In the evolving world of cryptocurrency, crypto lending platforms provide ways to access liquidity without selling your assets. These platforms allow users to borrow against Bitcoin, Ethereum, and other digital assets using either centralized or decentralized solutions. Below, we review five widely used crypto lending platforms and highlight their features and considerations.

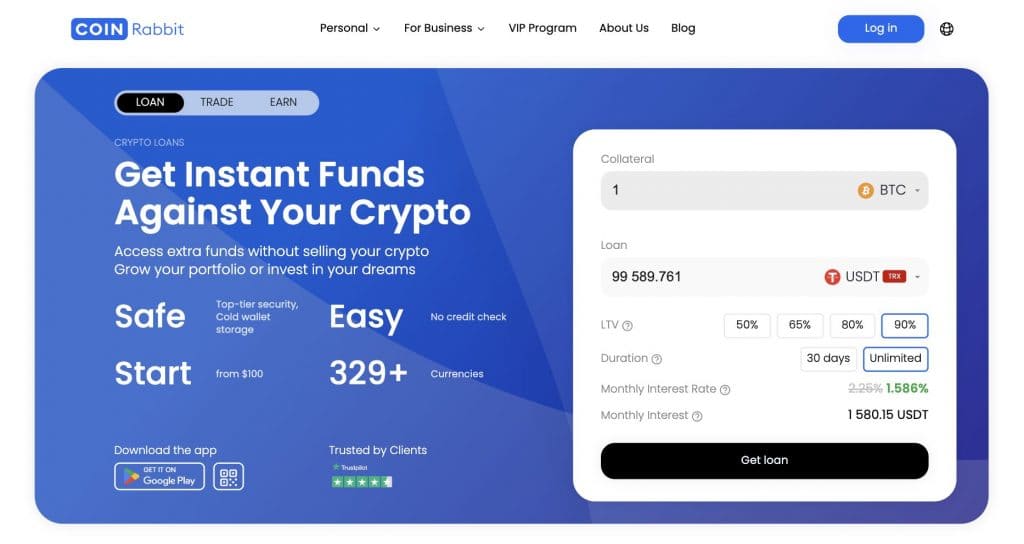

CoinRabbit Crypto Lending – Quick Access and Multi-Asset Support

CoinRabbit, launched in 2020, offers loans using over 300 cryptocurrencies as collateral. Users can borrow stablecoins against their assets without credit checks.

Key Features:

- Collateral support: 300+ cryptocurrencies

- Loan-to-value (LTV) ratios: up to 90%

- No rehypothecation policy; collateral is stored in cold wallets with multisig access

Considerations:

- Fast processing, but transparency is lower compared to fully decentralized platforms

- Relatively new compared to larger exchanges

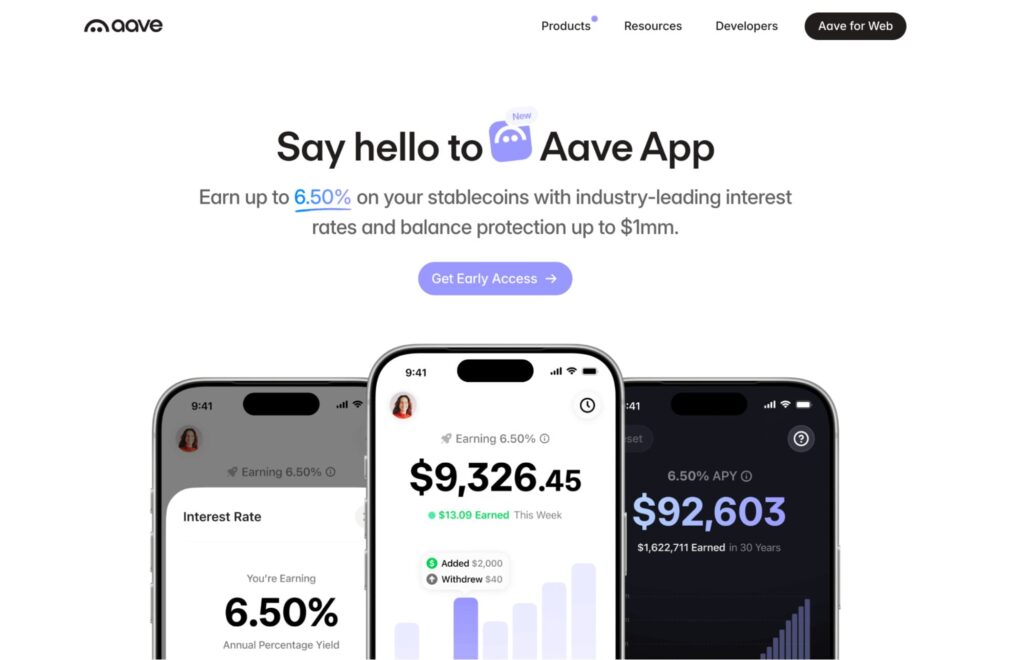

Aave – Decentralized Crypto Lending Across Multiple Chains

Aave is a decentralized finance (DeFi) protocol that allows users to lend and borrow through liquidity pools on Ethereum, Avalanche, and other blockchains.

Key Features:

- Non-custodial crypto lending: collateral locked in smart contracts

- Variable interest rates based on supply and demand

- Community-driven governance with regular audits

Considerations:

- Requires DeFi knowledge and monitoring of smart contract risks

- Gas fees can increase costs during network congestion

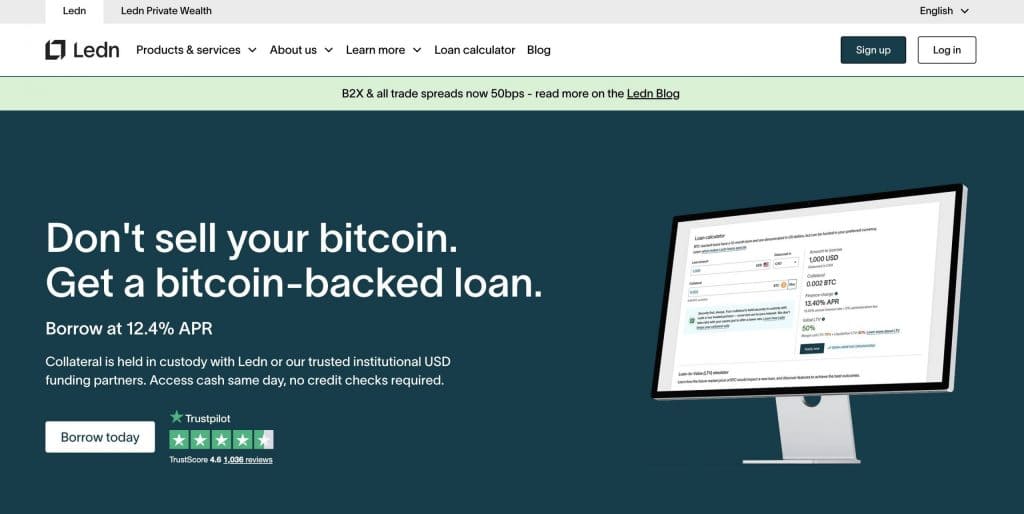

Ledn – Bitcoin-Focused Lending with On-Chain Custody

Ledn is designed for BTC holders who want to access USD loans while keeping their Bitcoin in secure custody.

Key Features:

- On-chain custody with quarterly audits

- LTV ratios around 50%

- Fiat payouts processed in hours

Considerations:

- Lower borrowing limits compared to some other platforms

- Primarily suited for long-term BTC holders rather than high-leverage traders

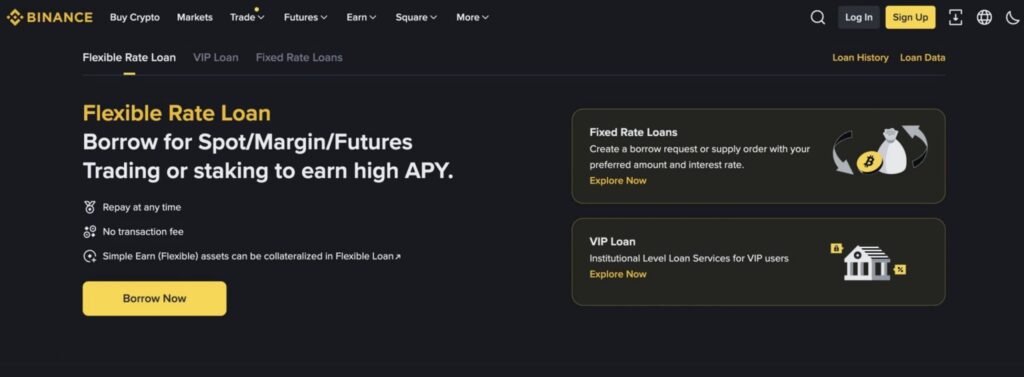

Binance Crypto Loans – Integrated Crypto Lending within Exchange Ecosystem

Binance Loans provides collateralized loans using major cryptocurrencies such as BTC, ETH, and BNB, integrated directly within the Binance platform.

Key Features:

- Flexible or fixed-term loans

- LTV ratios up to 80%

- Direct integration with Binance’s financial services

Considerations:

- Collateral is centrally managed and may be rehypothecated

- Minimum borrow amounts may be high for casual users

Maple Finance – Institutional-Grade Crypto Lending via Delegated Pools

Maple Finance offers a decentralized crypto lending marketplace for businesses and institutions, using delegate-managed liquidity pools.

Key Features:

- Fixed-rate, short-term loans

- Over-collateralized borrowing for BTC and ETH

- Transparency in pool management

Considerations:

- Slower application process due to delegated approvals

- Limited retail access compared to consumer-focused platforms

FAQ – Understanding Crypto Lending Platforms

What is crypto lending?

Crypto lending involves borrowing fiat or stablecoins using digital assets as collateral. Lenders provide liquidity to pools and earn interest, while borrowers retain ownership of their collateral. For more information, see our guide on how crypto lending works.

How to choose a crypto lending platform?

Consider:

- LTV ratios

- Interest rates

- Security and audit history

- Supported cryptocurrencies

- Centralized vs decentralized options

The information presented in this article is for informational purposes only and should not be interpreted as investment advice. The cryptocurrency market is highly volatile and may involve significant risks. We recommend conducting your own analysis.