Uniswap plunged 90 percent throughout 2022, and its current valuation is worse year-to-date. Technically, sellers remain in control from a top-down preview. Nonetheless, the past few months have been encouraging.

For instance, the coin successfully shook off the FTX contagion. Unlike some assets, which dropped to register new 2022 lows, UNI prices found support at a critical reaction point. Notably, prices rebounded from multi-week support, and the token remained within a bullish formation.

UNI prices are still trending higher, adding 40 percent from November 2022 lows, a net positive for optimistic bulls. As it is, traders may find entries on every dip, targeting a retest of August 2022 highs in the short to near term.

Will Uniswap Deploy On BSC?

Uniswap remains a critical component of DeFi. Even though the winter froze participation last year, Uniswap has a total value locked (TVL) of over $3.4 billion across several chains. Most are locked in Ethereum, with Polygon being the second most popular, mainly because of fees and scalability. Uniswap tokens are also managed in Arbitrum and Celo.

Still, the broadness of DeFi and the liquidity advantage of Uniswap may be seen in the decentralized exchange deployed in the BNB Smart Chain (BSC).

Last week, a proposal to have Uniswap v3 launch in the BSC passed what the proposer said was a “temperature check”. There was overwhelming support, and the proposal moves to the Governance Proposal stage. Should it pass, Uniswap v3 deployment on BSC will be massive for UNI.

Uniswap Price Analysis

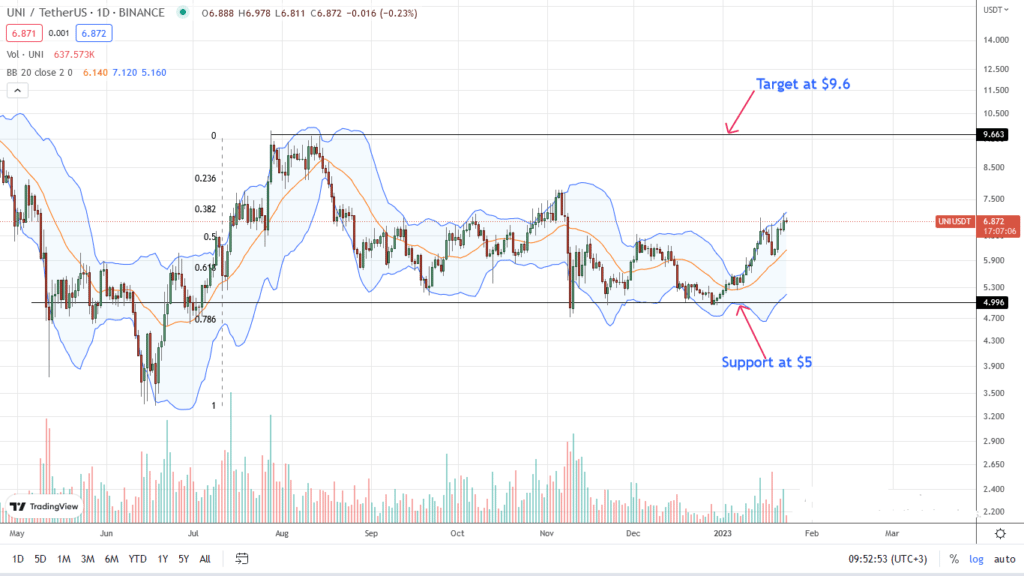

Uniswap prices are bullish and defined by Q3 2022 trade range. Provided prices are within this range, the path of least resistance will remain northwards. This is further cemented by the fact that UNI rebuffed November bears, soaking selling pressure and keeping the token above $5.

In the current setup, buyers have the upper hand. UNI bulls have support at $6 and the middle BB. A breakout above the bull flag at $7 may see UNI traders swing, aiming at $7.8 or November 2022 highs.

Further gains, ideally with expanding volumes, may see UNI tear higher to August 2022 highs at $9.6.

Any loss below $6 cancels this bullish outlook.

Technical charts courtesy of Trading View. Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more about Uniswap.