TL;DR:

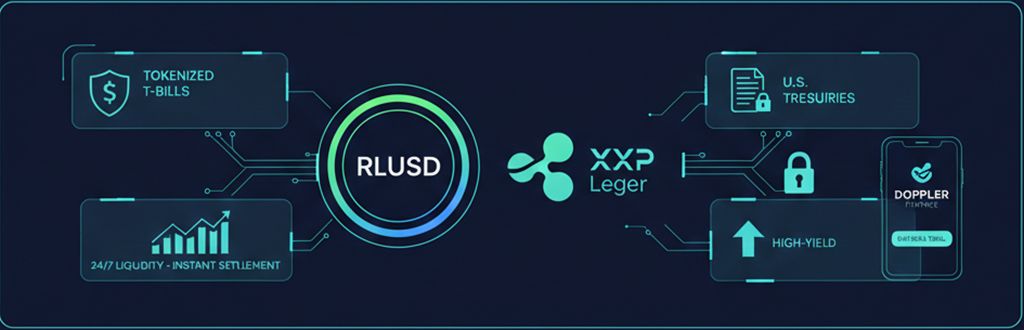

- Doppler Finance and OpenEden partner to bring U.S. Treasury Bills (TBILL) directly to the XRP Ledger.

- RLUSD stablecoin holders will be able to access institutional yields backed by the U.S. government.

- The alliance aims to transform RLUSD from a passive medium of exchange into a highly liquid productive asset.

The Ripple ecosystem is taking a significant step toward financial maturity following the announcement of an alliance between Doppler Finance and OpenEden. This collaboration will facilitate the arrival of tokenized Treasury bills on XRPL, allowing the network’s native liquidity to flow into institutional-grade financial products.

Doppler Finance has entered a strategic partnership with @OpenEden_X to support $RLUSD adoption and accelerate activity across the XRP Ledger (XRPL).

— Doppler Finance (@doppler_fi) February 10, 2026

The collaboration explores the use of tokenized U.S. Treasury Bills (TBILL) and USDO, a regulated yield-bearing stablecoin, to… pic.twitter.com/t6yUykoCaK

Through this action, Ripple’s new stablecoin, RLUSD, will no longer be a mere safe-haven asset; it will now be a tool for generating sustainable returns. Therefore, users will have access to the benefits of a financial instrument traditionally reserved for large capital holders, but with the agility of blockchain technology.

Doppler Finance will serve as the primary on-chain gateway, optimizing a process that was previously considered fragmented and complex. Consequently, this infrastructure removes entry barriers so that both institutional investors and XRP holders can participate in the sovereign debt market.

RLUSD and the Evolution of Real World Assets (RWA)

The integration represents an achievement for OpenEden, which had already pioneered the launch of the first treasury bills on this network in 2024. However, the inclusion of Doppler Finance and RLUSD ensures that tokenized Treasury bills on XRPL function similarly to a fully decentralized high-yield savings account.

This evolution is necessary to accelerate the adoption of Ripple’s stablecoin against its direct competitors in the crypto market. By offering direct access to the security of U.S. bonds, the XRPL network positions itself as a robust ecosystem for the management of Real World Assets (RWA).

In summary, the convergence between traditional finance and Ripple’s technology promises to redefine the utility of its ledger. Upon completion of the implementation, users will be able to manage their portfolios with maximum global security without needing to leave the digital environment of the XRP Ledger.