TL;DR

- Vitalik Buterin’s Selloff: Ethereum co-founder Vitalik Buterin sold 760 ETH, worth approximately $1.835 million in USDC, raising concerns within the crypto community amid a market downturn.

- Liquidity Impact: The selloff led to a 20% drop in Ethereum’s liquidity on US-based exchanges, contributing to a 6% price decline over the past week and 25% over the past 60 days.

- Community Reactions: Buterin clarified that his sales are for charitable contributions and ecosystem funding, not personal profit, but the market remains cautious about the implications.

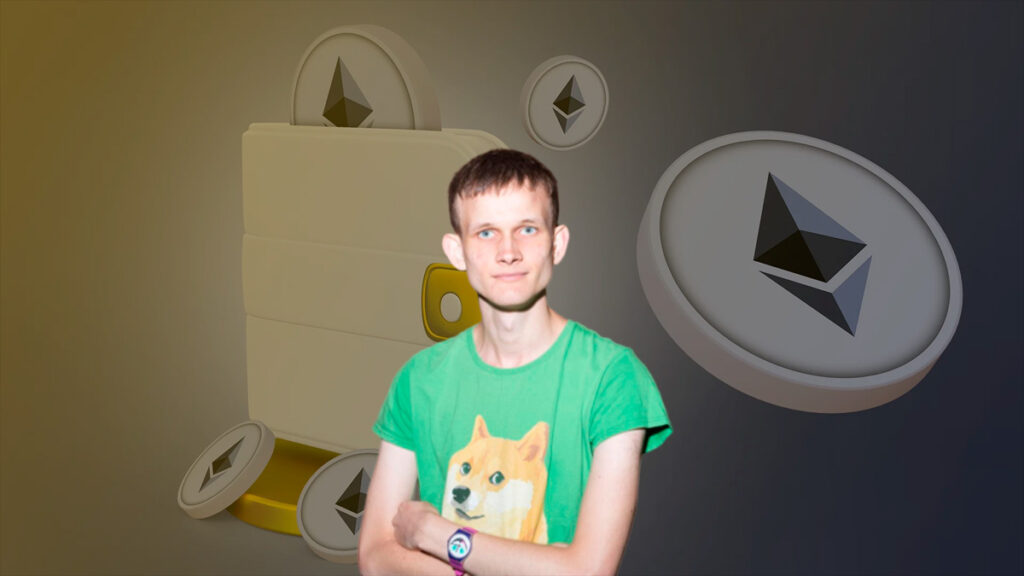

Ethereum co-founder Vitalik Buterin has recently made headlines by selling 760 ETH from his multi-signature wallet, generating approximately $1.835 million in USDC. This transaction has raised eyebrows within the crypto community, especially given the timing amid a broader market downturn.

The multi-signature wallet that got $ETH from @VitalikButerin is on a selling streak!

After receiving 3,800 $ETH ($9.99M) from Vitalik on Aug 9 and 30, it’s been cashing out, selling 760 $ETH for 1.835M $USDC at ~$2,414 per ETH. The latest sale happened just 21 hours ago.… pic.twitter.com/ELcjpPSg4K

— Spot On Chain (@spotonchain) September 9, 2024

Impact on Ethereum Liquidity

The sell-off has had a noticeable impact on Ethereum’s liquidity. Data indicates that the liquidity of Ether pairs on US-based centralized exchanges has dropped by 20%, with the average market depth falling to $14 million.

This decline in liquidity has contributed to a 6% drop in ETH prices over the past week and a 25% decline over the past 60 days. Adding to the market’s concerns, the Ethereum Foundation has also been active in offloading its holdings.

The Foundation sold 450 ETH for 1.029 million DAI, and in total, it has sold 550 ETH worth approximately $1.28 million over the past four days. These transactions have further exacerbated the selling pressure on ETH.

Vitalik Buterin’s Clarification

In response to the concerns, Buterin clarified that he has not sold ETH for personal profit since 2018. He emphasized that his sales are typically for charitable contributions, donations, or funding projects within the Ethereum ecosystem.

This statement aims to reassure the community that his actions are not driven by personal gain but by a commitment to support valuable initiatives. The crypto community has been abuzz with discussions about the timing and implications of these transactions.

Some speculate that the selloff could signal a lack of confidence in the market, while others believe it is a strategic move to support various projects and charities. The broader market sentiment remains cautious, influenced by ongoing economic factors and market volatility.

Vitalik Buterin’s recent ETH selloff and the Ethereum Foundation’s active offloading have sparked significant concerns within the crypto community.

While Buterin’s clarification provides some reassurance, the impact on Ethereum’s liquidity and market sentiment cannot be ignored. As the market continues to navigate these developments, all eyes will be on how these actions influence the future of Ethereum.