidity for their favorite AMM curves like constant product AMMs. This AMM-based trading is powered by Polkapool. While Polkadex orderbook is layer-2 dex atop Polkadex Network, Polkapool is a traditional on-chain AMM DEX. It not only introduces feeless swaps but also eliminates front-running.

Polkapool takes advantage of Polkadex’s cross-chain bridges like Snowfork and allow for seamless interoperability between tokens and liquidity on different networks. User can provide to Polkapool’s pools just like they do on Uniswap.

This means Polkadex has two trading-focused products: Polkadex Orderbook and Polkapool AMM-based on-chain DEX.

Not quite right 😉

Polkadex has two products:1. Polkapool – AMM based DEX completely on-chain with feeless transactions, no KYC & no frontrunning

2. Polkadex Orderbook: a High-frequency Trading orderbook featuring fiat support, decentralized KYC (thanks to KILT), trading bots— Polkadex (@polkadex) July 15, 2021

Polkadex IDO

Polkadex Network is not a decentralized exchange alone. We can say that Polkadex is a Substrate-based application-specific blockchain that host Polkadex Orderbook, Polkapool and Polkadex IDO.

Polkadex ecosystem also offers a launchpad for conducting and taking part in the initial dex offerings (IDO) called PolkaIDO. Polkadex IDO platform will provide whitelisting, distributing tokens and vesting done fully on the blockchain. It aims to offer one-stop-shop efficient solution for all the activities from conducting the fundraise to listing tokens on Polkadex exchange fully on-chain. The documentation, about PolkaIDO reads:

“IDO platform will be the easiest way to deploy tokens and distribute them among IDO participants. Teams will receive an end-to-end product that allows them to create tokens, bridge to other networks, list in the Orderbook, conduct IDOs and also finally migrate to their own blockchains later on in the project’s development.”

According to team, its IDO platform solves the problem of current IDO platforms. Other platforms are more centralized than decentralized, meaning that teams have to go through manual lottery selection. Other IDO platfrom requires invesotrs to hold a large number IDO platform’s native token, resulting in lower chances for an average retail invesotrs to get tokens. Furthermore, most IDO platforms are on Etheruem where whitelisting and executing smart contracts to distribute tokens is very expensive.

In Polkadex IDO, there will no gas wars and users have to pay affordable fees to participate in the IDOs. Polkadex will use on-chain randomness that is free and fair for all to pick the lottery winners.

More Features

Polkadex Fungible Assets

This feature allows teams to issue their tokens before their “projects are fully deployed in Ethereum and Polkadot ecosystems simply by sending a transaction in Polkadex.” Polkadex Fungible Assets are assets that work on the native Substrate chain of Polkadot network and are also compatible with the Ethereum network.

These token are ERC-20 compatible and teams building on Etheruem can move them back to Ethereum when needed. The tokens can move freely between their native parachain and other parachains. This feature will be “further enriched to support tokenizing company shares and other real-world assets.”

Polkadex Non-Fungible Tokens (NFTs)

According to the documentation, Polkadex NFT functionality is to gamify its trading ecosytem to make it more fun for users to trade on Polkadex. Polkadex NFTs will be reward for Polkadex exchange traders and network participants.

Decentralized KYC

As Polkadex allows fiat-to-crypto on-ramp, KYC is necessary for using fiat money. Furthermore, to onboard institutional investors and liquidity providers, KYC is required as insitutions are always registered organizations. But privacy is the most important feature of DeFi.

Therefore, Polkadex has decentralized the KYC process for its users offering to store their data on wallets instead of our platform. To make this possible, Polkadex has integrated KILT Protocol, a decentralized identity protocol for issuing self-sovereign, verifiable credentials. This decentralized KYC system enables Polkadex to bring institutional liquidity on the platform.

High-Frequency Trading and Forkless Upgrade

Polkadex enables HFT through trading bots for both retail and institutional investors. Polkadex can connect to all the favourite trading bots of the community enabling users to implement multiple trading strategies.

Furthermore, upgrades for new features, bridges to new blockchains, bug fixes, and performance improvements do not require a hard fork of Polkadex Network.

Polkadex (PDEX) Token

PDEX is the native token of Polkadex which was an ERC20 token before the mainnet. Thetotalsupply of Polkadex native token, PDEX, is capped at 20 million. According to CoinMarketCap, the current circulating supply of PDEX is 4,501,930 (23%).

According to the documentation, PDEX supply can fluctuate at times. “The supply can move between 18 mln and 22 mln tokens at certain periods, but it will always come back to fixed 20 mln tokens in total in the long run.” This will be done by using an automatic system of burning tokens self-regulated by the Polkadex Network itself.

According to token economics, the Polkadex core team will receive 9% of the max supply. 7% (1.4M tokens), 8% (1.6M tokens) and 10.193% (more than 2M tokens) is reserved for seed, strategic, and private investors. 41% (8.2M PDEX) will be locked in the treasury. 10% will be reserved for parachain auction. Polkadex advisor will receive 6% of the total supply.

6.807% will be reserved for marketing, ecosystem, and partnerships. 2% (400K tokens) were released for Community Round as a part of the Token Generation Event through IDO & IEO.

As Polkadex is a multi-feature project, PDEX is used multiple functions that include staking to become a network validator, participation in on-chain governance of the network, participate in Polkadex IDOs, and nomination of validators and collators of the network.

Polkadex network uses the governance mechanism of the Polkadot network. The governance is based on votes and their weight. Like Polkadot, 50% of the circulating supply of PDEX will always be staked.

Imortant Note: The current mainnet of Polkadex is just a mainnet of Pokadex Network, the substrate-based blockchain. Products like Polkadex Orderbook, Polkapool, PolkaIDO and other feature are yet to be launched on the mainnet.

Important Links

- Website: https://www.polkadex.trade/

- Lightpaper:https://github.com/Polkadex-Substrate/Documentation/blob/master/polkadex-lightpaper.md#abstract-memo

- Documentation: https://docs.polkadex.trade/

- Twitter: https://twitter.com/polkadex