Discussion around crypto projects in 2025 has increasingly focused on utility and execution. Hedera, VeChain, and Pi Network each target different use cases that could attract demand if broader market activity remains elevated. Remittix is presented as a payments-focused project that aims to support conversions from crypto to bank transfers for users and businesses, according to project materials.

Hedera’s Settlement Focus Draws Ongoing Attention

Hedera was reported at around a $8.1 billion market cap and about $782.3 million in daily trading volume at the time of writing, placing it among larger utility-focused networks. Market data also indicated consistent trading activity over the week, which can support liquidity during periods of volatility.

Market participants often monitor recent support and resistance levels to evaluate trend continuation, though outcomes remain uncertain. Any change in sentiment may depend on broader market conditions and whether trading volume remains elevated.

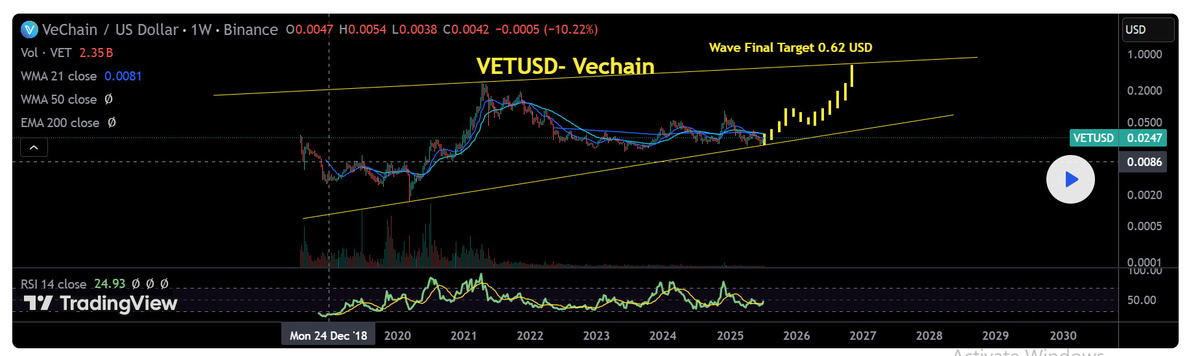

VeChain’s Enterprise Rails Remain Closely Watched

VeChain was reported at around a $1.3 billion market cap and roughly $48.5 million in 24-hour volume at the time of writing. The project is often discussed in the context of supply-chain and verification use cases, though adoption and market pricing can vary over time.

From a technical-analysis perspective, traders may look for a move above prior range highs or for support to hold near recent bases. Any such move, if it occurs, is not guaranteed and may be influenced by broader market liquidity and risk sentiment.

Pi Network and Questions Around Durable Liquidity

Pi Network’s visibility has increased, while recent coverage has also pointed to sharp price swings over short windows. That can raise liquidity and slippage considerations for market participants. Some analysts who track exchange data typically look for more consistent volume and tighter spreads before describing trends as established. For now, sentiment in the market appears cautious as participants watch for clearer signals.

Remittix and the payments use case

Compared with Hedera’s settlement focus and VeChain’s enterprise tracking, Remittix is described as targeting a specific payments workflow: moving value from crypto to bank accounts. Whether that approach gains traction depends on execution, regulatory considerations, user demand, and market conditions.

The project’s materials describe a wallet beta and planned expansion of testing. As with other early-stage initiatives, product milestones, adoption and token-market outcomes are uncertain.

Remittix has also cited third-party security tooling and team verification, though readers should independently review the underlying disclosures and scope of any audits or verification. The project has reported fundraising and token distribution figures, as well as prospective exchange listings; these claims have not been independently verified by this outlet.

The project has also described marketing incentives and community promotions. Details and eligibility can change, and such promotions should not be treated as a measure of investment quality.

Below are several project-stated themes that are often cited in coverage of Remittix:

- A focus on a functional payments workflow (as described by the project)

- Token-supply and fee mechanics described as “deflationary” in project materials

- Positioning toward non-technical users and everyday payment scenarios

- Target users cited by the project include freelancers and cross-border payment users

- Claims of real-world relevance based on the project’s stated goals (not independently verified)

How these projects differ heading into 2025

HBAR and VeChain are frequently discussed in relation to enterprise adoption, which can involve longer decision cycles and may not map cleanly to token price movements. Pi Network remains a topic of debate, with observers watching for clearer liquidity and market-structure signals. Remittix, as described by the project, focuses on payments and related product development, though outcomes remain uncertain.

Readers should evaluate claims carefully, verify primary sources, and consider the risks associated with digital assets, including liquidity, volatility, and regulatory uncertainty.

Project links (for reference):

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.