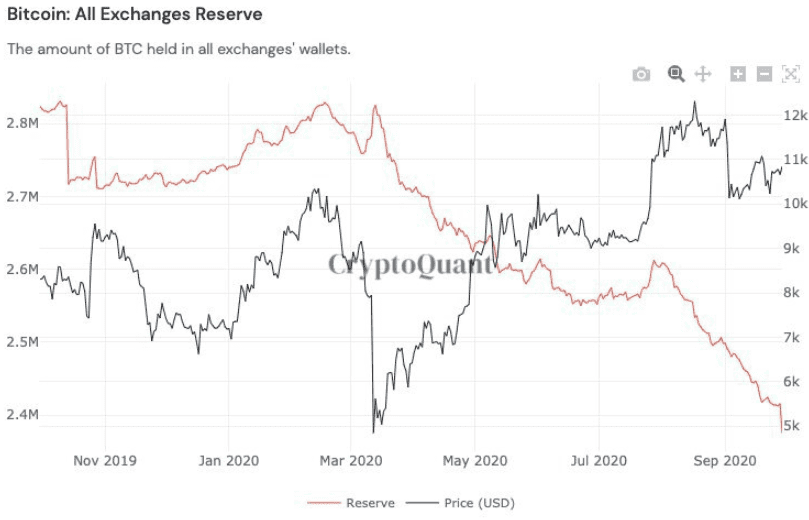

Based on statistics for exchange reserves, whales are accumulating Bitcoin in 2020 as reserves dropped $5 billion in 2020. In fact, Bitcoin reserves on exchanges continue to fall throughout the entire year, even now. This may imply that both retail investors and whales are hoarding Bitcoin and storing them on personal wallets.

Bitcoin reserve statistics from leading blockchain data analysis firm CryptoQuant revealed that exchange reserves fell to 2.4 million BTC. At the time of writing, the assets are worth $25.7 billion.

This is a significant difference compared to past activity as exchanges held 2.8 million BTC in October last year. Now, those reserves would equal $30 billion at current prices.

As deposits imply that investors are looking to buy cryptocurrencies, a lower amount of reserves means that there is less selling pressure. Likewise, investors are withdrawing their assets to personal assets to store them for long-term timeframes.

Considering that reserves did not increase even with a surge in price, statistics may show that Bitcoin is headed for higher price levels.

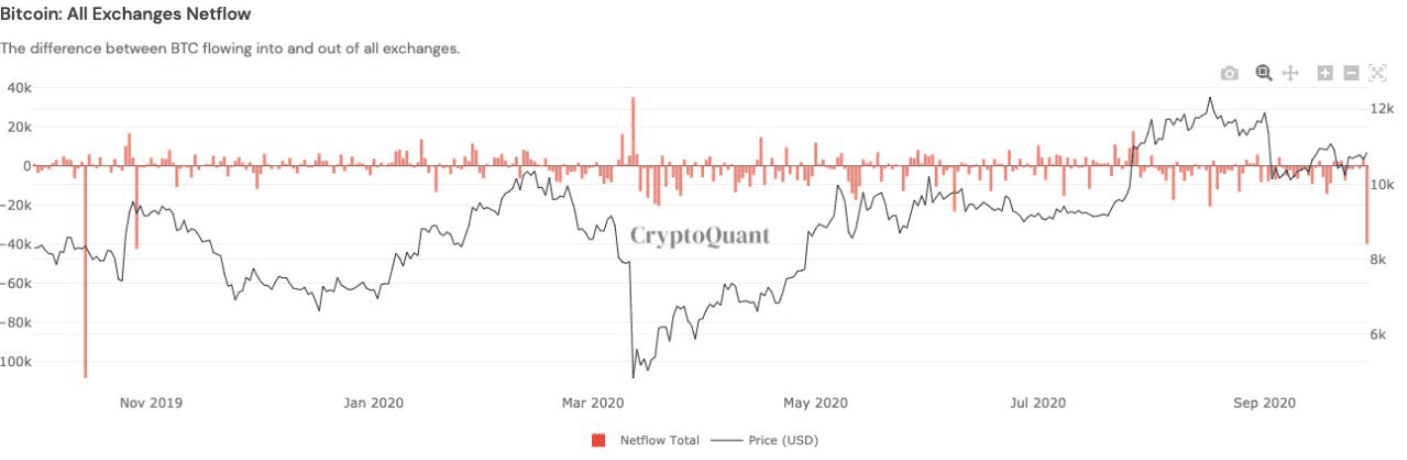

Based on a different chart from the firm, Bitcoin inflows to exchanges paint the same picture. In August and September, inflows circulated around -20,000 BTC. In the last few weeks, net inflows dropped even further as Bitcoin surged from its $10.2k local low to $10.7k.

All of these factors, combined with a recent price increase, can only mean one thing. If supported by the stock market, Bitcoin may have strong upwards price action in the fourth quarter of 2020. If market sentiment aligns with PA, Bitcoin may be even ready to reach old all-time highs.

May External factors stop Bitcoin’s bullish PA?

While most investors remain optimistic as a result of the bullish bounce on $10.2k, a macro overview may still point out flaws in the bullish rhetoric. At the moment, a part of the crypto community remains risk-averse as they believe that there is more downside than upside to prices. According to bears, an unstable stock market may result in a volatile new era. If a March crash were to repeat, Bitcoin could again fall to $3k.

However, data from Skew suggests that Bitcoin may have one of the best quarterly closes in 2020. While it may not surpass Q3 activity, Bitcoin may have its second-best quarter in Q4. As long as Bitcoin stays above $10.6k, it will achieve that.

Bulls believe that further growth in the stock and precious metals market may lead to that. Supported by stimulus bills from the U.S. government, Bitcoin will have enough global stability to continue its growth.

This year, stimulus bills have already contributed to a steady rise in prices. With the additional factor of low interests, the economy is bound to bounce from the recent crash. Further economic measures that would stimulate the global economy would only add to this growth.

If you found this article interesting, here you can find more Bitcoin news